Home & Leisure

/ArcaMax

After 33 years, it’s time to say goodbye to Real Estate Matters (part two)

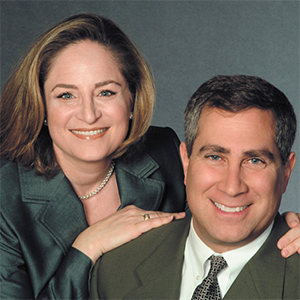

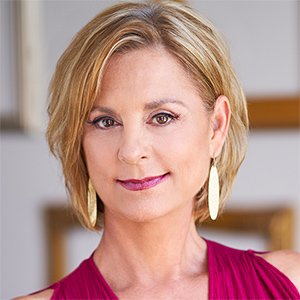

Bestselling real estate author and expert Ilyce Glink and Chicago-based real estate attorney Sam Tamkin have been writing this column continuously since 1993.

After 33 years of writing our weekly Real Estate Matters column, this one will be our last. In the previous column, we looked back on decades of extraordinary change in the world of real ...Read more

After 33 years, it’s time to say goodbye to Real Estate Matters (part one)

Bestselling real estate author and expert Ilyce Glink and Chicago-based real estate attorney Sam Tamkin have been writing this column continuously since 1993.

This is Real Estate Matters column number 1,726.

That means we’ve been writing Real Estate Matters every single week for 33 years straight — more than three decades of insights, ...Read more

Real estate trends and predictions for 2026 and beyond, part two

Every year, Ilyce and Sam offer buyer, seller and personal finance resolutions. This year, they’re adding some trends and predictions for 2026. This is part two.

In part one of the 2026 real estate trends and predictions, we looked at the Great Housing Gap, where mortgage rates would be and why home offices are a trend with staying power. ...Read more

Real estate trends and predictions for 2026 and beyond, part one

Every year, Ilyce and Sam offer buyer, seller and personal finance resolutions. This year, they’re adding some trends and predictions for 2026.

If 2025 taught us anything about real estate, it’s that the old playbook is being rewritten. Between mortgage rates stuck for most of the year well above 6%, insurance costs that shocked homeowners,...Read more

Personal finance resolutions: Stability in an unforgiving economy, part two

Every year, Ilyce and Sam offer their readers New Year’s resolutions for home buyers, home sellers and their personal finances. To move forward with their 2026 personal finance resolutions, they first explained the state of the economy and housing market as it was in 2025. Now, they offer their resolutions moving forward in 2026.

Will 2026 ...Read more

Personal finance resolutions: Stability in an unforgiving economy, part one

Every year, Ilyce and Sam offer their readers New Year’s resolutions for home buyers, home sellers and their personal finances. To move forward with their 2026 personal finance resolutions, we must first go back.

At the end of 2024, we asked our readers whether we were experiencing economic hardship or prosperity. A year later, the answer has...Read more

New Year’s resolutions for sellers, part two

This is part two of Ilyce and Sam’s thoughts on the housing market and their home seller resolutions.

Home Seller Resolution No. 6: Understand the lock-in effect (and why it matters)

While inventory is rising, it’s still not back to healthy pre-pandemic levels in many markets. One big reason? About 75% of homeowners with mortgages have ...Read more

New Year’s resolutions for sellers, part one

Every year, Ilyce and Sam offer their readers New Year’s resolutions for home buyers, sellers and their personal finances. These are their thoughts on the housing market and their Home Seller Resolutions.

For the past few years, home sellers have had it pretty good. The post-COVID-19 housing market was a seller’s paradise: homes flew off ...Read more

2025 New Year’s resolutions for homebuyers, part two

This is part two of Ilyce and Sam’s thoughts on the housing market and their 2026 homebuyer resolutions.

Home Buyer Resolution No. 6: Consider seller concessions and builder incentives.

In many markets right now, inventory is increasing and homes are staying on the market longer. That means you have more leverage than you’ve had in years. ...Read more

2025 New Year’s resolutions for homebuyers, part one

Every year, Ilyce and Sam offer their readers New Year’s resolutions for homebuyers, sellers and their personal finances. This is part one of their thoughts on the housing market and their 2025 Home Buyer Resolutions.

The housing market in 2025 has been nothing but brutal for first-time homebuyers.

First-timers now make up just 21% of all ...Read more

Resident booted from HOA board due to language of living trust

Q: I placed my condo in a living trust for estate purposes. I am the beneficiary of the trust and I can amend, add and remove administrators. However, I am not the trustee of my trust.

I was a board member of our homeowners association (HOA). The manager of our HOA said I was required to resign from the board, I could not serve on committees, ...Read more

We weighed in on a reader’s positive experience selling by owner

Reader comment: I recently read your column in the Chicago Tribune, and I’d like to share my experience of selling my home on my own.

I had an appraiser come to my home. He was hired by the buyer’s mortgage company. I’m 65, and have lived in my home my whole life. The appraiser was older and very familiar with my neighborhood. He even ...Read more