Couple seeks clarification on tax implications if they sell their second home

Second, there are some stringent rules you must follow. In essence, you must have a contract to sell the investment property and engage 1031 intermediary company before you sell. The proceeds from the sale of your investment property must flow to the intermediary company. The cost of the new replacement property must equal or exceed the sales price of the original investment property. From the date of closing, you have 45 days to find and identify a replacement property that you would like to purchase. And, you must close on the purchase of that identified property no later than 180 days following the initial sale of the original investment property.

The timeline must be strictly followed. As do myriad other rules that make up that part of the tax code. However, if you follow them correctly, you can sell the old investment property, end up owning a replacement property, and defer the payment of federal taxes to some date in the future when you end up selling the replacement property.

Or, in some cases, you won’t wind up paying any taxes if you die holding title to the replacement property and your heirs get the stepped-up basis at the time of your death. In other words, when you die, and if your estate is under the federal estate tax limit (currently $13,610,000 for the tax year 2024), your estate wouldn’t pay any estate taxes and your heirs would inherit the real estate investment at its value at the time of your death.

If your heirs then sell the investment property soon after your death, they, too, would pay no federal income taxes on that sale. Their basis in the investment property would be the value of the property when you died. The IRS would consider the sales price to be the value of the property at your death, even if your heirs sell the new property up to a year after your death.

As you can see, if you own the property as an investment and follow the 1031 exchange rules, you’ve got a solid option that will allow you to postpone paying capital gains tax.

But your options are more limited if the condo is a second home for your family. Here’s one option: You might consider keeping the condo and converting it into an investment property by renting it for several years. Then, you can sell it using a 1031 exchange and put the proceeds into a new property. Once you rent the property for two or more years, the property would officially become an investment property. That’s when the benefits of a 1031 exchange would kick in.

You’ll want to talk to a tax professional to go over the numbers as you might have to consider the sale down the line as part second home and part investment property. But, it still might save you some capital gains tax.

If you’ve decided to sell the condo so you can use the proceeds to buy something new that’s for personal use (either for yourselves or your son), you’ll likely pay taxes on any appreciation the condo has enjoyed. You’ll have to pay up to 23.8% in taxes to the federal government plus any state taxes due.

Your tax preparer might have other suggestions for you once they see how you’ve treated the property in the past and what other investments you have.

========

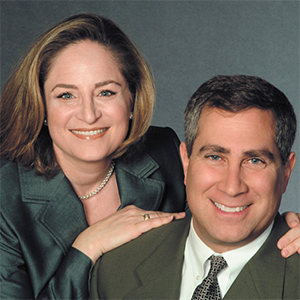

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.