Medical debt affects much of America, but Colorado immigrants are hit especially hard

Published in Health & Fitness

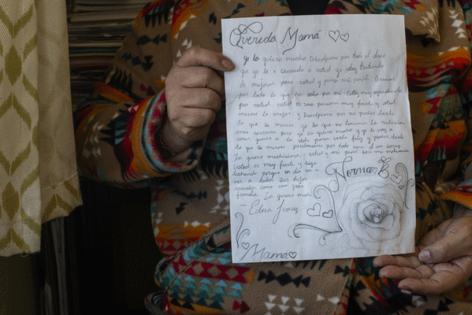

DENVER — In February, Norma Brambila’s teenage daughter wrote her a letter she now carries in her purse. It is a drawing of a rose, and a note encouraging Brambila to “keep fighting” her sickness and reminding her she’d someday join her family in heaven.

Brambila, a community organizer who emigrated from Mexico a quarter-century ago, had only a sinus infection, but her children had never seen her so ill. “I was in bed for four days,” she said.

Lacking insurance, Brambila had avoided seeking care, hoping garlic and cinnamon would do the trick. But when she felt she could no longer breathe, she went to an emergency room. The $365 bill — enough to cover a week of groceries for her family — was more than she could afford, pushing her into debt. It also affected another decision she’d been weighing: whether to go to Mexico for surgery to remove the growth in her abdomen that she said is as big as a papaya.

Brambila lives in a southwestern Denver neighborhood called Westwood, a largely Hispanic, low-income community where many residents are immigrants. Westwood is also in a ZIP code, 80219, with some of the highest levels of medical debt in Colorado.

More than 1 in 5 adults there have historically had unpaid medical bills on their credit reports, more in line with West Virginia than the rest of Colorado, according to 2022 credit data analyzed by the nonprofit Urban Institute.

The area’s struggles reflect a paradox about Colorado. The state’s overall medical debt burden is lower than most. But racial and ethnic disparities are wider.

The gap between the debt burden in ZIP codes where residents are primarily Hispanic and/or non-white and ZIP codes that are primarily non-Hispanic white is twice what it is nationally. (Hispanics can be of any race or combination of races.)

Medical debt in Colorado is also concentrated in ZIP codes with relatively high shares of immigrants, many of whom are from Mexico. The Urban Institute found that 19% of adults in these places had medical debt on their credit reports, compared with 11% in communities with fewer immigrants.

Nationwide, about 100 million people have some form of health care debt, according to a KFF Health News-NPR investigation. This includes not only unpaid bills that end up in collections, but also those being paid off through installment plans, credit cards, or other loans.

Racial and ethnic gaps in medical debt exist nearly everywhere, data shows. But Colorado’s divide — on par with South Carolina’s, according to the Urban Institute data — exists even though the state has some of the most extensive medical debt protections in the country.

...continued

©2024 KFF Health News. Distributed by Tribune Content Agency, LLC.

Comments