Home & Leisure

/ArcaMax

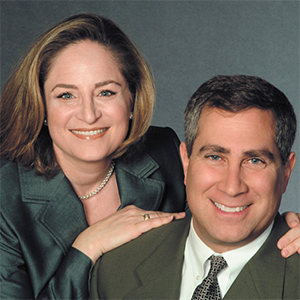

Homeowners consider paying off mortgage using DRIP investment

Q: We only owe about $60,000 on our house (thanks to your sound financial advice when we got the mortgage, and suggestions about making extra payments along the way). We have two dividend reinvestment plans (DRIP) worth about $110,000 (again, due to your advice).

Should we take money from the DRIP investments and pay off the house? We have no ...Read more

What happens if no one wants to be on the HOA board?

Q: I belong to a 55-plus community of 20 single-family homes. We are self-governed by a homeowners association board of five members. This past spring, the terms of two of the members expired and they declined to run again. No other residents volunteered to serve, so we are down to three board members.

Next spring two more board seats expire. ...Read more

Townhome owner seeks solution to neighbor’s seemingly hazardous downspout

Q: I live in a townhouse cluster governed by a homeowners association and a master community association. I have been having an issue with a neighbor’s downspout. I’ve noticed a large amount of water descending from this downspout onto my driveway. I’m concerned, because during the winter icicles hang from his gutters and the downspout ...Read more

How to prepare for your multigenerational living arrangement

Q: I read your article on multigenerational living and found it incredibly interesting. My family and I are planning a similar multigenerational living arrangement by adding on to my parents’ house. We are located in Colorado and hoping to find both a financial advisor and a real estate attorney to guide us through the process. Can you give us...Read more

Is it legal to deconvert a condo building?

Q: My daughter purchased her first home — a one bedroom condominium in a suburb of Chicago back in 2017. Recently, she was notified that the building was going to deconvert and become a rental building. We are questioning all parts of this move, as very little real information has been made available.

Is it legal to deconvert a condo building...Read more

Even if you already have a will, consider a living trust

Q: I read about people putting their home in trust to avoid probate. Our estate plan is a simple will. Our house and everything we own, including our money and personal effects, is left to our son. I thought that would be proper. Were we misguided when the will was made?

A: There’s nothing wrong with putting together and signing a will. We ...Read more

How does paying off your mortgage impact your trust beneficiaries?

Q: Well, I just paid off my house and don’t know what the next steps might be. I did receive a letter from my mortgage lender congratulating me on paying off my loan, but I don’t know what specific paperwork I should be looking for or requesting.

My home is in a trust. Upon my death, the home will go to my son. I don’t know if or how that...Read more

Reader’s experience after mother’s passing highlights importance of having a will and ensuring heirs have access

Q: My mother’s original will was kept in her attorney’s office. At some time after she signed the will with her attorney, the attorney died.

My sister hoped our mother died without a will so that she would get half of what my mother owned. My elder law attorney was able to find my mother’s will from my mom’s original attorney’s law ...Read more

Condo resident believes property management fee is inappropriate

Q: Have you ever heard of a property management company charging a condo association a 4% fee for a “loan administration”? This fee would be on top of the loan’s interest rate.

An attorney I know has suggested that the fee is not legal. I spoke to the department of professional and regulatory affairs, and I got the impression that the fee...Read more

Let’s discuss the ins and outs of co-ops

Q: We are wondering if you could provide us with some enlightenment about the ins and outs of buying a co-op. We would also like to know about how we can get more information about the co-op, specifically the bylaws, financial health and board minutes without actually putting a contract on it.

Our daughter is ready to move out on her own and ...Read more

Condo reserves a growing issue

A few weeks ago, we wrote about condo and co-op reserves and the new Florida State law. This new law, passed in the wake of the Surfside collapse in 2021, mandates condo and co-op buildings at least 30 years old do milestone structural inspections by Dec. 31, 2024. They must do additional milestone structural inspections every 10 years ...Read more

New homeowner experiences significant, costly repairs despite previous home inspection

Q: When we bought our house six years ago, we got an inspection with a 55-page illustrated report pointing out lots of typical problems (rusty rail, reversed wiring, cracked cement, etc.). We didn’t find many serious problems that were missed until after we moved in.

Because the inspector was “unable to walk on all steeper parts of the roof...Read more

Understanding tax sales and assessed home values

Q: My former stepdad purchased a property in 2018 at a tax sale. Since my mother had already passed, I assumed he bought it in his own name. I’ve recently been informed that he purchased the property in my name.

Its fair market value is around $600, but somehow the tax assessor’s office believes it’s worth $50,000. It has been uninhabited...Read more

Reader skeptical of companies offering assistance to sell timeshare

Q: I frequently read your column/advice in my local paper. I’ve read your advice about getting rid of timeshares. I tried one of your recommendations about calling the timeshare and asking how to get rid of it. You would have thought I was a two-headed monster! No one had information about how to get rid of it nor advice on who I should ...Read more

Are you still eligible for exclusion of capital gains if spouse isn’t on title?

Q: I am selling my primary residence in Chicago that I’ve owned for about 30 years. I owned another property in another state and we are downsizing to live there in our retirement years.

My wife and I have been married for 15 years and her name is not on the deed to the home in Chicago. I thought that you were allowed a $250,000 exemption on ...Read more

How opening and closing credit cards impact your credit score, interest rates

Q: I am widowed, retired, I love to travel, and I am grateful I have the wherewithal to do so. I am looking at getting an airline credit card to take advantage of their 75,000 point offer that my daughter says is worth around $750.

I already have way more credit than I’ll ever use. I have two credit cards that I generally use. One is from a ...Read more

Condo owner says HOA board refuses to address reported encounters with neighbor

Q: I hear Ilyce on the radio often and figured maybe the guru of all things having to do with money and real estate might help me. I am a condo owner in Illinois and have lived in my place for over 20 years.

I had a chance encounter in my condo building with a mentally unstable owner on several occasions. One time the neighbor hit me on the ...Read more

Realtor discourages friend from installing solar panels before listing home for sale

Q: We’re thinking of moving to a senior living development in a few years, so we’ll be selling our house. We’ve received quotes for solar and think it’s the thing to do, regardless of whether we’d use it long enough to pay off the initial investment.

I thought installing solar would increase the value and attractiveness of the house. ...Read more

Condo reserves a growing issue (Part 1)

It’s expensive to own any type of home. You’ve got the mortgage, homeowners insurance, property taxes, maintenance and upkeep. You may also, if you buy in a subdivision, have some sort of homeowners association fee to pay.

In an era where affordability is an issue, with home prices and mortgage interest rates at record highs, condominiums ...Read more

Stepdaughter navigates title issues with lender after stepmother’s passing

Q: Early last year, my stepmom and I had a meeting with her loan company to figure out what the easiest way to pass her home to me when she died. I know nothing about this stuff, so I put my trust in the loan servicer.

The lender suggested that I assume the loan and added me as a co-borrower. She said that once my stepmom died, all I’d have ...Read more