Business

/ArcaMax

Why Stellantis CEO says US market needs fixing after dismal first-half performance

Last year, Stellantis NV notched record-high profit and revenue results, but this year, not so much.

On Thursday, the maker of Chrysler, Dodge, Jeep and Ram, as well as other brands sold around the world, said its net profit tumbled by almost half in the first six months of the year to $6.1 billion (5.6 billion euro) compared to the same period...Read more

CrowdStrike's cyber blunder could be warning of worse to come

Our laptops, desktops and phones, our businesses, data, emails, our access to internet information and services — really, anything digital that traverses cyberspace and passes through a computer server — are all dependent on support and protection from security companies whose staffing and software are sometimes imperfect.

Not much you can ...Read more

Delta spent years building a premium reputation. Then it had a meltdown

As businesses around the world rushed to restart their operations after a global technology outage before dawn on July 19, aviation experts were shocked to see one carrier struggling more than any other: Atlanta-based Delta Air Lines.

A faulty security update that upended many industries practically knocked Delta out of the skies, leaving ...Read more

Judge clears Amazon in high-profile warehouse safety probe by WA regulators

Amazon did not endanger warehouse workers at three Washington facilities, a state judge who oversaw a months-long trial on claims brought by safety regulators ruled this week.

Judge Stephen Pfeifer, of the state Board of Industrial Insurance Appeals, threw out four citations issued by Washington’s Department of Labor & Industries against the ...Read more

Trader Joe's finally opens first store in Harlem

NEW YORK — Four years after first being announced, Trader Joe’s has finally made its way to Harlem USA.

On Thursday morning, the supermarket chain — a favorite of millennials and known for its Instagrammable food finds — held a ribbon cutting ceremony for its first location in the ever-gentrifying upper Manhattan hamlet.

Situated on ...Read more

Is this the solution to California's soaring insurance price due to wildfire risk?

In the past several years, homeowners across the state have been either burdened with extremely high insurance premiums or have struggled to find coverage at all. Wildfires have sent California's homeowners insurance market into crisis and the situation is only getting worse. So far, 2024 has seen 219,247 acres burned, more than 20 times the ...Read more

3M profits jump as restructuring pays off

As 3M's chief executive continues acclimating to his new digs, Bill Brown's eyes still light up at the sight of the 122-year old manufacturer turning out miles of tapes, films and sandpaper.

"There's so much opportunity here," Brown said. "Visiting the labs and the factories, I'm amazed at the products we produce and the scale we produce them ...Read more

Power line project would cut through Baltimore region's preserved land, farms

Central Maryland residents in growing numbers are vowing to stop a proposed upgrade to the region’s energy grid involving a 500,000-volt overhead transmission line that would cut across farms, parks, neighborhoods, wetlands and forests in three counties.

The Maryland Piedmont Reliability Project would carve a 70-mile path through largely ...Read more

Chipotle CEO says restaurants will serve bigger portions after skimping

The CEO of Chipotle told investors this week the restaurant had skimped on ingredients for customers in the past but would be “retraining” staff to serve bigger portions.

Brian Niccol, the chain’s top executive, said there was no “directive” to serve smaller portions, but the company was taking steps to fix it.

“Generous portion is...Read more

Auto review: 2024 KIA EV9 is EV comfort with a luxury price

When KIA enters Grasso’s Garage, it’s all about pricing, style and comfort. With the EV market in full force, the EV9 was released to satisfy consumers with big families looking for space and storage. Although our EV9 GT-Line AWD tester is really a great vehicle overall, the price tag is the elephant in the room.

With a starting price just ...Read more

Apple to adopt voluntary AI safeguards established by Biden

Apple Inc. is the latest company to agree to a set of voluntary safeguards for artificial intelligence crafted by President Joe Biden’s administration as it tries to guide the development of the emerging technology and encourage firms to protect consumers.

The administration announced Friday that the technology giant is joining the ranks of ...Read more

Henry Payne: Corvette ZR1 drops mic with 1,000+ horsepower

STERLING HEIGHTS, Michigan — Corvette has blown past the 1,000-horsepower marker.

Chevy introduced its fastest, track-focused, 2025 ZR1 model Thursday with a twin-turbocharged, 5.5-liter V-8 engine that makes a stratospheric 1,064 horsepower — the first ‘Vette to hit quadruple digits. The number puts the mid-engine sportscar in elite, ...Read more

AT&T, Ticketmaster breaches show hackers can attack from many angles

When cybercriminals stole five months of customers’ call logs from AT&T, they found an indirect path to attack the telecommunications giant’s data. They found an access point through a cloud computing vendor most customers had likely never heard of.

The same is true for the big Ticketmaster breach of credit card numbers and credentials that...Read more

Auto review: Ford Explorer ups game with interior remake, BlueCruise

DEXTER, Michigan — Like America’s No. 1 movie, Ford has gone “Inside Out” to sell tickets.

The handsome Explorer exterior now has interior toys to match. On course to load up on cider ‘n’ doughnuts at Jenny’s Farm Stand and Cider Mill in Dexter, I poked the BlueCruise button on my $50K 2025 tester’s steering wheel and the ...Read more

Auto review: 2025 Mini Cooper S Hardtop: a beguiling icon returns

In an automotive market where size and girth matter most, the 2025 Mini Cooper remains the contrarian, a small gem that looms large when it comes to driving fun, fuel economy and unabashed style. It’s a design icon, one feted last week at the ninth Mini Takes The States, or MTTS for short.

The biennial trek, open to Mini owners, originated in...Read more

Bally's board agrees to $18.25 per share buyout by Standard General, taking the casino company private

Weeks after securing financing to build its planned Chicago casino, Bally’s has struck a deal to sell the company to its largest shareholder.

New York hedge fund Standard General, which owns about 25% of Bally’s, reached an agreement with the board Thursday to buy out the rest of the stockholders at $18.25 per share, valuing the casino ...Read more

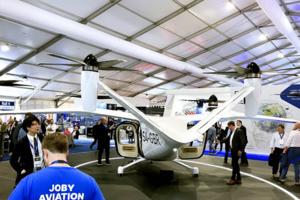

The moment of truth draws near for startup air taxis

FARNBOROUGH, England — In a small side room in an exhibition hall at the Farnborough Air Show, JoeBen Bevirt, the founder, CEO and Silicon Valley-style evangelist for Joby Aviation, leans eagerly across a table, his eyes intense, to convey his dream.

What if you could fly through the air from Seattle to the San Juan Islands in a whisper-quiet...Read more

Paramount, Skydance deal draws shareholder scrutiny

As expected, Paramount Global shareholders are challenging the terms of the struggling company's proposed blockbuster merger with Skydance Media.

The first lawsuit arrived Wednesday, three weeks after Paramount board members — including controlling shareholder Shari Redstone — approved an $8-billion, two-phase deal with tech scion David ...Read more

California Supreme Court upholds Prop. 22, ending legal saga over status of gig drivers

The California Supreme Court on Thursday upheld Proposition 22, the voter initiative that allows Uber, Lyft and other gig economy companies to classify drivers for their ride-hailing and delivery services as independent contractors rather than as employees.

In a unanimous decision released Thursday morning, the state's top court rejected claims...Read more

Boeing execs prioritized production over quality, DOJ says

Boeing and the Justice Department have finalized the details of a plea deal in the wake of two fatal 737 Max crashes five years ago.

The 83-page document memorialized a plea agreement between Boeing and federal prosecutors, punishing the company for fraud related to a faulty software system on the Max planes that led to the accidents.

Writing ...Read more

Popular Stories

- Long-awaited indoor heat standard has gone into effect in California. Here's what to know

- World-famous Wall Drug isn't immune from challenges facing rural pharmacies

- Bally's board agrees to $18.25 per share buyout by Standard General, taking the casino company private

- The moment of truth draws near for startup air taxis

- AT&T, Ticketmaster breaches show hackers can attack from many angles