The collapse of major US banks leads to bills calling for more regulation

Published in Political News

When Silicon Valley and Signature banks failed in early March 2023, government regulators rushed in to guarantee deposits and protect bank customers. Under current banking regulations, though, there was no obligation for the government to step in.

Now, both Democratic and Republican politicians are making pronouncements about whether bipartisan-backed deregulation in 2018 led to the banks’ collapse and whether the banking industry needs more government intervention.

Sen. Elizabeth Warren of Massachusetts and U.S. Rep. Katie Porter of California, both Democrats, introduced a bill on March 15, 2023, to restore stiff banking regulations that they maintain would have prevented the practices that led to the recent bank collapses. But some Republicans, including U.S. Rep. Andy Barr of Kentucky, say lax government policy that included overspending – which Barr says, fueled inflation, as well as long-term low interest rates – not deregulation, was behind the banks’ failures.

In dispute are requirements in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act that were rolled back in 2018. Dodd-Frank put in place financial regulatory changes in response to the 2008 global financial meltdown. The legislation included among its requirements one that banks with US$50 billion in assets be subject to strict standards. Some lawmakers, including Porter and Warren, say those requirements should have remained intact.

But the Economic Growth, Regulatory Relief and Consumer Protection Act of 2018 loosened the standards, raising the asset threshold to $250 billion, meaning fewer banks were under strict controls.

The Conversation asked Gerard W. Comizio, a law professor, former Wall Street attorney and former senior Treasury Department official, to explain some of the problems that spurred Silicon Valley Bank, Signature Bank and another bank to fail.

Significant withdrawals at all three banks caused cash crises that could not be addressed by selling assets, such as bank notes and bonds. In the case of all three banks, sales of their assets would have triggered significant additional losses, since their portfolios were worth less than they paid for them and interest rates were rising.

While some aspects of each failure were different, there were common elements, and a certain level of Murphy’s law – the idea that if something can go wrong, it will. In the case of these banks, everything went wrong.

In the last three months of 2022, Silvergate had a record $1 billion loss, due to heavy lending to troubled and failed crypto trading exchanges. And its interest rate-sensitive securities portfolio became kindling for the current crisis.

During 2022, Silvergate’s deposit base grew dramatically, almost doubling its assets to $210 billion. But the bank did not have either the administrative capacity or market demand to lend out all of the money, as banks normally do. So, it invested the excess deposits in Treasury bonds and mortgage investment products.

But the bond purchases became a problem as the Federal Reserve began to raise interest rates to address inflation. As Business Insider reported, a two-year U.S. Treasury note that offered nearly triple the amount of Silicon Valley Bank’s portfolio of long-term bonds – which generated income at an average of just 1.6% – was much more attractive.

Bond prices plunged, creating billions of dollars in paper losses for Silicon Valley Bank, popularly known as SVB.

To shore up its cash assets, in the face of increasing customer withdrawals, SVB sold $21 billion in bonds at a $1.8 billion loss.

Section 165 of the Dodd-Frank Act adopted so-called “enhanced prudential regulation” rules for all banking organizations with more than $50 billion in assets, designating them as “systemically important financial institutions,” popularly known by the term “too big to fail.” These standards were designed to be more stringent than those applied to smaller banks. Lawmakers believed the larger institutions posed far greater risk to the financial stability of the U.S.

These stricter rules required, among other things, that the banks deemed too big to fail periodically update for the Federal Reserve and the Federal Deposit Insurance Corp. a comprehensive resolution plan. Dubbed the Living Will, that plan details a company’s plans for a “rapid and orderly” dissolution of the bank in the event it is failing or has already failed. In addition, these too-big-to-fail banks had a requirement to periodically assess their risk under a variety of market conditions, including rises in interest rates and risk hedging strategies. The rules also said designated banks had significantly higher capital requirements.

No longer required to adhere to those key provisions of the Dodd-Frank Act, the failed banks did not. Arguably, the provisions could have saved them.

Industry leaders, among them Greg Becker, CEO of Silicon Valley Bank, lobbied Congress in 2015 to roll back some of the Dodd-Frank Act provisions.

Arguing that the $50 billion threshold needed to be raised, Becker said the restrictions on midsize banks under the Dodd-Frank Act were too burdensome and inhibited banks’ ability to “provide the banking services our clients need.”

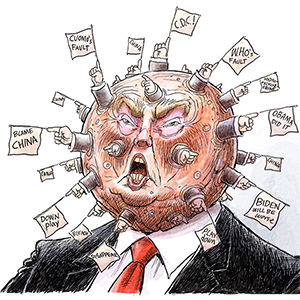

In 2018, Congress, in a bipartisan vote, with the support of then-President Donald Trump’s administration, all of the federal banking agencies and the banking industry, passed the Economic Growth, Regulatory Relief and Consumer Protection Act. It amended the Dodd-Frank Act to substantially reduce the number of banks subject to the more stringent regulation by raising the threshold at which banks posed potential systemic risk, from $50 billion up to $250 billion.

On July 6, 2018, all of the banking agencies issued a statement confirming the elimination of these requirements.

There are a number of arguments as to whether these failures could have been prevented and addressed faster if the Dodd-Frank standards had still been in place. These standards were arguably designed to specifically prevent and address the type of circumstances that triggered these recent bank failures: multiple failures and contagion in the financial system, market panic, deposit runs and liquidity crisis.

For example, abiding by Living Wills and stress testing would have identified problems far earlier and potentially required these banks to address a number of potential red flags that constituted higher risk, such as:

Interest rate risk in the banks’ securities portfolio investments, and the consequences of liquidating those investments at a significant loss in the event of a cash crisis;

Lack of interest rate risk hedging strategies;

Excessive uninsured deposits that posed a risk to the bank if customers withdrew their money en masse; and

The need to hold higher-than-normal levels of money to address their risks.

Ironically, in taking steps to provide unprecedented deposit insurance coverage to uninsured deposits at these banks, the U.S. Treasury, the Fed and the FDIC issued a joint statement on March 12 that they were invoking the systemic risk exception which allowed them to replace depositors’ money, even though the law was changed in 2018 to make clear banks of their size no longer posed systemic risk.

This article is republished from The Conversation, an independent nonprofit news site dedicated to sharing ideas from academic experts. If you found it interesting, you could subscribe to our weekly newsletter.

Read more:

US regulators avoided a banking crisis by swift action following SVB’s collapse – but the cracks it exposed continue to weaken the global financial system’s foundation

Inflation is proving particularly stubborn – but jitters over banking failures, softening economy complicate Fed rate decision

V. Gerard (Jerry) Comizio is a member of the Democratic party.

Comments