Health Advice

/Health

Doctors are preoccupied with threats of criminal charges in states with abortion bans, putting patients’ lives at risk

Abortion bans are intended to reduce elective abortions, but they are also affecting the way physicians practice medicine.

That is the key finding from our recently published article in the journal Social Science & Medicine.

Medical providers practicing in states that implemented abortion bans in the wake of the 2022 Dobbs...Read more

Mayo Clinic study: What standing on one leg can tell you

ROCHESTER, Minn. — How long a person can stand — on one leg — is a more telltale measure of aging than changes in strength or gait, according to new Mayo Clinic research. The study appears today in the journal PLOS ONE.

Good balance, muscle strength and an efficient gait contribute to people's independence and well-being as they age. How...Read more

Surgical innovations help personalize breast cancer treatment, improve quality of life

JACKSONVILLE, Florida — There are two surgical options to treat breast cancer: lumpectomy and mastectomy. But there are many more reasons why women choose one over another, says Sarah McLaughlin, M.D., a breast surgical oncologist and chair of the Department of Surgery at Mayo Clinic in Jacksonville, Florida.

"Some of that can be cancer-based...Read more

Recent recalls raise concerns about food safety, but experts credit better regulation and technology

CHICAGO -- Chicago Heights resident Stephanie Petersen was concerned by how many food recalls she saw daily on the Food and Drug Administration website.

“There was, like, (multiple) recalls every single day. And a lot of salmonella, listeria, a lot of different things,” Petersen said. “I was like, what is going on? It’s so many.”

...Read more

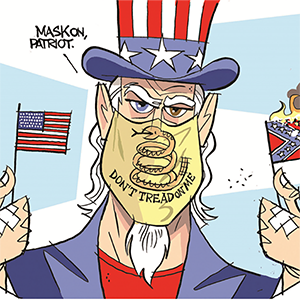

Commentary: Trump's toxic record on our food and health

While it is rarely a top campaign issue, Americans care deeply about our health and well-being, the food we put in our bodies and what corporations put into our food — especially when it comes to our children. We all want to know our food is safe and free of dangerous chemicals and additives that can cause serious health problems.

This ...Read more

Nedra Rhone: College students and mental health - they need support

When I was an undergrad, I became fast friends with a bubbly and seemingly outgoing fellow freshman. We were part of the same crew for a while but as the school year unfolded, we stopped seeing much of her.

She no longer joined us to eat in the dining hall each night. She declined invitations to weekend parties.

When I saw her on campus, she ...Read more

A California official helped save a mental health company's contract. It flew him to London

The director of California’s mental health commission traveled to London this summer courtesy of a state vendor while he was helping to prevent a $360 million budget cut that would have defunded the company’s contract.

Emails and calendars reviewed by KFF Health News show Toby Ewing, executive director of the Mental Health Services ...Read more

Tiny airborne particles within air pollution could be a silent killer – new study uncovers hidden risks and reveals who’s most at risk in New York state

Long-term high ultrafine particle concentrations in New York state neighborhoods are linked to higher numbers of deaths. That is the key finding of our new research, published in the Journal of Hazardous Materials.

Our study shows that high levels of ultrafine particles in the atmosphere over long periods of time are significantly ...Read more

Medicaid limits access to life-saving doses of addiction care

Consensus is growing around the idea that for some patients higher doses of a gold-standard opioid addiction treatment drug may be better than lower doses at keeping patients healthy and in treatment, especially for those who use fentanyl.

But whether someone can access higher doses of buprenorphine — which works by curbing cravings and ...Read more

Colorado's naloxone fund is drying up, even as opioid settlement money rolls in

DENVER — On a bustling street corner one recent afternoon outside the offices of the Harm Reduction Action Center, employees of the education and advocacy nonprofit handed out free naloxone kits to passersby.

Distributing the opioid reversal medication is essential to the center’s work to reduce fatal overdoses in the community. But how ...Read more

Mayo Clinic Minute: Clean out old medications safely

Note: National Prescription Drug Take Back Day is Oct. 26

____

Leftover or expired medications can be dangerous if not disposed of properly. Safely getting rid of unneeded prescriptions, like opioids or expired drugs, is essential to prevent misuse and accidental harm.

Dr. Tina Ardon, a Mayo Clinic family medicine physician, says proper ...Read more

Feel a pop, then pain in your knee? It could be an ACL tear

Getty Images You're playing tag with your kids, hitting a fast tennis return shot, landing after a gymnastics vault, evading a football tackle or jumping off a rock onto the beach. Suddenly, you feel a pop in your knee, then immediate pain followed by swelling.

You may have just injured or torn your anterior cruciate ligament, or ACL.

How an ...Read more

Mayo Clinic Minute: Radiation therapy for patients with breast cancer

Radiation therapy is a common component of breast cancer treatment for patients. The high-powered beams of intense energy kill cancer cells and reduce the risk of the cancer recurring.

Dr. Laura Vallow, chair of the Radiation Oncology Department at Mayo Clinic in Florida, explains how innovation is transforming radiation treatments.

Patients ...Read more

Mayo Clinic completes its first paired liver donation for transplantation

Anne Werpy rang a bell in late August, signifying her discharge from a recovery unit at Mayo Clinic in Rochester, Minnesota, after her liver transplant. Werpy received her liver as part of a unique pairing that matched recipients to donors who were unable to give their organs to loved ones who also needed transplants.

Anne Werpy had been ...Read more

Environmental Nutrition: Spotlight on supplements: bee pollen

With their talents for making things including honey and hives, few people question the origins of the phrase “busy as a bee.” But, what are the benefits of some of their creations, including bee pollen? EN dives into why bee pollen is creating a buzz as a supplement.

Background

In addition to honey, honeybees produce many byproducts, ...Read more

7 foods you should never eat raw

Plenty of everyday foods are perfectly safe and nutritious when prepared correctly, but when consumed raw or even undercooked, the ingredients put people at risk for illness, or worse.

Read on for a list of seven foods you should never eat raw, with input from professionals.

1. Flour

“The real reason you shouldn't eat raw cookie dough isn't...Read more

Virtual mental health care visits: Making them work for you

Before the pandemic, talking to a therapist or psychiatrist on a video call was novel. Now it’s fairly common. One recent analysis, for example, found that video appointments within the massive Veterans Affairs Health Care System jumped from about 2% of all mental health care encounters in January 2019 to 35% of these encounters in August 2023...Read more

Mayo Clinic Q&A: Protein needs for performance

DEAR MAYO CLINIC: I’ve taken up running and signed up for a half-marathon to keep me motivated. I know training puts a lot of wear and tear on the body, and I've heard protein is essential. How do I make sure I’m getting enough protein so I can perform at maximum ability?

ANSWER: As you prepare for your upcoming distance race — or any ...Read more

Mayo Clinic Q and A: Shockwave therapy may help relieve foot problem

DEAR MAYO CLINIC: I've had some foot issues, and I heard that shockwave therapy might be appropriate. How does it work? And how can it help?

ANSWER: This noninvasive treatment uses sound waves to transmit energy to tissues to help with the healing process. You may hear it referred to as extracorporeal shockwave treatment. Extracorporeal means ...Read more

'More change than usual:' Big revisions in drug plans and healthcare benefits ahead for Florida Medicare recipients

FORT LAUDERDALE, Fla. — Big Medicare changes will go into effect in 2025, giving Floridians more reason to sift through plans and make smart choices.

The 5.1 million Floridians who qualify for Medicare will have from Oct. 15 through Dec. 7 to choose original Medicare or one of the Medicare Advantage plans offered in their county.

Changes to ...Read more

Popular Stories

- Mayo Clinic study: What standing on one leg can tell you

- Commentary: Trump's toxic record on our food and health

- Tiny airborne particles within air pollution could be a silent killer – new study uncovers hidden risks and reveals who’s most at risk in New York state

- A California official helped save a mental health company's contract. It flew him to London

- Surgical innovations help personalize breast cancer treatment, improve quality of life