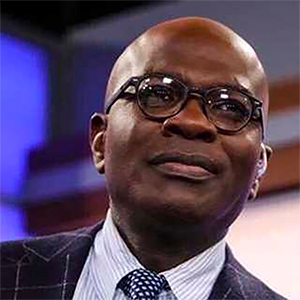

From the Right

/Politics

Taking Christmas Seriously

We all know that God works in mysterious ways.

Recently, I was deeply moved at a theatrical production of Charles Dickens' "A Christmas Carol." This is the famous and popular tale of the transformation and redemption of Ebenezer Scrooge from a rasping, grasping old miser into a lovable, generous old man who, late in life, becomes determined to ...Read more

Tucker Carlson and the Freedom of Speech

Last week, Sen. Charles Schumer, the leader of the Democrats in the United States Senate, introduced a resolution on behalf of himself and 40 other Senate Democrats that, if passed, would record the sense of the Senate as condemning the media superstar Tucker Carlson because of the political, historical and cultural opinions of a guest on ...Read more

'Kill Them All'

"Does anyone know where the love of God goes

When the waves turn the minutes to hours?"

-- Gordon Lightfoot (1938-2023) "The Wreck of the Edmund Fitzgerald"

As we learn more about the events on Sept. 2, 2025, in international waters 1,500 miles from the United States, the behavior of the United States military becomes more ...Read more

Murder for Christmas?

When Secretary of Defense Pete Hegseth posted a meme of Franklin the Turtle, the amiable child's cartoon character, in a helicopter using a military weapon to kill people in a small boat below him, and captioned it "For your Christmas wish list," it understandably caused an uproar.

Should the secretary of defense be mocking the people his ...Read more

Thanksgiving and the Constitution

"Government requires make-believe. Make believe that the king is divine, make believe that he can do no wrong or make believe that the voice of the people is the voice of God. Make believe that the people have a voice or make believe that the representatives of the people are the people. Make believe that governors are the servants of the ...Read more

What the Founders Feared

"The means of defense against foreign danger have been always the instruments of tyranny at home." -- James Madison (1751-1836)

America today would terrify the Founding Fathers. Armed troops roam the streets of major cities, masked government agents arrest people without probable cause and disrupt the public speech that the president ...Read more

Can the President Disrupt Free Speech?

While the country's attention was drawn to the federal government shutdown, President Donald Trump signed National Security Presidential Memorandum 7 (NSPM-7), which purports to designate the ideology of antifa as a "domestic terrorist organization" and directs federal law enforcement to disrupt its gatherings and those of its supporters.

The ...Read more

Jailed in America for Free Speech

In the aftermath of the murder of Charlie Kirk, many folks who dared to express views of him and his work outside the mainstream lost their jobs, professional standing and State Department visas as they were fired or otherwise disciplined by employers or bureaucrats who concluded that anti-Kirk views could harm the employers' businesses or were ...Read more

A Trumpian Headache

President Donald Trump's use of the U.S. military to kill persons on speed boats in international waters, or in territorial waters claimed by other sovereign nations -- all 1,500 miles from the U.S. -- has posed grave issues of due process. The Constitution's guarantee of due process requires it for every person, not just Americans. The ...Read more

A Constitution of No Authority

What if the whole purpose of the Constitution was to establish and to limit the federal government? What if Congress's 16 enumerated powers in the Constitution no longer limit Congress but are actually used as a justification to extend Congress's authority over nearly every aspect of human life? What if Congress bribes the states with cash, the ...Read more

Can the President Extrajudicially Execute Someone, Legally? In a Word: NO!

During the past six weeks, President Donald Trump has ordered U.S. troops to attack and destroy four speed boats in the Caribbean Sea, 1,500 miles from the United States. The president revealed that the attacks were conducted without warning, were intended not to stop but to kill all persons on the boats, and succeeded in their missions.

Trump ...Read more

Who Will Protect Us From the Protectors?

In the same week in which President Donald Trump announced that he was federalizing 200 Oregon National Guard soldiers and dispatching them to the streets of Portland, he quietly signed a Presidential National Security Memorandum that purports to federalize policing. The Memorandum, just like the federalization of troops in Oregon, completely ...Read more