Income issues, rising debt put former homeowner in a difficult position

Moving across the country is a difficult decision, but you need to do what is best for you and your family. We know that you might want to be near your parents. If that’s non-negotiable, then you have to decide what you’re willing to live without, or cuts you’re willing to make, to live near them.

Sonoma is lovely, but if you can make things work on your budget in Connecticut, you might have money left over to visit your parents several times a year. That’s a tough choice. One only you can make.

Let’s talk about your credit card debt. That is likely a huge burden right now, given that interest rates are approaching 30%. With those kinds of interest rates, it can take years to get out from under that debt level. The best thing you can do is tighten your belt and pay it down as fast as possible. Swapping housing expenses (if you live with your sister awhile) for repaying your debt quickly might take a year or more. But when you’re done, you’ll can begin to plan for your next move: Finding your own place, or even buying another house.

Let’s start with a budget. Take out a sheet of paper and write down every cent you spend. Write down your take home pay. Then, strip everything you can out of your expenses. Calculate how quickly you can repay your credit card debt. If your credit score is still good, you might be able to apply for a zero- or low-interest card. Consolidating your debt there will buy you time to get that debt paid off.

Once you see where you are financially, you can make the next decision: Whether to stay in California or make a move to Connecticut. We recognize that each move has pluses and minuses. Only you know what you (and your family) can live with.

We’re sorry that there are no “easy” buttons. What you’re facing is about as challenging as it gets. But taking this first step will lead to another, and then another. Pretty soon, you’ll be in a much better place.

By the way, we don’t think you should be so hard on yourself. You sold your home because you couldn’t afford to live there. Had you stayed, it might have still been impossible to manage financially. Good luck, and please let us know how it goes.

========

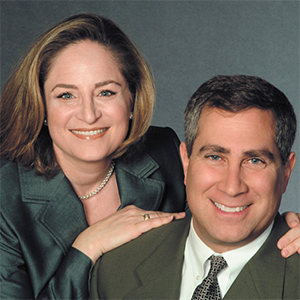

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.