Politics

/ArcaMax

Full jury selected for Trump hush money trial

NEW YORK — The 12 New Yorkers who will decide whether or not Donald Trump is a felon before this year’s presidential election were seated during a dramatic day of proceedings Thursday, leaving the court to find five alternates before his historic hush money trial begins in earnest.

“We have our jury,” Manhattan Supreme Court Justice ...Read more

More than 20 previously uncounted ballots discovered during California's Congressional District 16 recount

SAN JOSE, Calif. — As the recount in the Congressional District 16 race entered its fourth day, more than 20 ballots excluded from the original count in Santa Clara County have been uncovered — a development that could swing the results of the election and break the tie for second between Assembly member Evan Low and Santa Clara County ...Read more

Donald Trump will hold a May rally in Wildwood, Pennsylvania

PHILADELPHIA — The mayor and commissioners of Wildwood, Pa., announced that former President Donald Trump will hold a campaign rally on the beach on May 11.

“What a great boost to our town at the start of the summer season! We host hundreds of large capacity events annually, so the city is ready to welcome the crowds and looks forward to ...Read more

A Paul-Massie alliance fight FISA's renewal. They're running out of time

WASHINGTON — Kentucky Sen. Rand Paul formed a noisy alliance with Rep. Thomas Massie this week that scrambled Congress’ plans to renew the Foreign Intelligence Surveillance Act without additional privacy protections for Americans and threatened the six-month tenure of the Republican speaker of the House.

The libertarian duo scored a ...Read more

Full jury selected for Trump hush money trial

NEW YORK — A full jury was sworn in Thursday for Donald Trump’s historic hush money criminal trial in Manhattan.

The seven jurors selected late in the day join the five panelists chosen earlier this week, and comes after two were dismissed Thursday morning.

The newest selections include someone who follows Trump on Truth Social and former ...Read more

Proposed resolution would allow Georgia war hero to lie in state in US Capitol

Ralph Puckett Jr. of Columbus, who died April 8 and was the last living person to receive the Medal of Honor for heroism during the Korean War, would lie in state in the U.S. Capitol Rotunda under a bipartisan resolution pending in Congress.

Last week, a measure was introduced that aims to honor all those who served in the U.S. military during ...Read more

Two jurors, one too frightened to serve, excused from Trump hush money trial

NEW YORK — Two jurors in the Donald Trump hush money trial were excused Thursday, one after telling the court she was too scared and intimidated to serve, as prosecutors renewed their request to hold Trump in criminal contempt over alleged gag order violations.

The first juror, one of seven initially chosen to serve on the case, told Judge ...Read more

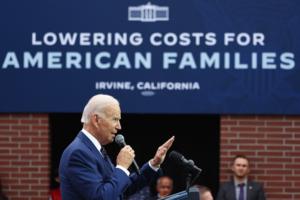

Kennedy family endorses Biden in bid to counter RFK Jr.

WASHINGTON — President Joe Biden called it an “incredible honor” as he received endorsements from more than a dozen members of the Kennedy family, in a public show of force aimed at undercutting the presidential campaign of independent Robert F. Kennedy Jr.

Biden, flanked by his rival’s siblings on stage at the event in Philadelphia, ...Read more

Key player in Adams campaign straw donor scheme pleads guilty

Shamsuddin Riza pleaded guilty Thursday to helping orchestrate a straw donor scheme that pumped illegal cash into Mayor Adams’ 2021 campaign in what prosecutors say was a scheme aimed at currying political favor in the hopes of landing city contracts.

Riza is the fourth defendant to plead guilty after being charged by Manhattan District ...Read more

Poll shows Florida abortion, marijuana referendums short of passage; bigger challenge for pot question

MIAMI — The two high-profile referendums on the 2024 Florida ballot — on abortion rights and recreational marijuana — are polling short of what they need to pass.

A statewide public opinion poll released Thursday by Florida Atlantic University found less than 50% support for each. Passage requires 60% of the vote.

•Abortion: The ...Read more

Juror too frightened to serve excused from Trump hush money trial

NEW YORK — A juror in the Donald Trump hush money trial was excused Thursday after telling the court she was too scared and intimidated to serve as prosecutors renewed their request to hold Trump in criminal contempt over alleged gag order violations.

The juror, one of seven chosen so far to serve on the case, told Merchan that she was too ...Read more

Biden counters RFK Jr. with Kennedy family endorsements

President Joe Biden will be endorsed by more than a dozen members of the Kennedy family at an event Thursday in Philadelphia, as he looks to blunt the outsider presidential bid of Robert F. Kennedy Jr.

Biden will be introduced by Kerry Kennedy — the sister of the third-party candidate — and joined by fellow siblings including Kathleen ...Read more

Cities with Black women police chiefs had less street violence during 2020’s Black Lives Matter protests

Black Lives Matter protests in cities with Black women police chiefs experienced significantly lower levels of violence – from both police and protesters – than cities with police chiefs of other racial backgrounds and gender, according to our newly published paper.

After George Floyd’s death at the hands of Minneapolis police ...Read more

5 years after the the Mueller Report into Russian meddling in the 2016 US election on behalf of Trump: 4 essential reads

In the long list of Donald Trump’s legal woes, the Mueller report – which was released in redacted form on April 18, 2019 – appears all but forgotten.

But the nearly two-year investigation into alleged Russian interference in the 2016 U.S. presidential election dominated headlines – and revealed what has become Trump’s ...Read more

Editorial: Biden shrugs at inflation

Over the past three years, the Biden White House has gradually passed through the five stages of grief when it comes to inflation. President Joe Biden has now reached the “acceptance” stage. The American public, however, may not be so accommodating.

Denial came first. Recall Biden’s famous assertion in July 2021 that, “There’s nobody ...Read more

Oman serves as a crucial back channel between Iran and the US as tensions flare in the Middle East

Prior to launching a barrage of drones and missiles at Israel on April 13, 2024, Iran reportedly got word to Washington that its response to an earlier strike on its embassy compound in Syria would seek to avoid major escalation. The message was conveyed via the Gulf Arab state of Oman.

The current crisis in the Middle East is one ...Read more

Trump presses Republicans for kickbacks when using his likeness

WASHINGTON — Donald Trump’s presidential campaign wants other Republicans to pay up, if they use the former president’s name, image or likeness in any fundraising solicitations, according to a new campaign memo obtained by Bloomberg News.

Signed by co-campaign managers, Susie Wiles and Chris LaCivita, the memo asks that all candidates ...Read more

Senate rejects impeachment of Homeland Security Secretary Mayorkas

WASHINGTON — Senators were sworn in at 1 p.m. Wednesday for their third impeachment trial in four years, this time of Homeland Security Secretary Alejandro N. Mayorkas.

Three hours later, they had voted along party lines to dismiss both counts against Mayorkas.

House Republicans, who say Mayorkas has failed to fulfill his duties in ...Read more

Rep. Jamaal Bowman trails Democratic primary challenger George Latimer in fundraising battle in NY's 16th District

NEW YORK — Rep. Jamaal Bowman is trailing in the fundraising battle with his Democratic primary battle challenger George Latimer.

Newly released Federal Election Committee documents revealed the two-term progressive incumbent raised $1.3 million in the first quarter of 2024, compared to $2.2 million for Latimer in the same period.

Bowman ...Read more

Bodega worker Trump went to visit in Harlem was with family in Dominican Republic, instead

NEW YORK — The Harlem bodega worker who Donald Trump was planning to visit on Tuesday missed the meeting because he was on a trip to the Dominican Republic, according to the man’s lawyer.

“Jose wanted to come but couldn’t get a flight on time,” Jose Alba’s attorney Rich Cardinale said Wednesday.

Alba, who in 2022 was arrested and ...Read more

Popular Stories

- Senate rejects impeachment of Homeland Security Secretary Mayorkas

- PT Barnum, suckers and the plummeting stock price of Truth Social

- Ireland at the crossroads: Can the ancient Brehon laws guide the republic away from anti-immigrant sentiment

- 5 years after the the Mueller Report into Russian meddling in the 2016 US election on behalf of Trump: 4 essential reads

- Cities with Black women police chiefs had less street violence during 2020’s Black Lives Matter protests