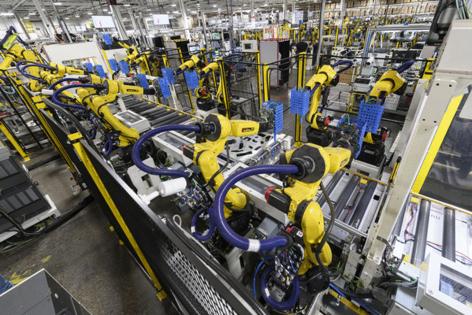

Labor costs, shortage, increasing reliability: Why we're seeing more robots inside plants

Published in Automotive News

Long used mostly for the “dull, dirty and dangerous” tasks in manufacturing, robots are increasingly considered “desirable” amid rising labor costs and shortages, strike risks and the need for flexibility in navigating the bumpy electric vehicle transition.

A record contract between the United Auto Workers and the Detroit Three following an up-to 46-day strike last fall might’ve been the final "catalyst" for a boom in investment in more automation, according to Lou Finazzo, a vice president at Japanese robot supplier Fanuc Corp. Some workers at automakers as well as suppliers already are seeing it affect their jobs at assembly plants, too.

UAW Local 2209 Shop Chairman Rich LeTourneau, in recent months, has watched General Motors Co. install new robots inside its body shop at the Fort Wayne Assembly Plant in Indiana. It's affected about 30 jobs at the three-shift plant. Although nobody is being laid off because of attrition, LeTourneau is concerned about the overall job count going down at the plant. The plant that makes the Chevrolet Silverado and GMC Sierra trucks has more than 4,200 employees, including salaried workers, according to GM's website.

"They're working on all kinds of automation all over the whole plant," LeTourneau said. "We keep hearing there's gonna be some in general assembly. There's gonna be some in the material department."

In a statement, GM spokesperson Kevin Kelly said the automaker is a "people-centric employer" that deploys "technology to aid our team members in making our work environments safer." The technology aids with quality goals and "helps our team minimize ergonomic stressors and achieve productivity goals which will help ensure the viability of the business for all of us into the future."

That, however, is likely just a glimpse for what it is to come, say executives and other experts in the industry.

"With the UAW negotiations and the result of higher labor costs, it's sort of like that last tipping point where a lot more automation programs and requests now are also financially desirable and justifiable," said Finazzo, contrasting it to the past when a return on the investment in robots could've taken four years compared to a more desirable two years. "Now, many of these drop right into available funding based on return on investment."

In 2022, the global automotive industry installed 135,000 new industrial robotics, according to the International Federation of Robotics. The only industry to surpass that installation rate was electronics. In 2023, though, robot manufacturers saw a 30% decrease in orders in total across industries, including e-commerce, agriculture and other areas, according to Association for Advancing Automation. Finazzo called it a "reconciliation" after 15% to 20% year-over-year growth during the pandemic compared with a more typical 2½% to 4% annual growth.

Companies bought these robots to take advantage of downtime in response to labor shortages and in preparation for new products as EV demand soared during a low-inventory vehicle environment. But now those timelines are adjusting amid a slower adoption than expected because of affordability, charging infrastructure and range anxiety challenges. On top of that, a shortage of robot technicians and other integration workers to install the machines have resulted in a consumption problem, Finazzo said.

As a result of shifting EV program timelines, there's greater uncertainty on when a new program will launch, which offers a smaller window for the integration of robots, Finazzo said: "That is putting a little bit of labor pressure on us, as well, to align with their programs and timing."

...continued

©2024 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments