Netflix agrees to buy Warner Bros. in a $72 billion deal that will transform Hollywood

Published in Business News

LOS ANGELES — Netflix has prevailed in its bid to buy Warner Bros., agreeing to pay $72 billion for the Burbank-based Warner Bros. film and television studios, HBO Max and HBO.

The two companies announced the blockbuster deal early Friday morning. The takeover would give Netflix such beloved characters as Batman, Harry Potter and Fred Flintstone.

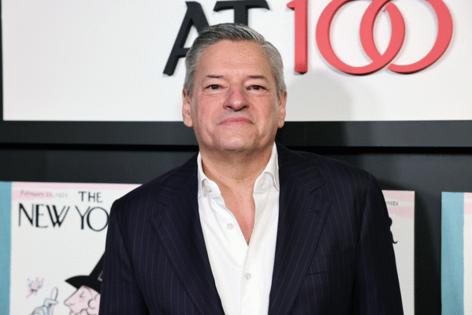

"Our mission has always been to entertain the world," Ted Sarandos, co-CEO of Netflix, said in a statement. "By combining Warner Bros.' incredible library of shows and movies — from timeless classics like 'Casablanca' and 'Citizen Kane' to modern favorites like 'Harry Potter' and 'Friends' — with our culture-defining titles like 'Stranger Things,' 'KPop Demon Hunters' and 'Squid Game,' we'll be able to do that even better."

Netflix's cash and stock transaction is valued at about $27.75 per Warner Bros. Discovery shares. Netflix also agreed to take on more than $10 billion in Warner Bros. debt, pushing the deal's value to $82.7 billion.

The breakthrough came earlier this week, after the three contenders — Netflix, Paramount and Comcast — submitted binding second-round offers. Netflix's victory was assured by late Thursday, soon after another deadline for last-minute deal sweeteners. Netflix and Warner's boards separately and unanimously approved the transaction.

Warner's cable channels, including CNN, TNT and HGTV, are not included in the deal. They will form a new publicly traded company, Discovery Global, in mid-2026.

Anti-trust experts anticipate opposition to Netflix's proposed takeover. Netflix has more than 300 million streaming subscribers worldwide, and with HBO Max, the company's base would swell to more than 420 million subscribers — a staggering sum much greater than any of the other premium video-on-demand streaming services.

In addition, Netflix has long prioritized releasing movies to its streaming platform — bypassing movie theater chains.

The deal posed "an unprecedented threat to the global exhibition business," Cinema United, a trade group representing owners of more than 50,000 movie screens, said in a statement announcing its opposition.

"The negative impact of this acquisition will impact theatres from the biggest circuits to one-screen independents in small towns in the United States and around the world," said Cinema United President Michael O'Leary said in a statement. "Netflix's stated business model does not support theatrical exhibition."

Netflix, in the statement, said it would maintain Warner Bros. operations, including theatrical releases for Warner Bros. films.

The Directors Guild of America said the proposed combination "raises significant concerns."

"A vibrant, competitive industry — one that fosters creativity and encourages genuine competition for talent — is essential to safeguarding the careers and creative rights of directors and their teams," the DGA spokesperson said. "We will be meeting with Netflix to outline our concerns and better understand their vision for the future of the company."

Losing the auction is a crushing blow for Paramount's David Ellison, the 42-year-old tech scion who envisioned building a juggernaut with the two storied movie studios, HBO and two dozen cable channels.

One month after buying Paramount, he set its sights on Warner Bros., triggering the auction with a series of unsolicited bids in September and early October.

But Warner Bros. Discovery's board rejected Paramount's offers as too low. In late October, the board opened the auction up to other bidders.

Comcast also leaped into the bidding for Warner's studios, HBO and its streaming service. Comcast wanted to spin off its NBCUniversal media assets and merge them with Warner Bros. to form a new jumbo studio.

____

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments