How Small Loans Became Big Business

Published in Clarence Page

It's not really fair to refer to payday lenders as loan sharks. After all, loan sharks don't have their own lobbyists.

Nor do loan sharks advertise with big signs on city streets, rural strip malls and the Internet.

Yet, in the 35 states where they still operate legally, "payday lenders" -- like their brethren in pawn shops and the "instant tax refund" businesses -- often charge percentage rates that on an annualized basis run high enough to make real sharks drool.

The $42 billion a year industry offers short-term loans secured by your next paycheck in exchange for hefty fees that, as annualized percentage rates of interest can run into the triple digits -- as high as 650 percent in some states.

Of course, payday lenders argue that it is not fair to talk about their "annual" percentage rate as we might with a conventional loan for a house or car because payday loans are not offered on an annual basis. The loan is pegged to your next payday, not to the next year.

Indeed, that doesn't have to be a bad thing, if you're living paycheck-to-paycheck and need fast cash for a health emergency, car repair or some other calamity.

Most of the states that permit these two-week payday advances limit lenders to a fee of $15 on every $100 they loan out. That percent doesn't sound like much, especially if you pay it all back on time.

But borrowing can be addictive. Despite their advertising, the average payday loan rolls over between eight and twelve times, according to various research and consumer organizations. Stretched out all year, that $15 fee per $100 works out to an annual percentage rate of almost 400 percent, according to Gary Rivlin, author of "Broke, USA: From Pawn Shops to Poverty Inc. -- How the Working Poor Became Big Business.".

"Any more than six payday loans in a year and you're no longer talking about an emergency product, but a very expensive way of balancing the monthly checkbook," says Rivlin, a former New York Times reporter.

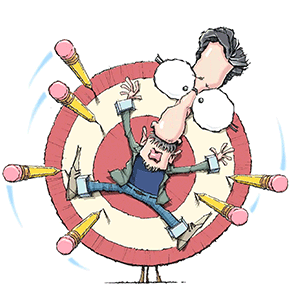

In an amendment cosponsored by Democratic Sens. Dick Durbin of Illinois and Charles Schumer of New York, to Connecticut Democratic Sen. Chris Dodd's financial regulatory reform bill, Democratic Sen. Kay Hagan of North Carolina recently proposed a modest limit of no more than six payday loans a year. But it never reached a vote, thanks to a parliamentary move by Alabama Republican Sen. Richard Shelby, who just happened to receive more campaign donations from payday lenders in 2009 than any other Republican senator (behind three Democrats, according to Citizens for Responsibility and Ethics in Washington).

In legislating regulations for banks that are "too big to fail," credit for the working poor may seem too small to matter. Yet as Rivlin shows, "Poverty, Inc.," is a multibillion-dollar industry that provided the model for subprime lending abuses that brought the big lenders down.

(Full disclosure: I have been asked to write the preface without compensation to a forthcoming edition of Rivlin's award-winning 1992 book "Fire on the Prairie" about the late Chicago Mayor Harold Washington.)

As is so often true of such tragedies, the subprime market's meltdown began with the best of intentions. Most poor people try very hard to pay their debts, even when they wind up paying way more than they initially borrowed.

Unfortunately, some lenders, if they can get away with it, inevitably will talk borrowers into borrowing more than they can afford. For all the angry talk we hear about the "moral hazards" of leniency toward those who borrow more than they can afford, the bigger moral hazard comes from certain slick lenders who talk them into it.

With Hagan's measure dead, reformers now turn to the larger and more sweeping Consumer Financial Protection Agency created by House and Senate leaders in their new financial reform measures. Among its many other duties, it will have rule-making authority over payday lenders and similar small businesses.

It remains to be seen how that new bureau will handle such questions as how much a borrower can be squeezed before it sounds like serious exploitation -- and smells like a shark.

========

E-mail Clarence Page at cpage(at)tribune.com, or write to him c/o Tribune Media Services, 2225 Kenmore Ave., Suite 114, Buffalo, NY 14207.

(c) 2008 CLARENCE PAGE DISTRIBUTED BY TRIBUNE MEDIA SERVICES, INC.

Comments