Consumer

/Home & Leisure

Lori Borgman: Conversations are growing ear-resistible

My husband and I have experienced some hearing loss. The most frequently heard word at our house is "WHAT!?"

More pressing than our physical hearing loss is our selective hearing loss, something that happens to couples who have been married a long time.

Just the other day, the husband was working on his laptop at the kitchen table with his ...Read more

Real estate Q&A: Do I have to sell condo to another owner in building?

Q: When we decided to sell our apartment, one of our friends wanted to buy it, and we agreed to sell it to him at a discounted price. When he went for his interview with the condo board, he was told that he could not buy it because another owner in the building was going to. Do I need to sell it to my neighbor at the discounted price, or can I ...Read more

Nix the oven? A skinny fridge? Tips on designing a tiny kitchen in your ADU

LOS ANGELES -- Unlike European kitchens, which are designed for efficiency rather than luxury, American kitchens often emphasize open-concept designs simply because they are larger.

But now that people are adding accessory dwelling units, or ADUs, in their backyards to house family members and generate passive income, the European model is ...Read more

Millions of New Yorkers facing rent hikes of up to 4% for 1-year lease

Around 2 million New Yorkers living in stabilized apartments will likely see their rents climb for the third year in a row, after the board tasked with setting rates okayed a range of possible hikes at a raucous preliminary vote on Tuesday — as tenants and their board representatives walked out in protest.

The rest of the Rent Guidelines ...Read more

Hong Kong vies with US in Bitcoin ETF market after crypto's revival

A batch of exchange-traded funds investing directly in crypto will debut in Hong Kong on Tuesday, heralding potential competition for US Bitcoin products whose popularity stoked a record rally in the digital asset.

Harvest Global Investments Ltd., the local unit of China Asset Management, and a partnership between HashKey Capital Ltd. and ...Read more

May Fed meeting preview: Are rate cuts canceled or just delayed? Watch for these 3 key themes as inflation stays hot

At the start of the year, the nation’s top economists thought the Federal Reserve would be using its May rate announcement to tee up the first cut of its fiercest inflation-fighting regime in 40 years.

Now, as inflation stays more stubborn than expected, they’re wondering whether those cuts are delayed — or completely canceled.

It’s ...Read more

Friends split a mortgage, share a home to beat high housing costs

Sara Kemper and Betsy Ohrn have been besties since first grade, so they've shared a lot through the years: even the mortgage on a St. Paul house that's much larger and grander than anything they could have afforded individually.

"We needed something we could grow into," said Kemper, recalling the house-shopping wish list she, Ohrn and their ...Read more

Erin Lowry: Your retirement anxiety can't be cured online

The often-cited goal of having a $1 million retirement nest egg needs to be retired itself. Adjusted for inflation, it would take nearly $1.9 million to have the same purchasing power today as in 1999, when the oldest of millennials were just turning 18. Granted, $1 million still sounds like a lofty sum to many Americans, which could be why so ...Read more

LA court strikes down controversial California law abolishing single-family zoning

A controversial housing law that abolished single-family zoning across California has been ruled unconstitutional by a Los Angeles County judge — but the narrow ruling is likely to be appealed by the state.

Passed in 2021, SB 9 allows single-family homeowners to split their lots in two and build two homes on each lot — allowing up to four ...Read more

Mortgage rates climb for a fourth week to reach 7.17%

Mortgage rates in the U.S. increased for a fourth straight week.

The average for a 30-year, fixed loan was 7.17%, up from 7.1% last week, Freddie Mac said in a statement Thursday.

House hunters looking to land a deal during the typically busy spring season are having to dig deeper to afford a purchase. Borrowing costs have climbed fairly ...Read more

Childcare costs 'more than a mortgage' per kid, forcing Philly parents to make tough choices

The Salovin family pays $26,000 a year for childcare for their two daughters.

For them, it’s a worthwhile expense, knowing their 1- and 4-year-old girls are at a licensed facility and they can both stay in the workforce.

But even the Delaware County, Pennsylvania, couple — who work in health-care administration and pharmaceuticals — is ...Read more

Can Colorado cities prevent thousands of apartments from losing affordability protections?

Nine years ago, one of Silverthorne, Colorado’s few income-restricted housing properties was sold to a private firm. The sale — at a price that was double the property’s assessed value — raised worries in the high-cost mountain community that the new owner of the Blue River Apartments might lift rent caps that had kept its 78 units ...Read more

Real estate Q&A: Can I break lease in poorly maintained building?

Q: I lease an apartment in a poorly maintained building. Lately, it has gotten to the point where the smell is literally making me sick. I want to move, but I signed a one-year lease. Can I get out of my lease due to this? — Cara

A: When a property is leased, it creates a legal relationship with benefits and responsibilities for the landlord ...Read more

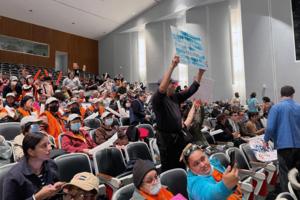

Amid homeowner insurance crisis, consumer advocates and industry clash at hearing

The fault lines running through California's spiraling homeowners insurance crisis were on display Tuesday at a state hearing, where consumer advocates clashed with industry firms over a plan to allow insurers to use complex computer models to set premiums — a move state officials say will attract insurers to the market.

State Insurance ...Read more

'Don't piss off the DOJ': Veteran Las Vegas agents react to renewed push against Realtors

Multiple veteran Las Vegas real estate agents say they are largely on board with the upheaval currently going on in their industry.

It’s time for change and more transparency in their governing bodies, they say.

A federal appeals court ruled earlier this month that the U.S. Justice Department could restart its investigation into the policies...Read more

PulteGroup announces 10% jump in revenues, earnings up 32%

PulteGroup last quarter had revenues of $3.8 billion, a 10% jump from the same period a year ago, as the nation’s housing shortage promises to fuel more construction, the company announced Tuesday.

The Atlanta-based homebuilding giant reported a 32% bounce in earnings, an 11% increase in the number of homes sold, as well as a higher profit ...Read more

Survey: More than 1 in 3 American travelers plan to go into debt for their summer vacations this year

Perhaps your summers hold fond memories of strolling along the beach, hiking mountains or trying new foods at a destination hundreds of miles from home. If so, are you planning to keep the travel streak going this year? Would you go into debt for it?

A new Bankrate survey found that only about half (53%) of Americans are planning a summer ...Read more

Thrivent has found a way for everday folks to get a piece of the private equity market

Private equity has been an outperforming investment options for years, but it's not been an option for most investors.

Private equity investment options have generally been reserved for institutional investors or people who have at least $5 million or more to commit. That has left the bulk of investors watching from the lobby.

Now Minneapolis-...Read more

California sees two more property insurers withdraw from market

California’s already strained property insurance market is facing a new challenge as two more insurers, Tokio Marine America Insurance Co. and Trans Pacific Insurance Co., plan to withdraw from the wildfire-prone state entirely starting in July.

The two companies, units of Japan-based Tokio Marine Holdings Inc., disclosed their plans in ...Read more

NYC storefront vacancies remain stuck at pandemic levels; lower Manhattan hit hard

Storefront vacancy rates in New York City have yet to recover from pandemic peaks, with Manhattan in particular struggling to bounce back, new city data show.

The issue made headlines during the pandemic, when retail storefronts on many major thoroughfares sat empty as businesses across the city shuttered. The issue was the focus of a City ...Read more

Popular Stories

- Erin Lowry: Your retirement anxiety can't be cured online

- Thrivent has found a way for everday folks to get a piece of the private equity market

- Real estate Q&A: Do I have to sell condo to another owner in building?

- Hudson Yards Vessel to reopen three years after spate of deaths

- House hunters fear Realtor settlement could make homebuying harder