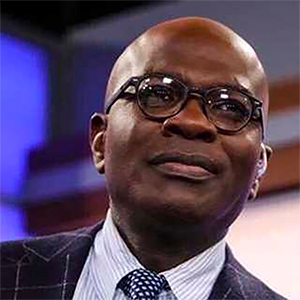

From the Right

/Politics

Was Climate Change the Greatest Financial Scandal in History?

Environmental scholar Bjorn Lomborg recently calculated that across the globe, governments have spent at least $16 trillion feeding the climate change industrial complex.

And for what?

Arguably, not a single life has been or will be saved by this shameful and colossal misallocation of human resources. The war on safe and abundant fossil fuels ...Read more

Dow 50,000: A Supply-Side Miracle

When I first arrived in Washington in 1982, the Dow Jones hit a low of 800. You may not believe that, so feel free to look it up.

If anyone had predicted that in a little more four decades the Dow would surpass 50,000, they might have been admitted into a mental institution. But U.S. stocks have grown 60-fold (not counting inflation). Even ...Read more

I Guess That's Why They Call It the Blues

The Democrats circa 2026 have almost become tax-and-spend parodies of themselves.

They used to pretend that raising taxes was a last resort. Now, the leftwing base regards raising taxes as a badge of honor.

New York City Mayor Zohran Mamdani declared last week that he has no other choice but to raise taxes on the rich and corporations ...Read more

Those Suffering from Trump Derangement Syndrome Sink to New Depths of Depravity!

A political prisoner who has been locked behind bars for nearly eight years, Caleb Bailey has been serving a term of 16 years and eight months. Why is he in prison? Judge for yourself.

In April 2016, Caleb and his father were elected as Trump delegates to the Republican National Committee from Maryland. Maryland is, of course, one of America's ...Read more

This Is No Way to Gimme Shelter

Americans today are justifiably angry about the price of rents and mortgages. Home prices have roughly tripled over the last 25 years, and the median home price is now $415,000.

The 30- and 40-somethings are having a tough time buying a first home. Young families may need to pay a whopping $75,000 on a down payment.

Democrats and some populist...Read more

We Must Stop Pretending That Colleges Are Nonprofit Institutions!

Here's a recent story from the Chicago Tribune that jumped off the page when I read it. Northwestern University is finishing up the construction of a new $800 million football stadium. This is supposedly a nonprofit "educational" entity. Uh-huh.

Northwestern -- an "institution of higher learning" located outside of Chicago -- is flush with cash...Read more

Why Hasn't Trump Repealed Biden's $50 Billion Backdoor Business Tax Increase?

The Trump administration took a well-deserved victory lap last week for repealing more than 100 Biden-era rules for every new regulation. This will save U.S. businesses potentially hundreds of billions of dollars of unnecessary costs. Gone are discriminatory racial preferences, Green New Deal mandates and electric vehicle mandates -- to name a...Read more

The Economists Got 2025 All Wrong

Well, Donald Trump has done it again! He stumped the chumps. The "chumps" in this case were the "blue-chip" academic and financial economists whose consensus forecast this time last year was of high inflation and low economic growth. Wrong on both counts.

As you've probably heard, the GDP growth for Q3 came in at a red-hot 4.3%, following 3.5% ...Read more

It's Amazing What a Difference a President Who puts America First Can Make!

I've been shocked that Americans are in such a grumpy mood as reflected in all the public opinion polls.

What a paradox: At the same time, we have peace and prosperity, including more income, more wealth, more of almost everything that we want to buy (yes, except for housing), Americans seem to think we have an "affordability crisis." In 2025 ...Read more

The Tyranny of Low Expectations Leads to a "Make Everyone Below Average" Solution

Reading and math scores are abysmal across the country, as national testing results keep documenting. Illiteracy rates are rising: The number of 16- to 24-year-olds reading at the lowest literacy levels increased from 16% in 2017 to 25% in 2023, according to data from the National Center for Education Statistics.

In some inner-city schools, ...Read more

How Trump Can Help Accelerate Argentina's Economic Comeback

President Donald Trump and Argentine President Javier Milei have a special relationship. Each is engaged in a crusade to make his respective country's economy great again. Trump was all in on helping Milei win his elections earlier this year, and he has also offered the Argentines a $20 billion "lifeline" as they adjust to the bumpy path to ...Read more

If Young People Want More Affordability, They Should Get Jobs!

Polls show that the age group of Americans most worried about "affordability" are the 20- and 30-somethings. That's young millennials and Gen Z.

Why are they so financially stressed out? One reason things seem so unaffordable to young people is that too many aren't working hard -- they are hardly working.

The latest Labor Department data ...Read more

Stop the Trial Lawyer Tax

Trial lawyers have been the bane of U.S. employers for many decades, sucking blood out of the economy like a swarm of mosquitos.

The most famous case was back in the 1990s when the courts awarded a $500,000 judgment to a McDonald's customer who claimed she was burned by coffee that was too scalding hot. Then there was the Washington man who ...Read more