Automotive

/Home & Leisure

How Ford's most profitable business is defying the EV slump

While malaise sets in across much of the electric vehicle market, there’s a corner that’s still going strong, where buyers like Chris Russo show little concern about high prices or range anxiety or spotty charging infrastructure.

The co-founder of Elite Home Care, a South Carolina-based company, bought his first EV more than two years ago �...Read more

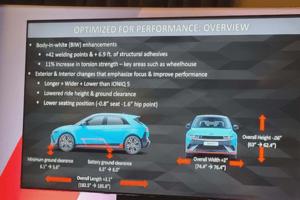

Auto review: Flat out in the Hyundai Ioniq 5 N electric track rat

LAGUNA SECA, California — Out of slow, 90-degree Turn 11 onto the Laguna Seca Raceway’s pit straight, my 2025 Hyundai Ioniq 5 N performance SUV instantly put down 545 pounds of torque and 601 horsepower to all four fat Pirelli P Zero performance tires. No downshift to second gear. No turbo lag. Just pure thrust. Zot! Seconds later, the EV ...Read more

Auto review: 2024 Lexus TX PHEV displays beauty and luxury

You heard it here first! As a Volvo fan myself, I don't see a lot of manufacturers that do it better, as the competition seems to always be chasing Volvo’s design, comfort and pricing. But with Lexus sharpening their pencil, we may have ourselves something here. I give you the 2024 Lexus TX550h+ Luxury.

This six-passenger hybrid SUV takes a ...Read more

Auto review: Two new Toyotas sure to satisfy your soul

Toyota has long been America’s favorite automaker, even if it hasn't always topped the sales charts. Certainly, it’s the world’s largest auto manufacturer, a spot once claimed by General Motors. So, when Toyota introduces two new models, it’s certainly big news. Better yet, along with the news came the chance to briefly experience both ...Read more

'This feels totally different': For 3rd time, VW workers mull joining UAW

CHATTANOOGA, Tennessee — Some are betting they will make history this week as Volkswagen AG workers vote on whether to join the United Auto Workers in this southern auto-producing state, where a right-to-work law is ingrained in its constitution.

Those pushing for unionization at the sprawling plant surrounded by the mountains of East ...Read more

Mercedes-Benz workers to vote on whether to join the UAW in May

Employees at Mercedes-Benz Group's assembly and battery plants outside Tuscaloosa, Alabama, will vote whether to join the United Auto Workers from May 13-17, the National Labor Relations Board said Thursday.

The election will be the Detroit-based union's second at a foreign-owned assembly plant following the launch of its $40 million organizing...Read more

Construction paused at VinFast's NC site as carmaker seeks a smaller footprint

Nearly nine months after VinFast broke ground on its planned $4 billion electric vehicle factory in North Carolina, construction at the Chatham County site has stalled while local officials await updated building plans from the Vietnamese carmaker.

Chatham County confirmed Tuesday what News & Observer drone footage makes clear: No significant ...Read more

Tesla asks investors to approve Musk's $56 billion pay again

Tesla Inc. will ask shareholders to vote again on the same $56 billion compensation package for Chief Executive Officer Elon Musk that was voided by a Delaware court early this year.

In its proxy filing issued Wednesday, Tesla also said it will call a vote on moving the company’s state of incorporation to Texas from Delaware. The carmaker ...Read more

Broken and unreliable EV chargers become a business opportunity for LA's ChargerHelp

Right place, right time, with an eye for opportunity, a commitment to economic growth for all, and a will to get things done. That’s entrepreneur Kameale Terry, co-founder of ChargerHelp, a Los Angeles startup.

She’s tackling a modern problem — the sorry state of electric vehicle public charging stations— while training an often-...Read more

Ford F-150 Lightnings now shipping after February stop order

Ford Motor Co. says it's shipping 2024 F-150 Lightning electric pickup trucks, and the vehicles now are available to order online.

The automaker on Feb. 9 had placed a stop-shipment on the all-electric trucks made at the Rouge Electric Vehicle Center in Dearborn because of an undisclosed issue resulting in the company saying it was extending ...Read more

'Threaten our jobs and values': Southern politicians ramp up campaign against UAW organizing

Political opposition to the United Auto Workers’ southern organizing push is cranking up ahead of a first test of the union’s strength this week at Volkswagen AG’s Tennessee plant, where a worker vote on whether to join the union runs Wednesday to Friday.

A Tuesday joint statement from the Republican governors of Alabama, Tennessee, ...Read more

How the UAW is winning over new plants -- starting with Volkswagen

The United Auto Workers is on the cusp of a significant milestone in its audacious effort to grow by 150,000 people across 13 automakers, including Tesla Inc., BMW AG and Nissan Motor Co.

This week, a Volkswagen AG factory will vote on whether to become the only foreign commercial carmaker unionized in the US. It would also be the first vehicle...Read more

Labor costs, shortage, increasing reliability: Why we're seeing more robots inside plants

Long used mostly for the “dull, dirty and dangerous” tasks in manufacturing, robots are increasingly considered “desirable” amid rising labor costs and shortages, strike risks and the need for flexibility in navigating the bumpy electric vehicle transition.

A record contract between the United Auto Workers and the Detroit Three ...Read more

Tesla to cut over 10% of workforce in global retrenchment

Tesla Inc. is slashing headcount by more than 10%, part of a global retrenchment extending all the way into its executive ranks as the carmaker struggles with slowing demand for electric vehicles.

Chief Executive Officer Elon Musk revealed the job cuts in an email to staff, citing duplication of roles and the need to reduce costs. If the ...Read more

Motormouth: Downshifting

Q: I own a car with an 8-speed automatic transmission and manual shifters. If I am approaching a red light 50-100 yards away, am I better off downshifting or gently applying the brakes? Does repeated downshifting do long term damage to the transmission?

P.J., South Windsor, Connecticut

A: Many transmissions remain in the drive mode or can be ...Read more

Honda's Midwest manufacturing plants begin EV conversion

Move over Accord, here comes Honda’s EV line.

Honda Motor Co. is transferring production of its iconic, internal combustion engine-powered Accord sedan from its long-time home in Marysville, Ohio, to its Greensburg, Indiana, assembly plant to make room for electric vehicle production starting in 2025. The move is a major step in Honda’s "...Read more

New EV sales hit crossroads, while used EVs have open road for growth

No one said electrifying the auto industry was going to be a smooth ride.

Electric vehicle sales got off to a slow start in 2024, with some some automakers — namely EV pioneer Tesla — seeing their sales momentum reverse.

After the country eclipsed 1.2 million EV sales in 2023, new plug-in vehicle sales increased about 3% year-over-year ...Read more

Ruling paves way for Biden to approve stricter California vehicle rules, but SCOTUS looms

WASHINGTON — A federal court ruling this week allows California to keep setting air pollution and vehicle emissions standards above and beyond federal limits, with potentially far-reaching impacts for an auto industry that's navigating a bumpy electric transition.

The decision preserves a regulatory double standard across the country. There ...Read more

Auto review: 2024 Fiat 500e is the perfect cup of automotive espresso

Here we go again.

The battery-electric Fiat 500e returns for 2024, five model years after it was previously offered for sale in the United States and a decade after it debuted.

Of course, if you don’t remember the previous Fiat 500e, you probably didn’t live in in California and Oregon, the only states where it was sold merely to meet ...Read more

Henry Payne: Delivering packages in Rivian's Amazon EV truck

PONTIAC, Michigan — Coming to your Metro Detroit neighborhood, Amazon.com Inc.’s Rivian electric delivery vans are the culmination of a five-year collaboration between the retail giant and the U.S.-based electric vehicle startup.

Michigan is among the major metropolitan areas receiving 100,000 Rivian Automotive Inc. vans that will both meet...Read more

Popular Stories

- Motormouth: Downshifting

- Construction paused at VinFast's NC site as carmaker seeks a smaller footprint

- 'This feels totally different': For 3rd time, VW workers mull joining UAW

- Mercedes-Benz workers to vote on whether to join the UAW in May

- Tesla asks investors to approve Musk's $56 billion pay again