Consumer

/Home & Leisure

/ArcaMax

Sacramento is doubling down on tiny homes. Is it a bold move or a misguided one?

Sheleko Maynard was riding on a bus, worried about the possibility of spending another year living alone outside in a tent when she got a call: She had been accepted into a tiny home community in Sacramento and could move in the next day.

That was about a year ago. The 75-square-foot dwelling gave her a heater, a bed to herself and a desk she ...Read more

For these thrifters, their rental is 99% secondhand goods and that's 'part of the fun'

LOS ANGELES -- After moving to Los Angeles from Palo Alto in 2023 with only a standing desk and a bed frame, Tess van Hulsen and Andrew Chait learned quickly how to furnish an empty rental without buying anything new.

Because they love thrifting, decorating together was actually fun for them.

Two years later, their love of thrifting, antiquing...Read more

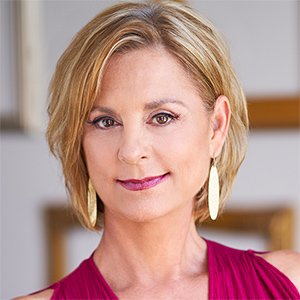

Everyday Cheapskate: Simple Secrets to Make Clothes Look Better and Last Longer

You should see the big wad of lint I just plucked from the trap of my clothes dryer. Ack! Where does all of that come from? I know I emptied all pockets, and I'm certain I did not wash a bag of pillow stuffing.

I'll tell you what it is, and I am not happy about this: It's visual proof the dryer is wearing out our clothes. Those fibers were ...Read more

Everyday Cheapskate: How to Deep-Clean a Coffee Maker

Performing a deep clean on a coffee maker is important to extend its useful life and ensure you're brewing the best-tasting coffee possible.

A buildup of hard water scale and rancid coffee oils in a coffee maker is to be expected. Allowing that buildup to remain (and multiply) can be very hard on the machine and make the coffee that comes from ...Read more

Anthropic AI tool sparks selloff from software to broader market

Once again, artificial intelligence is dominating investors’ attention in the stock market. These days, however, the focus is turning more and more toward companies that may get disrupted by the new technology rather than those who stand to profit from it.

A Goldman Sachs basket of U.S. software stocks sank 6% on Tuesday, its biggest one-day...Read more

Everyday Cheapskate: 8 Surprising Ways Lemons Can Make Your Life Easier

Several years ago, my son gave me the bounty from the two fruit trees that pretty much rule his backyard. My Mother's Day gift of Meyer lemons weighed in at 124 pounds. I know, lucky me!

I had to figure out ways to use, share and preserve lemons in a big hurry. I juiced, cooked and baked all kinds of lemon things. And I learned so many ways to ...Read more

Zillow cuts 200 jobs

Think the real estate market is tough? Working for a real estate giant could be tougher.

The Seattle-based real estate giant Zillow terminated around 200 employees last month for failing to meet performance expectations.

The cuts coincided with widespread layoffs at several Seattle-area companies that sent shock waves through the local job ...Read more

Eviction levels hit an all-time high in WA, especially in Seattle area

Washington state and King County recorded more evictions in 2025 than ever before — a sign that the affordability crisis is deepening.

The number of eviction cases filed in Washington courts rose to 23,965 in 2025, a 3% increase from 2024. The increase was significantly greater in the Seattle area.

Eviction cases grew by 12% to 8,732 in King...Read more

Everyday Cheapskate: What on Earth Can I Do With These Chinese Leftovers?

We've all faced that moment of truth: You open the refrigerator door and there sit the Chinese leftovers from last night's dinner, looking a little wilted and more than a little judgmental. You didn't throw them away -- good for you. But what do you do with them now?

Before you resign yourself to eating cold lo mein over the sink, let's rethink...Read more

'Time to do better': Las Vegas public housing complex to be torn down, redeveloped

When Marble Manor opened in the early 1950s, the Las Vegas public housing complex offered modern homes with up-to-date kitchens, bathrooms, heating and cooling.

It had everything needed for “comfort and clean living,” a newspaper columnist wrote, noting it served people who had been living, or just existing, in “paper-box or cardboard ...Read more

Rocket Companies accused of mortgage steering

Rocket Companies, which acquired Seattle-based Redfin last year, allegedly pressured agents to steer buyers toward its loans — even if the loan terms were unfavorable for their clients, a lawsuit claims.

In the lawsuit filed Monday in the U.S. District Court for the Eastern District of Michigan, three homeowners from Georgia, North Carolina ...Read more

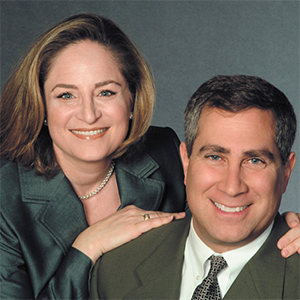

Real estate Q&A: What should we prioritize as we look to buy our first home?

Q: My partner and I have been together for a few years and have been living in a rented house. It’s time for us to buy our first house. Do you have any recommendations on what we should be looking for in our new home? — Christine

A: There is no shortage of advice when you are looking to buy your first home.

The first thing to understand is...Read more

San Diego shows what happens when a city actually lets builders build

As Los Angeles grapples with a housing shortage, it could learn from San Diego, which has proved better at convincing construction companies to build more.

The city is more welcoming to developers, industry insiders say, with fewer regulations and fees, better planning and less rent control.

"It is easier to build in San Diego over Los Angeles...Read more

Everyday Cheapskate: Why You Should Never Be Late Paying Your Rent

Some days, my email inbox fills me with joy. And then there are the days that a message nearly breaks my heart. That was the case when I opened this letter from one of my dear readers who lives in Missouri.

Dear Mary: In one of your columns ("What To Do When You Can't Pay Your Bills?" EverydayCheapskate.com/bills), you recommend paying your ...Read more

The Fed didn't cut interest rates. Here are 5 things to watch next

The Federal Reserve left interest rates alone at its first meeting of the year, keeping borrowing costs at a multiyear high for Americans as policymakers grow more cautious.

The decision means Fed policymakers will keep their benchmark rate in a target range of 3.5-3.75%, pausing a recent string of three rate cuts that began in September 2025. ...Read more

Everyday Cheapskate: You Need an Insurance Checkup

From regular oil changes to changing furnace filters and annual trips to the dentist, smart consumers know that preventive maintenance can avoid costly repairs down the road. Insurance is another item that needs to go on your routine maintenance list.

Here's the challenge: No one wants to think about insurance unless forced to. But at least ...Read more

Everyday Cheapskate: Mortgage Lender Calling Every Hour All Day Long!

Dear Mary: We are one month behind on our mortgage payments and plan to catch up this month. We have told our credit union we will pay half on the 1st and the second half on the 13th. This will bring us current. Still, they call all day, every hour. When we answer they say they have to call us constantly until the amount due is paid. That is ...Read more

California ranks among worst states to retire in. Here's why

Maureen Spranza marked her retirement with a party in August 2024. By December of 2025, the 60-year-old was back at work, “un-retiring” as rising costs made retirement unaffordable. She now holds three jobs.

Moving from celebration to working six days a week was difficult and disappointing, she said, and meant putting personal projects and...Read more

Debate over taxing short-term rentals rages in Washington

Washington is debating a bill that would make short-term rentals more expensive to fund affordable housing initiatives.

After a similar effort failed last session, the Legislature is once again considering a controversial bill allowing local governments to tax short-term rentals up to 4% — which would be $8 on a $200-a-night stay.

Short-term...Read more

Everyday Cheapskate: How Often Should You Wash Everything? A Launderer's Guide

We all know the laundry pile never goes away. But instead of guessing your way through life, here's a no-nonsense guide to how often you should launder key household fabrics -- and yes, that includes your sheets, towels and all those overlooked blanks and throws.

BEDDING

Your nightly contact zone deserves weekly attention. You spend roughly 50...Read more

Inside Consumer

Popular Stories

- Tax refunds are larger this year. Make yours a stepping stone for your future

- Redfin to show some non-MLS home listings in deal with Compass

- The newest trend in LA office space: In-house studios for traveling influencers

- Real estate Q&A: How can I stop neighbor from leaving dogs' waste in my yard?

- Rents are rising fast in Michigan's mid-size cities. Here's why