Carbon offsets bring new investment to Appalachia’s coal fields, but most Appalachians aren’t benefiting

Published in Science & Technology News

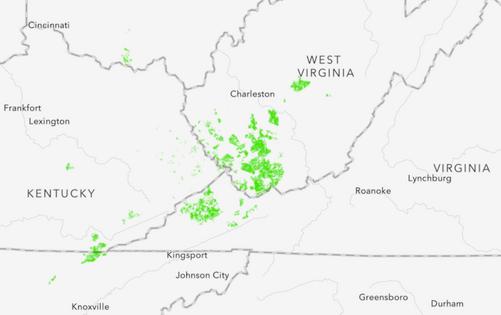

Central Appalachia is home to the third-largest concentration of forest carbon offsets traded on the California carbon market. But while these projects bring new investments to Appalachia, most people in Appalachia are not benefiting.

The effect of this new economic activity is evident in the Clearfork Valley, a forested region of steep hills and meandering creeks on the Kentucky-Tennessee border.

Rural communities here once relied on coal mining jobs. As the mines shut down, with the last closing in 2022, the valley was left with thousands of acres of forests and strip-mined land but fewer ways to make a good living.

Today, corporate landowners and investment funds have placed most of that forest land into carbon offset projects – valuing the trees for their ability to absorb carbon dioxide emissions to help protect the climate.

These carbon offsets projects can be lucrative for the landowner, with proceeds that can run into the millions of dollars. Companies subject to California’s carbon emissions rules are willing to pay projects like these to essentially cancel out, or offset, the companies’ carbon emissions. However, my research shows that few local residents are benefiting.

The projects are part of a wider and growing trend of investor-owners of rural land making money but providing little local employment, local investment or community involvement in return.

The rise of carbon forest offset projects in Appalachia has coincided with the historic decline of the coal economy.

Central Appalachia lost 70% of its coal jobs from 2011 to 2023 as its coal production fell by 75% in that same period. As corporate landowners looked for new revenue streams, they found a burgeoning forest carbon offset market after California instituted a forest carbon offset protocol in 2011.

Much of the Clearfork Valley was originally owned by the American Association, a British coal corporation that accumulated the land in the 1880s. That property passed between other coal companies before NatureVest, a climate change-driven investment firm owned by The Nature Conservancy, created an investment fund to purchase the land in 2019.

The previous owner, a forestland investment company, had established carbon offsets on that land in 2015, making a 125-year commitment to retain or grow the forest carbon stock. When NatureVest purchased the land in 2019, it generated at least US$20 million in proceeds from the sale of additional offsets. The details of such transactions are typically private, but offset sales can be structured in a number of ways. They might be one-time payments for existing credits, for example, or futures contracts for the potential of additional credits.

The investment fund is attempting to demonstrate that managing land to help protect the climate can also generate revenue for investors.

In Appalachia, offset projects largely involve “improved forestry management.” These offsets pay landowners to sequester carbon in trees – additional to what they would have pulled in without the offset payment – while still allowing them to produce timber for sale. In practice, this often means letting trees stand for longer rotations before cutting for timber.

Recent research, however, indicates that the carbon storage of improved forestry management projects may be getting overcounted on the California market, the largest compliance offset market in the Americas. Other approaches to carbon offsets could produce better outcomes for people and the climate.

And while the landowners and investors profit, my research, including dozens of interviews with residents, has also found that former mining communities in this valley have seen little return.

The Nature Conservancy has offered support to local communities. But while the organization operates a small grant program from coal mining and gas drilling royalties it receives from the land, the investment in the local economy has been relatively small – roughly $377,000 in the three states since 2019. Furthermore, while some communities have benefited, these investments have largely bypassed struggling former coal communities in the Clearfork Valley in Tennessee.

Looking for other revenue sources on these lands, by 2022, The Nature Conservancy had also leased access to nearly 150,000 acres of its Cumberland Forest Project, including parts of the Clearfork Valley, to state agencies and outdoor recreation groups. As a result, permits and fees are often now required to enter much of the forestland.

As one interviewee told my co-author for our forthcoming book, “For three generations my family has been able to walk and use that land, but now I could be arrested for entering it without a permit.”

While a century ago many of the landowners in Appalachia were coal companies and timber companies, today they are predominantly financialized timber investment management organizations, or TIMOs. TIMOs are financial institutions that manage timberlands to generate returns for institutions, such as endowments and pension funds, and private investors. While NatureVest is more diversified than a TIMO, its timberland investments operate in a similar fashion.

The financial ownership of timberlands is part of the much wider trend of financialization of the United States economy. Wall Street-based investors have become major owners of all sectors of the U.S. economy since the 1970s, from agriculture and manufacturing to natural resources.

Financial profits, however, often do not entail job creation or investments in infrastructure in the surrounding communities. Yet the investor-owned timberlands in Central Appalachia do generate millions of dollars in revenue for their investors.

Political economists have diagnosed the trend of falling employment that accompanies increasing economic activity as partially the result of growing rentierism.

Rentierism is a term for generating income predominantly from rents as opposed to income from production that employs people. Rural communities have acutely felt the effects of increasing rentierism in various sectors since the 1970s.

Researchers have noted growing trends of rentierism in forestland management. Many TIMOs seek new revenue streams from timberlands outside of wood products and timbering, such as in conservation easements. As firms such as NatureVest seek to generate income from controlling carbon stocks or conservation resources, there is now a growing climate rentierism.

A robust body of research in sociology and political science shows how the hollowing out of rural North American economies has fed into a kind of rural resentment. Trust in government and democracy is particularly low in rural North America, and not only because of economic woes. As sociologist Loka Ashwood documents, it is also because many rural residents believe that the government helps corporations profit at the expense of people.

Carbon offsets in Appalachia, unfortunately, fit within these troubling trends. Government regulation in California generates sizable revenue for corporate landowners, while the rural communities see themselves locked out of the economy.

This article is republished from The Conversation, a nonprofit, independent news organization bringing you facts and analysis to help you make sense of our complex world.

Read more:

Satellites detect no real climate benefit from 10 years of forest carbon offsets in California

Trees aren’t a climate change cure-all – 2 new studies on the life and death of trees in a warming world show why

Gabe Schwartzman received funding from the National Science Foundation. He is a board member of the Southern Connected Communities Project (SCCP), a non-profit based in East Tennessee, and former board member of Statewide Organizing for Community eMpowerment (SOCM).

Comments