Science & Technology

/Knowledge

NASA confirms space junk that hit Florida home came from space station

NASA completed analysis of an object that hit a Florida home in March and determined it was the remains of debris released from the International Space Station two years earlier.

In an update to the agency’s website, NASA said the hand-sized chunk of metal came from a pallet of nickel hydride batteries that were jettisoned from the ISS in ...Read more

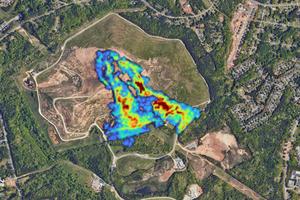

More climate-warming methane leaks into the atmosphere than ever gets reported – here’s how satellites can find the leaks and avoid wasting a valuable resource

Far more methane, a potent greenhouse gas, is being released from landfills and oil and gas operations around the world than governments realized, recent airborne and satellite surveys show. That’s a problem for the climate as well as human health. It’s also why the U.S. government has been tightening regulations on methane leaks and ...Read more

Editorial: High electric bills threaten California's clean future. This plan would help

California has some of the nation’s highest electricity rates, and power bills are rising fast. That’s a problem because it makes it harder for people to afford switching from fossil fuels to clean electric cars and appliances that are essential to combating climate change.

Who wants to invest thousands of dollars in a heat pump or ...Read more

Nine beavers die from disease in Utah -- and it can spread to people, officials say

Beavers are turning up dead in Utah, and the disease killing them can spread to humans, officials said.

So it’s important not to touch any dead animals — especially rodents — while wildlife officials learn more about the “unusual” event that killed nine beavers so far since the end of March, Utah’s Division of Wildlife Resources ...Read more

Too expensive, too slow: NASA asks for help with JPL's Mars Sample Return mission

After months of turmoil over the future of a vaunted mission to bring samples of the Red Planet back to Earth, NASA has its verdict on Mars Sample Return.

The space agency is "committed" to bringing those rocks back from Mars, administrator Bill Nelson said Monday, but will have to do it with way less money and in far less time than currently ...Read more

Microsoft, beset by hacks, grapples with problem years in the making

The world’s largest seller of cybersecurity products has a problem with its own cybersecurity.

In recent years, Microsoft Corp. has been hit with a series of embarrassing hacks that have exposed corporate and government customers. Earlier this month, the U.S. Cyber Safety Review Board issued a scathing report documenting the company’s ...Read more

Rural counties increasingly rely on prisons to provide firefighters and EMTs who work for free, but the inmates have little protection or future job prospects

If you call 911 in rural Georgia, the nearest emergency responders might come from the local prison.

In 1963, the Georgia Department of Corrections began a program to train incarcerated people as firefighters to support not only their prisons, but also the surrounding communities. Over time, the program has grown dramatically. Today, ...Read more

'It's environmental racism': Ag officials sued over farm chemicals near Latino schools

For Nelly Vaquera-Boggs, the plastic tarps that cover strawberry fields in Monterey County, California, when they are being fumigated with toxic chemicals offer little comfort — especially when those fields are close to schools.

The tarps, she said, sometimes come loose in the wind. They can get holes.

And in the small farm towns of the ...Read more

The airline industry's biggest climate challenge: a lack of clean fuel

In a glimmer of progress for the daunting task of reducing air travel’s climate impact, a newly built plant in rural Georgia is expected to begin pumping out the world’s first commercial quantities of a new type of cleaner jet fuel this month.

The $200 million plant from LanzaJet Inc. will be the first to turn ethanol into a fuel compatible...Read more

Could a bald eagle and a winery block a proposed rock quarry along the Boise River?

A nesting bald eagle, a beloved local winery and over 30 neighbors may jeopardize a proposal to open a 260-acre surface mine along the Boise River.

Emmett developer Evan Buchert of Premier LLC wants to build the mine at 25706 Boise River Road off U.S. 95 in Parma in eastern Canyon County, Idaho. The Pintail Long Term Mineral Extraction Mine ...Read more

Extreme heat is a problem in Virginia. Here's how researchers want to help.

The summers in Hampton Roads, Va., are hot, but for some residents, swelling temperatures and their impacts can be disproportionately worse.

In Portsmouth, Va., for example, a lack of green space and increase of development over time has created urban heat islands, said Elizabeth Malcolm, professor of ocean and atmospheric sciences and director...Read more

Environmental concerns raised by rocket flights over San Diego County

Plans by SpaceX and other companies to boost the number of rocket launches sometimes seen streaking across San Diego County's skies have prompted the California Coastal Commission to question the environmental effects.

Residents near Vandenberg Space Force Base, on the state's Central Coast, say the launches shake their homes and rattle their ...Read more

SpaceX launch from Florida tonight to mark record turnaround, record booster flight

If SpaceX manages a Starlink launch from Cape Canaveral tonight, it will come less than three days since the last rocket blasted off from the same launch pad, setting a new turnaround record while using a first-stage booster for a record-setting 20th flight.

A Falcon 9 carrying 23 more of SpaceX’s Starlink internet satellites is set to lift ...Read more

Environmental groups grateful but vigilant after Key Bridge collapse

BALTIMORE — When Alice Volpitta watched the video of the Francis Scott Key Bridge collapse, and the trucks tumbling into the Patapsco River in the darkness, she thought first for the people who had fallen.

And as her mind raced, the Baltimore Harbor Waterkeeper thought of the river.

“What’s on that ship?” thought Volpitta, of ...Read more

Colorado is latest state to try turning off the electrical grid to prevent wildfires − a complex, technical operation pioneered in California

The U.S. power grid is the largest and most complex machine ever built. It’s also aging and under increasing stress from climate-driven disasters such as wildfires, hurricanes and heat waves.

Over the past decade, power grids have played roles in wildfires in multiple states, including California, Hawaii, Oregon and Minnesota. When ...Read more

The South’s aging water infrastructure is getting pounded by climate change – fixing it is also a struggle

Climate change is threatening America’s water infrastructure as intensifying storms deluge communities and droughts dry up freshwater supplies in regions that aren’t prepared.

The severe storms that swept through the South April 10-11, 2024, illustrated some of the risks: In New Orleans, rain fell much faster as the city’s pumps...Read more

Can toothpaste tubes be recycled across the US? It's getting closer

Toothpaste tubes and other squeezable plastic containers are getting closer to being more sustainable in the U.S. Some 90% of toothpaste tubes on the market are now made in a way that makes them compatible for recycling with HDPE, the same plastic used for products like shampoo bottles, according to research firm Stina Inc.

Overall, 75% of all...Read more

Biden plans sweeping effort to block Arctic oil drilling

WASHINGTON — The U.S. set aside 23 million acres of Alaska’s North Slope to serve as an emergency oil supply a century ago. Now, President Joe Biden is moving to block oil and gas development across roughly half of it.

The initiative, set to be finalized within days, marks one of the most sweeping efforts yet by Biden to limit oil and gas ...Read more

Amazon CEO Andy Jassy touts AI in annual shareholder letter

In his annual letter to shareholders, Amazon CEO Andy Jassy went back to 2003.

Quoting from a “Vision document” that year for Amazon Web Services — the company’s cloud computing division — Jassy said Amazon has always been focused on designing and offering “primitives,” or the building blocks that other innovators need to make the...Read more

SpaceX is launching more rockets from a military base. Can the Coastal Commission impose a limit?

LOS ANGELES — SpaceX has significantly increased the frequency of its rocket launches from a Santa Barbara County military base, and its plans to add even more have raised concerns by the California Coastal Commission over the impacts on the environment and nearby communities.

The company, officially Space Exploration Technologies Corp., ...Read more

Popular Stories

- Nine beavers die from disease in Utah -- and it can spread to people, officials say

- More climate-warming methane leaks into the atmosphere than ever gets reported – here’s how satellites can find the leaks and avoid wasting a valuable resource

- Editorial: High electric bills threaten California's clean future. This plan would help

- Microsoft, beset by hacks, grapples with problem years in the making

- Too expensive, too slow: NASA asks for help with JPL's Mars Sample Return mission