The clock is ticking in Maryland: Where lawmakers stand on $63 billion budget, juvenile justice in final week of General Assembly session

Published in News & Features

Moore’s plan to incentivize the development of new affordable housing is the only piece of the Democrat’s 16-bill package that is moving sluggishly to the finish line. The Housing Expansion and Affordability Act would make multiple zoning changes to allow for development in higher-density areas and prevent local governments from setting “unreasonable” limits or requirements to development. It passed the House with amendments that would, compared to the first version of the bill, require a smaller number of affordable units in new development. Ferguson has said the Senate will also pass the bill, but the details are still being debated in a committee and it’s unclear what differences both the House and Senate would need to sort out before Monday.

Juvenile justice (Senate Bill 744/House Bill 814)

Ushered through the legislature in response to constituent calls to address a spike in carjackings, car thefts and firearms charges among Maryland youth, this multi-pronged bill would increase what charges children ages 10 to 12 can face to include third-degree sex offenses, car theft and firearm possession, and allow juvenile judges to extend probationary periods, among myriad other measures. Though the House and Senate bills started with identical language, both were amended to include unique provisions. There are still differences to iron out among both versions of the bill, which is expected to head to Moore’s desk before the legislature adjourns.

Immigrant health care (Senate Bill 705/House Bill 728)

The Access to Care Act would allow Marylanders lacking permanent legal status to purchase health insurance through the state’s health benefit exchange portal with assistance from its insurance navigators, who would help to choose the best plan for them in the language they are most comfortable speaking. Those who choose to use the program would pay the full price for their insurance policies. The House version of the bill has received preliminary approval in the Senate chamber. Its Senate counterpart passed out of the House last week, and is awaiting approval from the governor.

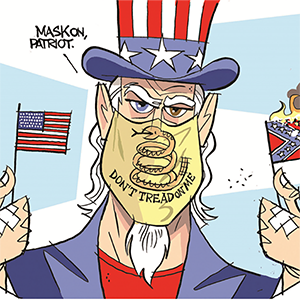

A higher tax on guns and ammunition (Senate Bill 784/House Bill 935)

The Comprehensive Community Safety Funding Act would raise the sales tax on firearms, firearm accessories and ammunition from 5% to 11%. The legislation, which is facing an uncertain future, intends to funnel the additional 6% of tax revenue to Maryland’s shock trauma system. The Senate version of the bill passed out of its original chamber. The House has yet to give its version a committee vote. Both versions of the bill are currently in the House Ways & Means Committee.

Civil liability for gun manufacturers (Senate Bill 488/House Bill 947)

The Gun Industry Accountability Act of 2024 would allow Maryland’s Attorney General to sue firearms manufacturers and dealers for damages if the attorney general believes they did not use reasonable measures to prevent sales to gun traffickers, people prohibited from legally owning a gun, or anyone they believe sought out a firearm to use in the commission of a crime. Dealers and manufacturers could also face lawsuits if they did not take measures to prevent the loss or theft of a firearm. The Senate version of the bill passed over to the House chamber March 15. The House version has yet to receive a committee vote. Both versions of the bill are currently in the House Judiciary Committee.

-------

©2024 The Baltimore Sun. Visit at baltimoresun.com. Distributed by Tribune Content Agency, LLC.

Comments