Science & Technology

/Knowledge

Native American voices are finally factoring into energy projects – a hydropower ruling is a victory for environmental justice on tribal lands

The U.S. has a long record of extracting resources on Native lands and ignoring tribal opposition, but a decision by federal energy regulators to deny permits for seven proposed hydropower projects suggests that tide may be turning.

As the U.S. shifts from fossil fuels to clean energy, developers are looking for sites to generate ...Read more

Removing PFAS from public water will cost billions and take time – here are ways to filter out some harmful ‘forever chemicals’ at home

Chemists invented PFAS in the 1930s to make life easier: Nonstick pans, waterproof clothing, grease-resistant food packaging and stain-resistant carpet were all made possible by PFAS. But in recent years, the growing number of health risks found to be connected to these chemicals has become increasingly alarming.

PFAS – ...Read more

Jim Rossman: Fixing a non-working AirPod

Most of the time I write about issues other people are having, but today the problem I will tell you about happened to me.

I love to listen to sports talk radio at lunch if I’m eating alone. I am lucky to get to test out a lot of different kinds of wireless earbuds and headphones, but most of the time I use second-generation AirPods.

I ...Read more

Review: In ‘Princess Peach: Showtime!’ a Mario supporting character gets a starring role

Despite being the ruler of the Mushroom Kingdom, Princess Peach has always played a supporting role in Nintendo’s games. She’s normally the one rescued or a playable character in an ensemble adventure, but that changes this year.

For the first time since 2005’s “Super Princess Peach,” the heroine stars in her own game. “Princess ...Read more

Gadgets: Better, faster chargers

Most people want charging accessories that are better and faster. Leading accessory brand ESR helps achieve this with its new collection of Qi2 chargers.

Qi2 is the latest standard in wireless charging technology, delivering 15W of charging power and utilizing magnetic alignment for fast and efficient charging. The Qi standard was limited to ...Read more

What the ‘Fallout’ show gets right about the post-apocalyptic video game series

With superhero movies losing pop culture steam, the next big thing emerging on the horizon is video game flicks. Over the past few years, films and TV shows based on interactive entertainment have steadily gained traction, with the likes of “Sonic the Hedgehog,” “The Super Mario Bros. Movie” and “The Last of Us.”

Hollywood’s ...Read more

Review: ‘Dragon’s Dogma 2’ and ‘Rise of the Ronin’ offer divergent takes on open-world games

If you want to win game of the year, your best bet is to create an open-world game. The genre dominates when it comes to end-of-the-year considerations. The efforts are often the most eye-grabbing and they capture the imagination with their promise of adventure and fun.

Despite more than two decades of mining the format, developers are still ...Read more

Buy Nothing meets GoFundMe: How a new website aims to 'revolutionize' philanthropy

An Minnesota nonprofit leader hopes to "revolutionize" charitable giving with a new platform for people to trade household items they no longer need, resulting in a donation to a nonprofit.

Think Buy Nothing meets GoFundMe.

Joel Ackerman, a former UnitedHealth Group information technologies executive who's worked at numerous startups, was ...Read more

Tech review: Dyson is a champ at purifiying the air and keeping you comfortable

I sleep with a fan blowing to move the air in my bedroom.

Over the years I’ve had all sorts of fans, but for the last few years, my choice has been a Dyson fan sitting on a small table.

The Dyson fan I’ve been using was the Pure Hot+Cool. The Pure meant it had a HEPA filter, and Hot+Cool means it’s a heater as well as a fan. I loved that...Read more

Surrogate otter mom at aquarium is rehabilitating pup 'better than any human ever can'

LOS ANGELES — Millie, a fatigued mother of an infant, was ready for a nap.

So she grabbed her baby, flipped it around, threw it on her belly and started grooming its tail — a soothing behavior.

Millie, a sea otter, is rearing what could be the Aquarium of the Pacific’s first orphaned pup to return to the wild. As a surrogate mom, she’s...Read more

A Connecticut river is named one of 'most endangered' in US. Here's why and what it means for residents

HARTFORD, Conn. — The Farmington River, “the top priority watershed in the state,” according to the state’s environmental agency, has been named one of America’s Most Endangered Rivers by the organization American Rivers.

The 47-mile river, which flows into the Connecticut River, “has the potential to be the biggest positive ...Read more

Reports: Biden administration set to deny 200-mile Ambler mining road through Alaska wilderness

ANCHORAGE, Alaska — The U.S. Department of the Interior as early as this week is expected to issue an environmental report that recommends denying a permit needed to build a 200-mile access road to the Ambler mining district, according to national news reports on Tuesday.

The Alaska Industrial Development and Export Authority applied for the ...Read more

Next up is launch, as Boeing's Starliner takes trek to Cape Canaveral

The spacecraft has left the building.

Boeing’s CST-100 Starliner, set to take its first humans on board during the Crew Flight Test mission next month, was transported from Boeing’s Commercial Crew and Cargo Processing Facility at Kennedy Space Center in Florida on a 10-mile trip to Cape Canaveral Space Force Station.

It arrived at United ...Read more

Army Corps denies permit appeal by Pebble mine developer

ANCHORAGE, Alaska — The U.S. Army Corps this week rejected a permitting appeal by Pebble Limited Partnership, another setback for the copper and gold prospect in Southwest Alaska.

The Corps in 2020 had denied a permit for the project. That led to an appeal by Pebble and an additional review by the Corps.

The Corps said in a statement Monday ...Read more

Dozens of Google employees protest use of company's tech for war in Gaza

SUNNYVALE, California — A group of disappointed and angry Google employees protested outside a company building on Tuesday after it was reported that the search giant had deepened a contract with the Israeli government.

Googlers in New York City and Sunnyvale took action with the activist group No Tech for Apartheid, demanding that the ...Read more

Report: Tijuana River among most endangered in America due to sewage crisis

SAN DIEGO — The Tijuana River, with frequent flows of sewage and chemical-tainted waters, is among America's top endangered rivers, according to a report released Tuesday that spotlights threats to clean water nationwide.

American Rivers, a nonprofit focused on protecting the health of rivers in the U.S., compiled a list of the 10 most ...Read more

NASA confirms space junk that hit Florida home came from space station

NASA completed analysis of an object that hit a Florida home in March and determined it was the remains of debris released from the International Space Station two years earlier.

In an update to the agency’s website, NASA said the hand-sized chunk of metal came from a pallet of nickel hydride batteries that were jettisoned from the ISS in ...Read more

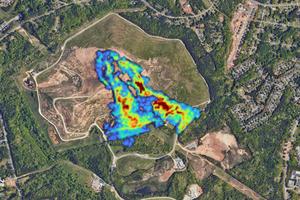

More climate-warming methane leaks into the atmosphere than ever gets reported – here’s how satellites can find the leaks and avoid wasting a valuable resource

Far more methane, a potent greenhouse gas, is being released from landfills and oil and gas operations around the world than governments realized, recent airborne and satellite surveys show. That’s a problem for the climate as well as human health. It’s also why the U.S. government has been tightening regulations on methane leaks and ...Read more

Editorial: High electric bills threaten California's clean future. This plan would help

California has some of the nation’s highest electricity rates, and power bills are rising fast. That’s a problem because it makes it harder for people to afford switching from fossil fuels to clean electric cars and appliances that are essential to combating climate change.

Who wants to invest thousands of dollars in a heat pump or ...Read more

Nine beavers die from disease in Utah -- and it can spread to people, officials say

Beavers are turning up dead in Utah, and the disease killing them can spread to humans, officials said.

So it’s important not to touch any dead animals — especially rodents — while wildlife officials learn more about the “unusual” event that killed nine beavers so far since the end of March, Utah’s Division of Wildlife Resources ...Read more

Popular Stories

- Surrogate otter mom at aquarium is rehabilitating pup 'better than any human ever can'

- Review: In ‘Princess Peach: Showtime!’ a Mario supporting character gets a starring role

- Review: ‘Dragon’s Dogma 2’ and ‘Rise of the Ronin’ offer divergent takes on open-world games

- Jim Rossman: Fixing a non-working AirPod

- Microsoft, beset by hacks, grapples with problem years in the making