US debt default could trigger dollar’s collapse – and severely erode America’s political and economic might

Published in Political News

They may not be alone: Recently, Saudi Arabia suggested it was open to trading some of its oil in currencies other than the dollar – something that would change long-standing policy.

Beyond the impact on the dollar and the economic and political clout of the U.S., a default would be profoundly felt in many other ways and by countless people.

In the U.S., tens of millions of Americans and thousands of companies that depend on government support could suffer, and the economy would most likely sink into recession – or worse, given the U.S. is already expected to soon suffer a downturn. In addition, retirees could see the worth of their pensions dwindle.

The truth is, we really don’t know what will happen or how bad it will get. The scale of the damage caused by a U.S. default is hard to calculate in advance because it has never happened before.

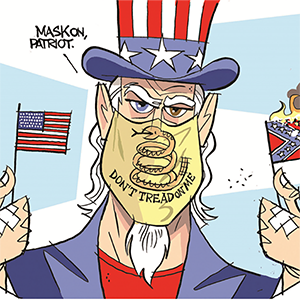

But there’s one thing we can be certain of. If Republicans take their threat of default too far, the U.S. and Americans will suffer tremendously.

This article is republished from The Conversation, an independent nonprofit news site dedicated to sharing ideas from academic experts. If you found it interesting, you could subscribe to our weekly newsletter.

Read more:

Why America has a debt ceiling: 5 questions answered

House Speaker McCarthy’s powers are still strong – but he’ll be fighting against new rules that could prevent anything from getting done

Michael Humphries does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Comments