Business

/ArcaMax

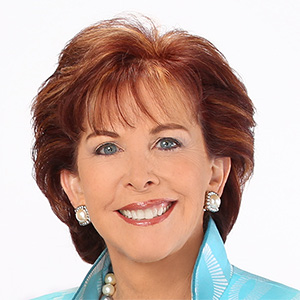

Terry Savage: How to find trusted financial advice

Whether you're retiring and rolling over your 401(k) or just starting to build your financial future, it pays to get trusted financial advice.

The key word here is “trusted”! There’s plenty of financial advice around, but does it come from someone who is “on your side” — working to build your retirement — not theirs?

You cannot ...Read more

It's scholarship time

Announcing free money! Did that get your attention? If you have a high school child or grandchild, don’t let them miss out on free money for college — not based on need — that is being handed out starting now!

Instead of heading back for senior year in high school hoping to coast for the next nine months, rising seniors should be spending...Read more

No Place to Hide

The world is awash in geopolitical confusion. In Britain, a new Labor government was just elected by a landslide, after 14 years of Conservative rule, which included Brexit. But the new Labour prime minister is said to have an authoritarian bent. In Canada, the existing eight-year reign of Liberal Prime Minister Justin Trudeau faces losing to a ...Read more

We need a statute of limitations on Social Security clawbacks

Most people would agree that for horrendous crimes there should be no statute of limitations for prosecution. For example, the federal government and most states impose no statute of limitations on murder charges. But in the case of sexual assault, state laws dictate varying statutes of limitations.

When it comes to tax fraud, the statute of ...Read more

As markets hit record highs, complacency is a risk

The stock market keeps reaching new highs on the major indices: The Dow Jones Industrial Average did it in mid-May, and the S&P 500 and the NASDAQ did it in mid-June. A casual glance at the evening news headlines gives the sense that all is well in the financial markets.

Last week’s column discussed a Harris poll showing that 56% of Americans...Read more

Terry Savage: There's no recession in sight, but economic pain is real

More than half of Americans — 56% to be exact — believe the United States is in a recession, according to a new Harris Poll. And all of those people are wrong.

The classic definition of a recession is two consecutive quarters of negative growth measured by GDP — gross domestic product. We haven’t had any negative quarters in GDP since a...Read more

SIM swap is a new way to swipe your savings

Identity thieves have a new way of gaining access to your finances. Even if you’ve frozen your credit report, they can grab your money by taking over your phone number. It’s called "SIM swapping.” It’s all done electronically, and it defeats the authentication controls that most banks have in place.

You may have been frustrated lately ...Read more

Terry Savage: Homeowners insurance — or not?

If you own your own home, it’s no surprise that your homeowner’s insurance premium has soared. Opening that bill, you might find a 25% increase or more — even though you’ve had no claims. If your premium is included in your monthly mortgage payment, you’ll get notice of a jump in your monthly payment.

Insurance companies have indeed ...Read more

Terry Savage: News on student loans, consumer protection

Consumers just got some good news about a student loan forgiveness extension and about protections on credit card late payment charges, resulting from a Supreme Court ruling on the Consumer Financial Protection Bureau. Here’s what you need to know:

The deadline for applications for student loan forgiveness has been extended to June 30, 2024. ...Read more

Terry Savage: Funding long-term care insurance

The most unexpected and costly expense of retirement is the need to pay for long-term custodial care — a burden that is not covered by Medicare or supplements. No one wants to think about needing help to eat or shower or do the basic activities of daily living. But you ignore the possibility at your peril.

For 2024, the projected national ...Read more

Terry Savage: Younger generations are changing the workplace

The unemployment numbers are encouraging. The unemployment rate has remained below 4% for 27 months, the longest streak since the 1960s. Average hourly wages are up 4.1% over the last year — slightly beating inflation. The economy has added around 200,000 new jobs every month.

Those financial headlines go beyond economic statistics and ...Read more