California, other states file suit to prevent shutdown of federal consumer agency

Published in Political News

California joined 20 other states and the District of Columbia on Monday in a lawsuit that seeks to prevent the federal Consumer Financial Protection Bureau from being defunded and closed by the Trump administration.

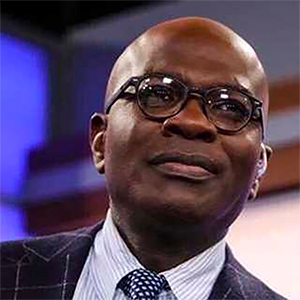

The legal action filed in U.S. District Court in Eugene, Ore. by the Democratic attorneys general accuses Acting Director Russell Vought of trying to illegally withhold funds from the agency by unlawfully interpreting its funding statute. Also named as defendants are the agency itself and the Federal Reserve's Board of Governors.

"For California, the CFPB has been an invaluable enforcement partner, working hand-in-hand with our office to protect pocketbooks and stop unfair business practices. But once again, the Trump administration is trying to weaken and ultimately dismantle the CFPB," California Attorney General Rob Bonta said in a press conference to announce the 41-page legal action.

The lawsuit asserts that the agency is critical for states to carry out their own consumer protection mission and its closure would deprive them of their statutorily guaranteed access to a database run by the CFPB that tracks millions of consumer complaints, as well as to other data.

The agency did not immediately respond to a request for comment about the action, co-led by Bonta and the attorneys general from Oregon, New York, New Jersey and Colorado.

Established by Congress in 2010 after the subprime mortgage abuses that gave rise to the financial crisis, the agency is funded by the Federal Reserve as a method of insulating it from political pressure.

The Dodd-Frank Act statute requires the agency's director to petition for a reasonable amount of funding to carry out the CFPB's duties from the "combined earnings" of the Federal Reserve System.

Prior to this year that was interpreted to mean the Federal Reserve's gross revenue. But an opinion from the Department of Justice claims that should be interpreted to mean the Federal Reserve's profits, of which it has none since it has been operating at a loss since 2022. The lawsuit alleges the interpretation is bogus.

"Defendant Russell T. Vought has worked tirelessly to terminate the CFPB's operations by any means necessary — denying Plaintiffs access to CFPB resources to which they are statutorily entitled. In this action, Plaintiffs challenge Defendant Vought's most recent effort to do so," the federal lawsuit states.

The complaint alleges the agency will run out of cash by next month if the policy is not reversed. Bonta said he and other attorney generals have not decided whether they will seek a restraining order or temporary injunction to change the new funding policy.

Prior to the second Trump administraition, the CPFB boasted of returning nearly $21 billion to consumers nationwide through enforcement actions, including against Wells Fargo in San Francisco over a scandal involving the creation of accounts never sought by customers.

Other big cases have been brought against student loan servicer Navient for mishandling payments and other issues, as well as Toyota Motor Credit for charging higher interest rates to Black and Asian customers.

However, this year the agency has dropped notable cases. It terminated early a consent order reached with Citibank over allegations it discriminated against customers with Armenian surnames in Los Angeles County.

It also dropped a lawsuit against Zelle that accused Wells Fargo, JP Morgan Chase, Bank of America and other banks of rushing the payments app into service, leading to $870 million in fraud-related losses by users. The app denied the allegations.

Vought was a chief architect of Project 2025, a Heritage Foundation blueprint to reduce the size and power of the federal bureaucracy during a second Trump administration. In February, he ordered the agency to stop nearly all its work and has been seeking to drastically downsize it since.

The lawsuit filed Monday is the latest legal effort to keep the agency in business.

A lawsuit filed in February by National Treasury Employees Union and consumer groups accuses the Trump administration and Vought of attempting to unconstitutionally abolish the agency, created by an act of Congress.

"It is deflating, and it is unfortunate that Congress is not defending the power of the purse," said Colorado Attorney General Philip Weiser, during Monday's press conference.

"At other times, Congress vigilantly safeguarded its authority, but because of political polarization and fear of criticizing this President, the Congress is not doing it," he said.

_____

©2025 Los Angeles Times. Visit latimes.com. Distributed by Tribune Content Agency, LLC.

Comments