Politics

/ArcaMax

Arizona Senate votes to repeal 1864 abortion law, leaving state with 15-week ban

The Arizona Senate voted Wednesday to repeal the state's 1864 abortion ban, sending a measure to the Democratic governor that would end weeks of turmoil and keep in place a 15-week abortion limit enacted in 2022.

In a testy and emotional session that included angry spats, a senator reading from the Bible and another playing a recording of his ...Read more

Donald Trump returns to Michigan amid court appearances, criminal probes

FREELAND, Mich. — Republican presidential candidate Donald Trump is returning to Michigan Wednesday, his first visit to the state since an agent for Attorney General Dana Nessel's office said he's considered an unindicted co-conspirator in an effort to overturn the 2020 election.

Trump is scheduled to speak at about 6 p.m. at an airport in ...Read more

Editorial: A frightening tyranny over Florida women

In the novel "The Handmaid’s Tale," a violent theocracy overthrows the U.S. government, and doctors who perform abortions are hanged. Young women are enslaved to bear children for influential older men.

Author Margaret Atwood’s imagination was inspired in part by the biblical tale of Hagar, the Egyptian handmaid whom Abraham’s wife gave ...Read more

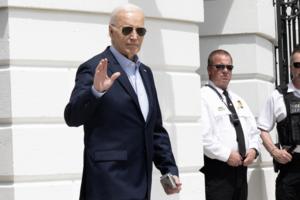

Biden rips Trump over abortion as draconian Florida ban goes into effect

President Biden ripped former President Trump over abortion on Wednesday, the same day a draconian ban went into effect in Florida.

Biden derided his White House rival for giving his blessing to Republican-run states that have enacted ever-stricter restrictions on abortion since the conservative Supreme Court rolled back the Roe v. Wade ...Read more

House, Senate farm bill summaries show SNAP, climate division

WASHINGTON — House and Senate Agriculture committee leaders released summaries of proposed farm bills Wednesday as they ramp up action on agricultural policy legislation, but they remain divided on food stamp benefits and on the use of conservation funds already appropriated.

Senate Agriculture Chairwoman Debbie Stabenow, D-Mich., released a ...Read more

Florida's new abortion ban goes into effect, but voters will decide its future

MIAMI — Democrats and abortion-access advocates have been warning for months of an impending voter backlash against Republicans who backed Florida’s six-week ban on the procedure. Now, it’s time to find out whether they’re right or wrong.

The six-week ban, which was quietly signed into law last year by Gov. Ron DeSantis, went into force...Read more

US lawmakers slam UnitedHealth's cybersecurity, call the company 'a monopoly on steroids'

A hugely disruptive cyberattack in February exposed clear technology flaws at a UnitedHealth Group subsidiary, lawmakers said Wednesday, and raised difficult questions about whether the Minnetonka-based health care giant has just gotten too big.

Andrew Witty, the UnitedHealth chief exeutive, offered an apology during testimony before the Senate...Read more

Mexico emerges as a destination for Americans seeking reproductive health services – not for the first time

When its six-week abortion ban went into effect on May 1, 2024, Florida joined nearly two dozen other U.S. states that ban abortion or greatly restrict it.

These laws came into effect after the Supreme Court’s 2022 decision to overturn Roe v. Wade ended nearly 50 years of the constitutional right to abortion in the United States....Read more

Miami-Dade voters will pick an elections supervisor. Donald Trump just got involved

MIAMI — Former President Donald Trump is backing a Republican candidate in the race for Miami-Dade elections supervisor, wading into the contest after years of falsely claiming the 2020 presidential election was stolen from him.

Trump used social media to post an endorsement Tuesday night of Florida state Rep. Alina Garcia, who represents a ...Read more

What the Supreme Court is doing right in considering Trump’s immunity case

Following the nearly three-hour oral argument about presidential immunity in the Supreme Court on April 25, 2024, many commentators were aghast. The general theme, among legal and political experts alike, was a hand-over-the-mouth, how-dare-they assessment of the mostly conservative justices’ questioning of the attorneys who appeared before...Read more

Biden plans Detroit visit to speak at NAACP dinner

WASHINGTON — Democratic President Joe Biden will return to Michigan this month to speak at the NAACP Detroit Branch's 69th annual Fight for Freedom Fund Dinner in Detroit, his campaign confirmed Wednesday.

The announcement came ahead of a planned Wednesday night campaign rally in Freeland, about 14 miles northwest of Saginaw, by former ...Read more

Commentary: Trump was just fined for contempt of court. Could he go to jail next time?

Judge Juan M. Merchan has, in his soft-spoken but hard-nosed way, told Donald Trump something no other court has over the course of his many civil and criminal cases: He’s down to his last chance.

Merchan ruled Tuesday on contempt motions brought by the Manhattan district attorney’s office in response to Trump’s serial violation of a gag ...Read more

Hate crimes laws passed in Washington have been remarkably ineffective in protecting LGBTQ people for decades

On Feb. 23, 2024, Daqua Lameek Ritter was found guilty of a hate crime for the murder of Dime Doe, a transgender woman from South Carolina believed to be in a relationship with Ritter.

The ruling marks both the first trial and first conviction of a hate crime on the basis of gender identity under the 2009 Matthew Shepard and James ...Read more

To reduce Black-on-Black crime, two criminal justice experts explain why offering monthly stipends to people at risk makes sense

After a historic spike in homicides in 2020, murder rates in most U.S. cities appear to be returning to pre-pandemic levels. This drop has sparked some public attention, as demonstrated during a meeting of police chiefs in February 2024 at the White House.

During the meeting, President Joe Biden lauded investments made in law ...Read more

Editorial: Less than rosy economic numbers dog Biden

The Jimmy Carter years were marked by high interest rates, rampant unemployment, soaring inflation and weak economic growth. President Joe Biden is now hitting .750 in his effort to replicate the economic performance of the one-term president from Georgia.

On Thursday, the Commerce Department revealed that gross domestic product grew at a ...Read more

How famines are formed: In Gaza and elsewhere, an underlying pattern that can lead to hunger and death

The United Nations’ latest report on hunger makes for grim reading. On April 24, 2024, the international body released its annual Global Report on Food Crises, showing that 281.6 million people faced acute hunger in 2023.

And indications for 2024 suggest worse may be to come. In March, the United Nations’ highest technical body ...Read more

Third parties will affect the 2024 campaigns, but election laws written by Democrats and Republicans will prevent them from winning

Once again, the U.S. is entering a presidential campaign with some voters expressing curiosity about independent and minor-party candidates. None of those candidates has a real shot at victory in November, but they might influence the race and politics beyond the election.

There was a time about a century ago when minor-party and ...Read more

Supreme Court lets Texas enforce age verification for porn

WASHINGTON — The U.S. Supreme Court let Texas continue to impose age-verification requirements on porn sites, rejecting a challenge by an industry-led group that argued the law violates the constitutional rights of adults.

The order, which came without explanation or any public dissent, leaves in force a measure that has already forced one of...Read more

Biden calls for tougher gun regulations after Charlotte shooting. Will Congress act?

WASHINGTON — After a shooting in Charlotte killed four law enforcement officers and injured four of their colleagues, President Joe Biden called on Congress to pass tougher gun regulations.

“We must do more to protect our law enforcement officers,” Biden said in a statement that came late Monday night."

He first called for more funding...Read more

Federal court blocks Louisiana's latest congressional map

A three-judge federal court in Louisiana stopped the state on Tuesday from using its new congressional map with two Black opportunity districts for any election, setting up a potential last-minute Supreme Court fight ahead of this fall’s election.

The state passed a new congressional map into law in January under a court order, after years of...Read more

Popular Stories

- Trump fined $9,000 for hush money trial gag order violations, threatened with jail

- Website files for bankruptcy amid lawsuit by Fulton County election workers

- Will Florida's strict 6-week ban be bypassed by abortion by mail?

- What the Supreme Court is doing right in considering Trump’s immunity case

- To reduce Black-on-Black crime, two criminal justice experts explain why offering monthly stipends to people at risk makes sense