The Budget Plan of a Charlatan

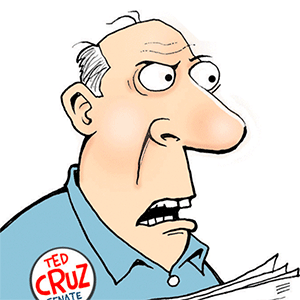

WASHINGTON -- In this depressingly unserious campaign season, it's time -- past time -- to take Donald Trump seriously. In particular, to take seriously what passes for Trump's domestic policy, aside from that wall.

Trump purports to care about the national debt. "We can't keep doing this," he said of the debt at MSNBC's town hall Wednesday. "We've got to start balancing budgets."

Except, Trump -- alone among Republican candidates -- insists that he will leave entitlement spending untouched, although it consumes more than two-thirds of the federal budget.

On Social Security, for instance, Trump rejects raising the retirement age (a move he once endorsed), increasing payroll taxes, reducing cost of living adjustments and trimming benefits.

In Trump world, the solution to controlling entitlement spending is that refuge of lazy and dishonest politicians everywhere: waste, fraud and abuse. "It's tremendous," Trump said at the recent CBS News debate, citing "thousands and thousands of people that are over 106 years old" and collecting Social Security.

Reality check: A 2013 audit found 1,546 people who had received Social Security benefits, despite being dead. Total cost? $31 million. Cost of Social Security that year? $823 billion.

Another Trump favorite -- empowering Medicare to negotiate prescription drug prices -- produces claimed savings, $300 billion annually, that are mathematically impossible. Medicare spending on prescription drugs was $78 billion in 2014. Total nationalspending on prescription drugs, not just by the federal government, was $300 billion in 2014, according to the Centers for Medicare and Medicaid Services. Stick with Trump! He'll get the drug companies to pay us to take their meds!

Push Trump on cuts elsewhere in the budget, and you get suggestions that are paltry and unrealistic.

"I'm going to cut spending big league," Trump pronounced at the MSNBC town hall. His sole example, when pressed by Joe Scarborough, was the Department of Education.

Which part, please? The $28 billion to fund Pell Grants for low-income college students? The $16 billion to local school districts with large numbers of low-income elementary and secondary students? The $13 billion to states for special education? The entire $78 billion federal education budget?

Sometimes Trump tosses in abolishing the Environmental Protection Agency (budget $8.1 billion). Which brings his potential cuts to $86 billion. The Congressional Budget Office projects this year's deficit at $544 billion.

This would not be so maddening if Trump were not simultaneously pushing a tax cut costing the double-digit trillions of dollars over the next decade. His Republican rivals peddle big tax cuts -- Trump's is huuuger.

The nonpartisan Tax Policy Center estimates its 10-year cost at $9.5 trillion, or $11.2 trillion with interest. The Tax Foundation gives the Trump plan credit for generating economic growth; as a result, its estimated $12 trillion cost of Trump's plan would drop to a mere -- mere! -- $10 trillion, excluding interest.

How to pay for this? The Tax Policy Center illustrates the magnitude of cuts required. The Trump tax plan would reduce revenues by $1.1 trillion in 2025. Federal spending that year is estimated to be $5.3 trillion, excluding interest payments. Thus, Congress would have to cut spending across-the-board by 21 percent merely to pay for the tax cut, no less bring the budget into balance.

Trump asserts that his cuts "are fully paid for" by cutting deductions for the wealthy and corporate special interests, plus generating extra cash from corporate profits held overseas.

But the Tax Policy Center numbers already account for that new revenue and for limits on deductions Trump has already specified. So how is Trump going to pay the $1 trillion annual cost? TPC Director Leonard Burman tells me that wiping out allindividual and corporate deductions would raise perhaps $700 billion annually at Trump's tax rates. That's all deductions -- charitable contributions, mortgage interest, retirement savings, health insurance. Which would Trump eliminate?

Trump also claims his plan would spur economic growth to offset the cost. "My policies are going to reduce taxes, OK?" he told MSNBC. "And the taxes is going to bring jobs back and we're going to bring jobs back into the country big league, and we're going to have a dynamic economy again."

The Committee for a Responsible Federal Budget calculates that paying for Trump's tax plan would require the economy to grow at more than 7 percent annually. The average since 1946 has been 3.3 percent. The Federal Reserve predicts future growth in the 2 percent range.

Trump is a charlatan. Exposing his ignorance is harder than covering his boorishness, but it is no less essential.

========

Ruth Marcus' email address is ruthmarcus@washpost.com.

Copyright 2016 Washington Post Writers Group