What does 'moral hazard' mean? A scholar of financial regulation explains why it's risky for the government to rescue banks

Published in News & Features

When the students returned from their vacation, news of Silicon Valley Bank’s failure appeared to be the start of what might become a bank crisis.

“What happened? It’s completely different from what you taught us!” the students in my class exclaimed, almost in unison. Questions tumbled from their heads demanding an explanation.

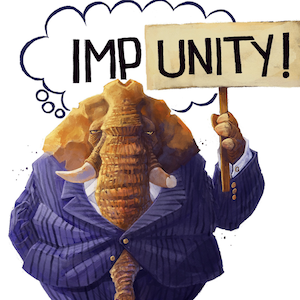

Why did the government apparently throw out concerns about moral hazard when SVB failed?

Any explanation would have to begin with what moral hazard can mean in the context of banking, which can summon the colloquial phrase “too big to fail.”

That controversial concept applies to how the government responds in the aftermath of the risky behavior of a bank – if the collapse of the bank is likely to harm the economy. Yet, in reducing the risk of a widespread financial crisis, the government can end up sending the message that it’s willing to protect banks that engage in reckless behavior – and to shield their customers from the consequences.

This article is republished from The Conversation, an independent nonprofit news site dedicated to sharing ideas from academic experts. If you found it interesting, you could subscribe to our weekly newsletter.

Read more:

US regulators avoided a banking crisis by swift action following SVB’s collapse – but the cracks it exposed continue to weaken the global financial system’s foundation

Why SVB and Signature Bank failed so fast – and the US banking crisis isn’t over yet

Cassandra Jones Havard does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Comments