Current News

/ArcaMax

CNN facing defamation trial over report on company that charged fees to Afghanistan evacuees

CNN could soon land in a Florida courtroom as it faces a defamation lawsuit from a security contractor who took payments to evacuate people out of Afghanistan following the U.S. military's 2021 withdrawal.

The contractor, Zachary Young, was included in a November 2021 segment on war profiteers charging high prices to assist people in fleeing ...Read more

Chicago rapper Lil Durk charged in murder-for-hire plot: court records

CHICAGO — Chicago rapper and Englewood native Lil Durk, born Durk Banks, was arrested in Florida Thursday in connection with an alleged murder-for-hire plot, according to records from the Broward County sheriff’s office.

Banks, 32, was held in the Broward County Jail as of early Friday, records show, but the exact nature of the charges ...Read more

LA teachers union supports blocking US sale of about $20 billion in weaponry to Israel

LOS ANGELES — The governing body of the L.A. teachers union has weighed in on the ongoing Israel-Hamas war, voting Wednesday to support a congressional effort to block the sale of more than $20 billion in U.S. weaponry to Israel on the grounds that American-supplied arms were being used against civilians.

The United Teachers Los Angeles union...Read more

Doctors are preoccupied with threats of criminal charges in states with abortion bans, putting patients’ lives at risk

Abortion bans are intended to reduce elective abortions, but they are also affecting the way physicians practice medicine.

That is the key finding from our recently published article in the journal Social Science & Medicine.

Medical providers practicing in states that implemented abortion bans in the wake of the 2022 Dobbs...Read more

Why returning the name Kuwohi to the Great Smoky Mountains matters

It’s not every day that the name of a mountain is restored to the one used by Indigenous peoples for centuries.

But after nearly two years of trying, the Eastern Band of Cherokee Indians finally convinced the U.S. Board on Geographic Names on Sept. 18, 2024, to formally agree to rename the highest point in the Great Smoky Mountains ...Read more

Foreign countries are helping autocracies repress exiled dissidents in return for economic gain

Governments, even democratic ones, are willing to aid autocracies in silencing exiled dissidents if the host nation thinks it’s in its economic interest.

That is what we found when looking into cases of transnational repression – the act of governments reaching across their national border to repress diasporas and exiles – from ...Read more

Debates about Columbus’ Spanish Jewish ancestry are not new − the claim was once a bid for social acceptance

In connection to Columbus Day and Indigenous Peoples Day, media from the BBC and Fox to Reuters and Haaretz reported on new DNA evidence about the holiday’s original namesake. According to research revealed in a recent Spanish documentary, Christopher Columbus was not Italian, as widely assumed, but Sephardic: of Spanish Jewish lineage.

...Read more

Threatening ‘the enemy within’ with force: Military ethicists explain the danger to important American traditions

On the campaign trail, former President Donald Trump has declared there are serious threats to the United States. First, he said, there is “the outside enemy, and then we have the enemy from within, and the enemy from within, in my opinion, is more dangerous,” as he told Fox News in an Oct. 13, 2024, interview.

He went on to say ...Read more

A month after Helene, Georgia towns still digging out of destruction

HAZLEHURST, Ga. — “Good morning, baby. I missed you,” Principal Shelly McBride said, leaning over one of her tiny students. The child murmured something. “Oh, I love you, too,” McBride said.

Her goal was to exude normalcy as she greeted many of the kindergarten through second grade students Monday morning beside the car rider line at ...Read more

Putin says Russia won't make concessions to end war on Ukraine

President Vladimir Putin said Russia is open to a “reasonable compromise” but won’t make any concessions to end its war in Ukraine.

“We aren’t going to make any concessions here, there will be no trades,” Putin said in an interview with Russian state television published on Friday, after he’d hosted a summit of BRICS countries in ...Read more

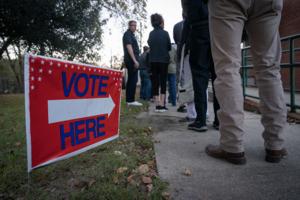

Early voting is surging across the country. It's unclear who benefits

LOS ANGELES — After Katie Kern and her father, Robert Kern, cast their ballots for former President Trump in this suburb of Las Vegas, they said they wanted to make sure their vote was counted in the critical battleground state of Nevada so that the Republican would retake the White House.

"I'm probably more of a last-minute voter, but I ...Read more

China, India start pulling troops from border friction areas

China and India are pulling back troops from the two remaining friction points along the disputed Himalayan border, days after the leaders of the two countries met.

Troops deployed toe-to-toe are moving back and temporary structures built during a four-year stalemate at the border are to be dismantled, senior Indian officials said, asking not ...Read more

LA judge frees ex-DEA agent accused of road rage, domestic violence and having grenades

LOS ANGELES — When Los Angeles County sheriff's deputies searched a former Drug Enforcement Administration agent's home last month, court records show they found DEA credentials modified to make it appear that he was still on active duty, along with 30,000 rounds of ammunition, several grenades and a cache of 15 different firearms — ...Read more

SpaceX Crew-8 completes record run with splashdown return off coast of Florida

ORLANDO, Fla. — The four members of the SpaceX Crew-8 mission are back on Earth after a record time in space completing their mission with a splashdown aboard the Crew Dragon Endeavour early Friday off the coast of Florida.

After a nearly eight-month stay on board the International Space Station, NASA astronauts Matthew Dominick, Michael ...Read more

Here are 5 industries with the most at stake in presidential election

The U.S. election next month will be a clash of visions that reverberates through the global economy for years to come.

Kamala Harris and Donald Trump in some cases have skirted how they will handle pivotal issues for major industries such as technology. Crucially, that includes how each candidate would proceed on antitrust efforts targeting ...Read more

GOP's Fred Upton backs Kamala Harris' presidential campaign

DETROIT — West Michigan Republican and former U.S. Rep. Fred Upton is endorsing Vice President Kamala Harris' 2024 bid for the White House, saying his party's nominee, former President Donald Trump, is divisive, unhinged and has "not changed his colors."

"Watching Trump day after day, he's ignored the advice of many senior, respected ...Read more

Recent recalls raise concerns about food safety, but experts credit better regulation and technology

CHICAGO -- Chicago Heights resident Stephanie Petersen was concerned by how many food recalls she saw daily on the Food and Drug Administration website.

“There was, like, (multiple) recalls every single day. And a lot of salmonella, listeria, a lot of different things,” Petersen said. “I was like, what is going on? It’s so many.”

...Read more

Hemp grow stinks up California town of Sutter and irks residents. What can they do?

From the west end of the unincorporated town of Sutter wafts a strong smell, familiar to many and scorned by some.

In recent weeks the odor from a nearby hemp grow, which smells just like marijuana, has subsumed parts of the small town that borders farm land surrounding the Sutter Buttes, and even lingered in the air outside of the town’s ...Read more

Election a 'scary moment' for those helping refugees come to Georgia

ATLANTA — Aimee Zangandou was just a teen in 1997 when she moved to metro Atlanta with her parents, leaving behind the violent aftermath of a bloody genocide in the family’s native Rwanda. They settled in Stone Mountain via the U.S. refugee program, a legal pathway into the country for people who fear for their safety back home.

Created ...Read more

North Carolina Board of Elections says Spanish election signs about 'foreigner' voting can be removed

CHARLOTTE, N.C. — The North Carolina State Board of Elections has ordered some Spanish-language signs warning noncitizens not to vote to be removed from around polling places. But others will stay up.

Multiple advocacy groups — including El Pueblo, Forward Justice, ACLU of North Carolina and the North Carolina State Conference of the NAACP ...Read more

Popular Stories

- WWE's Vince McMahon, wife accused of allowing 'rampant sexual abuse' of young boys

- Here are 5 industries with the most at stake in presidential election

- A California official helped save a mental health company's contract. It flew him to London

- GOP's Fred Upton backs Kamala Harris' presidential campaign

- Hemp grow stinks up California town of Sutter and irks residents. What can they do?