Business

/ArcaMax

Use solar power, kill a tortoise? Climate change solution carries environmental costs

Turn on your toaster, bulldoze a Joshua tree. Flip a light switch, feed an endangered tortoise to a badger.

Solar power, widely seen as humanity’s best hope for avoiding catastrophic climate change, can carry a heavy environmental cost, depending on where panels and transmission lines are built.

Some of that infrastructure — providing ...Read more

Now hear this: Sphere exosphere audio is coming

LAS VEGAS — By summer, people looking at the Sphere will be able to hear it as well as see it.

Sphere Executive Chairman and CEO James Dolan on Friday told investors on the company’s third-quarter earnings call that an audio component is coming to the Las Vegas venue’s exosphere.

In response to an investor’s question about how the ...Read more

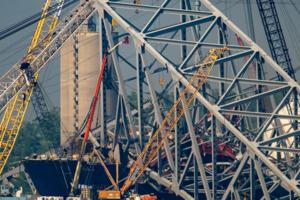

Cash assistance available to port workers impacted by Key Bridge collapse

Port workers affected by the collapse of the Francis Scott Key Bridge can apply for cash grants from a local nonprofit’s fund starting Friday.

Those who worked at the Port of Baltimore as of March 26, the day the bridge fell into the Patapsco River effectively closing the waterway to shipping traffic, are eligible for one-time payments of $1,...Read more

Maryland Apple store workers will vote Saturday on strike authorization

Apple store workers in Towson, Maryland, who became the first of the tech giant’s U.S. employees to unionize nearly two years ago, will decide Saturday whether to prepare to go on strike.

The union representing about 100 of the store’s workers said it scheduled a strike sanction vote after negotiations with management failed to resolve ...Read more

Elon Musk pledges to grow supercharger business he just decimated

Elon Musk touted plans to expand Tesla Inc.’s Supercharger network just over a week after firing almost all of the roughly 500 people who ran the business.

Tesla will spend “well over” $500 million on growing its network this year, Musk said on X, the social media network he owns. Ten days ago, the automaker’s chief executive officer ...Read more

Live Nation's bid to avoid US antitrust suit seen as likely to fail

Live Nation Entertainment Inc. is set to meet with senior Justice Department officials in the coming weeks in a bid to stave off a potential antitrust lawsuit to break up the company.

It isn’t likely to work.

The Justice Department staff have recommended a suit against Ticketmaster, Live Nation’s ticketing arm, according to people familiar...Read more

US consumer sentiment slumps as inflation expectations rise

U.S. consumer sentiment declined in early May to a six-month low as short-term inflation expectations and concerns about the job market picked up.

The sentiment index slid to 67.4 in May from 77.2, according to the preliminary reading from the University of Michigan. The figure was weaker than all forecasts in a Bloomberg survey of economists. ...Read more

Amazon's new fees on sellers likened to 'kick in the gut'

Amazon.com Inc. merchants have found themselves caught in an economic vice.

Earlier this year, the e-commerce giant rolled out changes to the fees its charges them — essentially shifting more of its operating costs onto the small businesses that account for most of the products sold on the site. Making matters worse for merchants, shoppers ...Read more

Auto review: Behind the wheel of the Acura ZDX Type S, a high-powered, GM-charged EV

SANTA BARBARA, California — I pulled to the brief left passing lane on California Route 154 and — ZOT! — my 2024 Acura ZDX Type S tester exploded past a line of slower traffic down the Santa Ynez Mountains north of Santa Barbara. Merging into heavy Route 101 traffic along the coast, the ZDX’s Hands-Free Cruise system took over and I ...Read more

Auto review: 2024 Cadillac XT4 Sport is a crowd pleaser

Cloaked in Radiant Red Tintcoat, the Cadillac XT4 Sport AWD effortlessly pleases drivers, as it stands ready to tackle nearly any task. Whether it's grocery shopping or daily commuting, the XT4 meets a wide array of consumer needs and desires. Its comfort, design and commanding presence continue to stand out, upholding Cadillac's substantial ...Read more

Auto review: 2024 Hyundai Palisade is a worthy family conveyance

If you’re a parent, I don’t need to tell you that raising children is demanding. It’s a job that constantly surprises, stresses and — occasionally — delights. It also demands a spacious vehicle, as the hectare of baby gear, grade school friends and their piles of sports gear or, for that matter, high-schoolers with their gaggle of ...Read more

Biden prods Boeing to end impasse with firefighters union

President Joe Biden weighed in on a labor dispute underway at Boeing Co., urging the planemaker to restart stalled contract talks with a union representing 160 of its firefighters.

“Collective bargaining is a right that helps employers and employees,” Biden said in a post on X, the social media site formerly known as Twitter. He said he was...Read more

Microsoft plans mobile-game store, vying with Apple, Google

Microsoft Corp. will launch its own online store for mobile-game consumables in July, creating an alternative to Apple Inc. and Google’s app stores and their fees.

The browser-based store will debut with Microsoft’s own games, offering discounts on in-game items associated with titles like Candy Crush Saga. Xbox President Sarah Bond ...Read more

Target limits Pride merchandise to select stores after last year's backlash

Target has Pride merchandise in fewer stores this year after backlash it received after pulling some items from last year's collection.

Officials at the Minneapolis-based company acknowledged later in the summer that the controvery had hurt Target's reputation.

Last year, Target sold an assortment of Pride products at all of its more than 1,...Read more

GOP states sue to stop power plant pollution rules

Twenty-five Republican-led states, including Georgia, filed a legal challenge Thursday to new federal regulations on air pollution from power plants that generate electricity.

The new rule, announced in April, would likely end coal-burning for power in the U.S. over the next 15 years and make it significantly harder for utilities to continue ...Read more

3M health care spinoff Solventum prioritizing paying down $8.3B long-term debt

Solventum, the spinoff of 3M's health care business, is starting out as Minnesota's newest public company with a heavy debt load and stagnant sales.

The Maplewood-based company has $8.3 billion in long-term debt and is projecting slightly negative to no revenue growth for its first full year of existence. Solventum reported first-quarter ...Read more

Report: 80 percent of low-income San Diegans spending more than half their income on rent

The vast majority of low-income renters in San Diego County are spending more than half of their income on rent, said a new study.

San Diego's Affordable Housing Needs Report, released Thursday by the nonprofit California Housing Partnership, gave the region poor marks across the board for everything from homeless housing to subsidized rentals ...Read more

Activist investor group falls short of Norfolk Southern takeover

An activist investor group that seeks to reform Atlanta-based Norfolk Southern got three new board members elected to the railroad’s board — but failed to gain majority control of the board and effect a plan to replace the company’s CEO Alan Shaw, according to preliminary results of a shareholder vote Thursday.

Norfolk Southern, ...Read more

After disastrous 2023, a 'bumper' crop of Georgia peaches is coming

In the 130 years Lawton Pearson’s family has been growing peaches in Middle Georgia, few harvests have been as disappointing as last year’s, when his crop — and most others in the state — were almost entirely wiped out by two March cold snaps.

Trees covered with quarter-sized fruit and delicate pink flowers were blasted by last year’s...Read more

Ford CEO Jim Farley says semi-solid state batteries are 'promising for production'

Ford Motor Co. CEO Jim Farley on Thursday said semi-solid state batteries are "looking very promising for production," as the automaker has emphasized the need for breakthroughs in electric vehicle technology to improve affordability.

"We're getting more and more excited about the potential," Farley said in response to a shareholder question ...Read more

Popular Stories

- Biden prods Boeing to end impasse with firefighters union

- Target limits Pride merchandise to select stores after last year's backlash

- Auto review: Behind the wheel of the Acura ZDX Type S, a high-powered, GM-charged EV

- GOP states sue to stop power plant pollution rules

- Microsoft plans mobile-game store, vying with Apple, Google