Secession is here: States, cities and the wealthy are already withdrawing from America

Published in Political News

Rep. Marjorie Taylor Greene, a Republican from Georgia, wants a “national divorce.” In her view, another Civil War is inevitable unless red and blue states form separate countries.

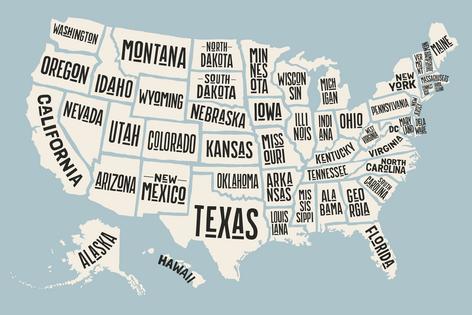

She has plenty of company on the right, where a host of others – 52% of Trump voters, Donald Trump himself and prominent Texas Republicans – have endorsed various forms of secession in recent years. Roughly 40% of Biden voters have fantasized about a national divorce as well. Some on the left urge a domestic breakup so that a new egalitarian nation might be, as Lincoln said at Gettysburg, “brought forth on this continent.”

The American Civil War was a national trauma precipitated by the secession of 11 Southern states over slavery. It is, therefore, understandable that many pundits and commentators would weigh in about the legality, feasibility and wisdom of secession when others clamor for divorce.

But all this secession talk misses a key point that every troubled couple knows. Just as there are ways to withdraw from a marriage before any formal divorce, there are also ways to exit a nation before officially seceding.

I have studied secession for 20 years, and I think that it is not just a “what if?” scenario anymore. In “We Are Not One People: Secession and Separatism in American Politics Since 1776,” my co-author and I go beyond narrow discussions of secession and the Civil War to frame secession as an extreme end point on a scale that includes various acts of exit that have already taken place across the U.S.

This scale begins with smaller, targeted exits, like a person getting out of jury duty, and progresses to include the larger ways that communities refuse to comply with state and federal authorities.

Such refusals could involve legal maneuvers like interposition, in which a community delays or constrains the enforcement of a law it opposes, or nullification, in which a community explicitly declares a law to be null and void within its borders. At the end of the scale, there’s secession.

From this wider perspective, it is clear that many acts of departure – call them secession lite, de facto secession or soft separatism – are occurring right now. Americans have responded to increasing polarization by exploring the gradations between soft separatism and hard secession.

These escalating exits make sense in a polarized nation whose citizens are sorting themselves into like-minded neighbhorhoods. When compromise is elusive and coexistence is unpleasant, citizens have three options to get their way: Defeat the other side, eliminate the other side or get away from the other side.

Imagine a national law; it could be a mandate that citizens brush their teeth twice a day or a statute criminalizing texting while driving. Then imagine that a special group of people did not have to obey that law.

This quasi-secession can be achieved in several ways. Maybe this special group moves “off the grid” into the boondocks where they could text and drive without fear of oversight. Maybe this special group wields political power and can buy, bribe or lawyer their way out of any legal jam. Maybe this special group has persuaded a powerful authority, say Congress or the Supreme Court, to grant them unique legal exemptions.

These are hypothetical scenarios, but not imaginary ones. When groups exit public life and its civic duties and burdens, when they live under their own sets of rules, when they do not have to live with fellow citizens they have not chosen or listen to authorities they do not like, they have already seceded.

Present-day America offers numerous hard examples of soft separatism.

Over the past two decades, scores of wealthy white communities have separated from more diverse school districts. Advocates cite local control to justify these acts of school secession. But the result is the creation of parallel school districts, both relatively homogeneous but vastly different in racial makeup and economic background.

Several prominent district exits have occurred in the South – places like St. George, Louisiana – but instances from northern Maine to Southern California show that school splintering is happening nationwide.

As one reporter wrote, “If you didn’t want to attend school with certain people in your district, you just needed to find a way to put a district line between you and them.”

Many other examples of legalized separatism revolve around taxes. Disney World, for example, was classified as a “special tax district” in Florida in 1967. These special districts are functionally separate local governments and can provide public services and build and maintain their own infrastructure.

The company has saved millions by avoiding typical zoning, permitting and inspection processes for decades, although Florida Gov. Ron DeSantis has recently challenged Disney’s special designation. Disney was only one of 1,800 special tax districts in Florida; there are over 35,000 in the nation.

Jeff Bezos paid no federal income taxes in 2011. Elon Musk paid almost none in 2018. Tales of wealthy individuals avoiding taxes are as common as stories of rich Americans buying their way out of jail. “Wealthier Americans,” Robert Reich lamented as far back as the early 1990s, “have been withdrawing into their own neighborhoods and clubs for generations.” Reich worried that a “new secession” allowed the rich to “inhabit a different economy from other Americans.”

Some of the nation’s wealthiest citizens pay an effective tax rate close to zero. As one investigative reporter put it, the ultrawealthy “sidestep the system in an entirely legal way.”

Schools and taxes are just a start.

Eleven states dub themselves “Second Amendment sanctuaries” and refuse to enforce federal gun restrictions. Movements aiming to carve off rural, more politically conservative portions of blue states are growing; 11 counties in Eastern Oregon support seceding and reclassifying themselves as “Greater Idaho,” a move that Idaho’s state government supports.

Hoping to become a separate state independent of Chicago’s political influence, over two dozen rural Illinois counties have passed pro-secession referendums. Some Texas Republicans back “Texit,” where the state becomes an independent nation.

Separatist ideas come from the Left, too.

“Cal-exit,” a plan for California to leave the union after 2016, was the most acute recent attempt at secession.

And separatist acts have reshaped life and law in many states. Since 2012, 21 states have legalized marijuana, which is federally illegal. Sanctuary cities and states have emerged since 2016 to combat aggressive federal immigration laws and policies. Some prosecutors and judges refuse to prosecute women and medical providers for newly illegal abortions in some states.

Estimates vary, but some Americans are increasingly opting out of hypermodern, hyperpolarized life entirely. “Intentional communities,” rural, sustainable, cooperative communes like East Wind in the Ozarks, are, as The New York Times reported in 2020, proliferating “across the country.”

In many ways, America is already broken apart. When secession is portrayed in its strictest sense, as a group of people declaring independence and taking a portion of a nation as they depart, the discussion is myopic, and current acts of exit hide in plain sight. When it comes to secession, the question is not just “What if?” but “What now?”

This article is republished from The Conversation, an independent nonprofit news site dedicated to sharing ideas from academic experts. If you found it interesting, you could subscribe to our weekly newsletter.

Read more:

Don’t trust the news media? That’s good

Expanding direct democracy won’t make Americans feel better about politics

Michael J. Lee does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Comments