From the Right

/Politics

A Turning Point for American Foreign Policy?

Was the passage by the House last Saturday and the Senate on Tuesday of the foreign aid package with money for Ukraine, Israel and Taiwan a turning point in American foreign policy?

It certainly was a turnabout in rhetoric and in partisan behavior. House Speaker Mike Johnson led the narrowly Republican House to pass by resounding margins bills ...Read more

Maybe Larger Families Will Produce Better Leaders, as in the Early US

Why was America in the Revolutionary War era, with 3 million people, able to generate leaders of the quality of Benjamin Franklin and George Washington, while today's America, with 333 million people, generates the likes of President Joe Biden and former President Donald Trump?

That's a question I keep asking as I alternate between writing ...Read more

A Fail-Safe Society Is Sure to Fail

When are we going to trust our fellow Americans again? When are we going to allow qualified individuals with responsibility to make decisions without consulting detailed rulebooks and formal procedures?

Those are questions New York lawyer and author Philip K. Howard (one of whose books is called, simply, "Try Common Sense") asks in his latest ...Read more

Disorder on the Border Remains a Problem for Biden Democrats

What were they thinking? Did President Joe Biden and the folks who put together his immigration policy imagine the voting public would celebrate policies that resulted in a record-high number of migration encounters -- more than three-quarters of a million -- in the usually low-immigration months of October, November and December 2023?

Did they...Read more

Today's Leaders Are Not Living Up to Constitutional Norms

How are America's leaders measuring up against the standards set by the Constitution and the examples of the Founding Fathers? It's a question I've been asking as I seek refuge from contemporary politics in reading and occasionally writing, in my 2023 book "Mental Maps of the Founders," about the early years of the republic.

One answer is that ...Read more

The Electric Car Fiasco

Donald Trump's anodyne if overexcited comment that the U.S. auto industry would face a "bloodbath" if he's not elected and doesn't impose 50% or 100% tariffs on cars produced predictable results.

"Don't outsmart yourself," Sen. Brian Schatz (D-Hawaii) posted, and Joe Biden's campaign promptly charged Trump with promising a "bloodbath" if he ...Read more

Democrats Losing Their Hold on California and California Losing Its Hold on America

Last week's Super Tuesday results ensured the renominations of former President Donald Trump and President Joe Biden, barring some unanticipated adverse health events. So, who's going to win in November?

Polls give us clues. Trump continues to have the small but persistent lead in public polls he has maintained since November 2023 -- in ...Read more

Are Voters Recoiling Against Disorder?

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley's withdrawal, there will be no more significantly contested primaries or caucuses -- the earliest both parties' races have been ...Read more

Some Idiosyncratic Observations of the Elections So Far

Herewith some idiosyncratic, perhaps eccentric, observations on the electoral contests so far in this presidential cycle.

1. Turnout is down. In the first five contests -- the Iowa and Nevada caucuses and the New Hampshire, South Carolina and Michigan primaries -- Republican turnout was down from 2016, the most recent cycle with serious ...Read more

Biden Open-Door Policy: Some Facts and Historical Context

What's been missing these past couple of months from the coverage of and debate over the failed immigration bill? Some important basic facts and lots of historical context.

First, basic facts. Coverage in left-leaning newspapers and even in the conservative Wall Street Journal editorial page has suggested that without new legislation, the Biden...Read more

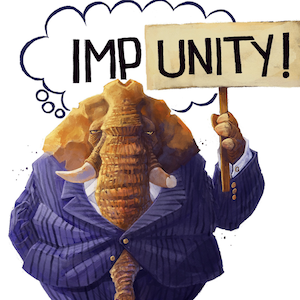

America's Dysfunctional Overclass

What does America's overclass think of the rest of us? The short answer is "not much." They think ordinary people's splurging on natural resources is destroying the planet and needs to be cut back forcefully. And that the government needs to stamp down on ordinary people enjoying luxuries that, in their view, should be reserved for the top ...Read more

Toward a Demotic Republican Party

What happens when a political party becomes demotic? Before answering the question, note that the word in question is not demonic, from the Greek word daimon, meaning a deity (remember that the Greek gods were notoriously jealous and greedy), but demotic, from the Greek word demos, meaning the people -- the same root as democratic.

My question ...Read more

Systemic Lying Corrodes Once-Great Institutions

The last six or seven months have been a couple of tough seasons for public policies based on lies. Two examples come to mind. One is the Disinformation industry, which has eroded the credibility of the public health establishment. The other is the Diversity, Equity, Inclusion industry, which has infected American higher education with a culture...Read more