Automotive

/Home & Leisure

Millions of semi-trucks on US roads still rely on fossil fuels. Cutting-edge EV tech in California could change that

On a recent cloudless spring day on the outskirts of Gilroy, California, Christian Martorella accelerated an 18-wheeler past budding orchards. But instead of the roar of a diesel engine, the cab filled with the gentle hum of an electric motor.

After driving diesel trucks for 10 years, Martorella initially eyed electric trucks skeptically. Now, ...Read more

Tesla axes most of Supercharger team in blow to other automakers

Tesla Inc. eliminated almost its entire Supercharger organization, which has built a vast network of public charging stations that virtually every major automaker is in the process of tapping into in the US.

The decision to cut the nearly 500-person group, including its senior director, Rebecca Tinucci, was made by Chief Executive Officer Elon ...Read more

Michigan EV fast-charging infrastructure increased 52% in 2023

Michigan’s electric-vehicle fast-charging infrastructure grew slightly faster than the nation overall last year, according to a new report by East Lansing-based Anderson Economic Group.

In 2023, the state's number of public DC fast-charging stations increased about 52%. Nationwide, the number of public DC fast charging stations increased by ...Read more

Stellantis first-quarter revenues, shipments fall amid transition to new vehicles

Stellantis NV on Tuesday said its first-quarter revenue fell 12% to $44.7 billion (41.7 billion euro) compared to last year as the company transitions to a number of next-generation vehicles that will be built on new platforms.

Vehicle shipments worldwide were down 10%, to 1.3 million, compared to the same three-month period a year ago.

For ...Read more

Big rigs in California are getting cleaner -- but can long-range targets for trucks be met?

California policymakers want to clean up the emissions spewed by the trucking industry — and they've passed mandates and established targets to get there.

The federal government recently followed up, creating its own set of national guidelines that are staggered by year and truck classification.

With California at the forefront, adoption is ...Read more

Stellantis first-quarter revenues, shipments fall amid transition to new vehicles

Stellantis NV on Tuesday said its first-quarter revenue decreased 12% to $44.7 billion (41.7 billion euro) compared to last year as the company transitions to making a number of next-generation vehicles to be built on new platforms.

Vehicle shipments reached about 1.3 million vehicles in the first quarter, down 10% compared to the same three-...Read more

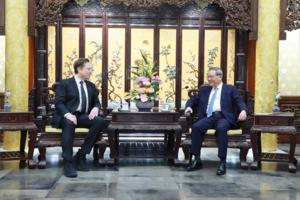

Tesla soars on tentative China approval for driving system

Elon Musk’s quick visit to China paid immediate dividends, with Tesla Inc. receiving in-principle approval from government officials to deploy its driver-assistance system in the world’s biggest auto market.

The U.S. carmaker was granted the approval under certain conditions, according to a person with knowledge of the matter, who asked not...Read more

Rivian: 'We are not abandoning Georgia'

Executives for electric vehicle maker Rivian said Saturday the company remains committed to building a massive manufacturing plant 60 miles east of Atlanta despite a recent pause on construction.

The company recently pivoted its plans and is ramping up production of its new R2 SUV at its plant in Normal, Illinois. This caused some state ...Read more

Motormouth: Can I use flex fuel?

Q: What's with this new eco-friendly gas blend with the yellow handle? Will it harm a non-flex fuel engine? It's 50 cents cheaper.

R.M., Elbert, Colorado

A: According to the U.S. Department of Energy, Energy Efficiency and Renewable Energy division, E85 (or flex fuel) is a term that refers to high-level ethanol-gasoline blends containing 51% ...Read more

Maserati GranCabrio Folgore: A healthy dose sexy Italian automotive lightning

Ooooh. That’s pretty, isn’t it? It’s the Maserati’s newest EV, the 2025 Maserati GranCabrio Folgore, a pure battery electric, two-door, four-seat convertible, a model in a class of one. It took nearly eight years to arrive from initial conception, but there’s a reason for that.

“We knew we had to create rolling sculpture,” said ...Read more

The first big-rig hydrogen fuel station in the US opens in California

OAKLAND, California — The first commercial hydrogen fuel station for big-rig trucks in the U.S. is up and running at the Port of Oakland, a baby step toward what hydrogen proponents see as a clean new future for long-haul trucking.

The small station, now serving 30 hydrogen fuel-cell trucks, could mark the start of a nationwide network for ...Read more

Auto review: The Genesis G90 is cool just sitting in your driveway

OAKLAND COUNTY, Michigan — Luxury cars are becoming Brookstone gadget stores on wheels. Who needs to drive them? They’re just fun to play with.

Take the 2024 Genesis G90 sitting in my driveway.

With the key in my pocket, I walked up to the Genesis and it rolled out the red carpet. Make that lit carpet. A Genesis logo splashed on the ground...Read more

Auto review: 2024 BMW X6 is nothing short of stunning

The luxury midsize coupe is becoming increasingly popular in the consumer market, and BMW is easily the leader of the pack with its X6. Featured in Grasso's Garage this week is the BMW X6 xDrive40i, adorned in Aventurin Red Metallic — a fiery red/orange metallic hue that is a stunning display of beauty, at least to my eyes.

Equipped with an ...Read more

Electric vehicle 'workforce hub' coming to Michigan, White House says

WASHINGTON — Michigan will be among four new "workforce hubs" designated to help prepare workers for new manufacturing jobs, the White House said Thursday. The Michigan hub will focus specifically on electric vehicles.

The effort — a collaboration between federal and state agencies — is meant to train or retrain workers through ...Read more

Toyota is investing $1.4 billion to build another all-electric SUV in US

Toyota Motor Corp. is moving ahead with plans to manufacture and sell more electric vehicles in the U.S. by investing $1.4 billion at a plant in Indiana, the Japanese carmaker’s second such announcement this year.

The Princeton, Indiana, facility — which currently makes four gas and hybrid models — will add an unnamed all-electric, three...Read more

Ford Q1 profits fall 28% as Ford Blue hit from F-150 ramp-up

Ford Motor Co. said Wednesday it made $1.3 billion in net income in the first quarter of 2024, a 28% decrease year-over-year, as earnings from Ford's gas-engine and hybrid business tumbled from the ramp-up of the refreshed 2024 F-150 pickup truck.

The profit that represented 33 cent earnings per diluted share came on $42.8 billion in revenue, ...Read more

GM's CEO no longer highest paid Detroit auto executive

General Motors Co. CEO Mary Barra is no longer the highest-paid Detroit automotive company chief executive, receiving a 2023 compensation package totaling $27.8 million — trailing Stellantis NV CEO Carlos Tavares' $39.491 million payout.

Barra, 62, saw her pay drop 4% from her 2022 compensation of $28.97 million with a decline in her bonus ...Read more

Tesla soars as Musk's cheaper EVs calm fears over strategy

Tesla Inc. shares surged after Elon Musk vowed to launch less-expensive vehicles as soon as late this year, easing concerns about disappointing earnings results and diminished growth prospects.

The automaker said Tuesday it’s accelerating new models using aspects of a next-generation platform that had been slated for the second half of next ...Read more

GM beats profit expectations in first quarter, increases guidance for 2024

General Motors Co. beat Wall Street expectations on Tuesday, delivering first-quarter net income of $3 billion on revenue of $43 billion.

The Detroit automaker increased its guidance for the year of adjusted earnings to be in a range of $12.5 billion to $14.5 billion, up from $12 billion to $14 billion. The automaker expects its net income for ...Read more

Honda nears deal with Canada to boost electric vehicle capacity

Canada is on the verge of an agreement with Honda Motor Co. that would see the Japanese firm build electric vehicles and their components in the province of Ontario, according to people familiar with the matter.

The deal, expected to be announced within a week, involves a multibillion-dollar commitment by Honda for new facilities to process ...Read more

Popular Stories

- Millions of semi-trucks on US roads still rely on fossil fuels. Cutting-edge EV tech in California could change that

- Tesla axes most of Supercharger team in blow to other automakers

- Stellantis first-quarter revenues, shipments fall amid transition to new vehicles

- Michigan EV fast-charging infrastructure increased 52% in 2023

- Big rigs in California are getting cleaner -- but can long-range targets for trucks be met?