Health Advice

/Health

Mayo Clinic Minute: Creating an advance directive for your future well-being

No one can predict the future, but putting together an advance directive can bring you peace of mind and a plan for your medical care during an emergency or end of life.

Dr. Maisha Robinson, chair of the Palliative Medicine Department at Mayo Clinic in Florida, advises people to have these conversations with family members and loved ones.

"An ...Read more

Medicare's push to improve chronic care attracts businesses, but not many doctors

Carrie Lester looks forward to the phone call every Thursday from her doctors’ medical assistant, who asks how she’s doing and if she needs prescription refills. The assistant counsels her on dealing with anxiety and her other health issues.

Lester credits the chats for keeping her out of the hospital and reducing the need for clinic visits...Read more

Cannabis legalization has led to a boom in potent forms of the drug that present new hazards for adolescents

Eventually, most adults reach a point where we realize we are out of touch with those much younger than us.

Perhaps it is a pop culture reference that sparks the realization. For me, this moment happened when I was in my late 20s and working with adolescents in school settings to help them quit smoking. When other drugs would ...Read more

'Miracle' weight-loss drugs could have reduced health disparities. Instead they got worse

LOS ANGELES -- The American Heart Association calls them "game changers."

Oprah Winfrey says they're "a gift."

Science magazine anointed them the "2023 Breakthrough of the Year."

Americans are most familiar with their brand names: Ozempic, Wegovy, Mounjaro, Zepbound. They are the medications that have revolutionized weight loss and raised ...Read more

Avian flu outbreak raises a disturbing question: Is our food system built on poop?

If it’s true that you are what you eat, then most beef-eating Americans consist of a smattering of poultry feathers, urine, feces, wood chips and chicken saliva, among other food items.

As epidemiologists scramble to figure out how dairy cows throughout the Midwest became infected with a strain of highly pathogenic avian flu— a disease ...Read more

Native Americans have shorter life spans. Better health care isn't the only answer

HISLE, S.D. — Katherine Goodlow is only 20, but she has experienced enough to know that people around her are dying too young.

Goodlow, a member of the Lower Brule Sioux Tribe, said she’s lost six friends and acquaintances to suicide, two to car crashes, and one to appendicitis. Four of her relatives died in their 30s or 40s, from causes ...Read more

Ask the Pediatrician: How to manage screen time and temper tantrums

Are you concerned about the time your child spends on digital devices? If so, you're hardly alone. Many parents and caregivers worry that screen time is taking over their child's day (and night), crowding out other activities they need for good health.

It helps to create a family media plan to set healthy digital habits. You may decide you want...Read more

Family caregivers face financial burdens, isolation and limited resources − a social worker explains how to improve quality of life for this growing population

Millions of Americans have become informal family caregivers: people who provide family members or friends with unpaid assistance in accomplishing daily tasks such as bathing, eating, transportation and managing medications.

Driven in part by a preference for home-based care rather than long-term care options such as assisted living ...Read more

Getting a good night’s rest is vital for neurodiverse children – pediatric sleep experts explain why

Most of us are all too familiar with the consequences of a poor night’s sleep – be it interrupted sleep or simply too little of it. If you’re a parent with kids at home, it often leaves you and your children on edge.

Children with neurodiverse conditions, such as autism and attention-deficit/hyperactivity disorder, or ADHD, are ...Read more

Solving the puzzle: Autism diagnosis often takes longer for girls, whose symptoms can differ from boys'

SAN DIEGO -- Donning one of her favorite unicorn-themed nightgowns and perched comfortably in an extra large beanbag chair, Alyssa Tracy watches videos on her tablet.

It’s a quiet, early April morning at the Lakeside, California, home where the 10-year-old lives with her parents, Dustin and Debra Tracy, and older sister Grace Tracy, age 12.

...Read more

Vulnerable Florida patients scramble after abrupt Medicaid termination

TAMPA, Fla. – Esther JeanBart leaned over her son’s wheelchair, caressing his face and trying to make him giggle. Gianni JeanBart was under the weather, but still his eyes rolled toward her and his mouth widened, cracking a smile.

Esther JeanBart said she has missed the sound of Gianni’s voice the most. In 2017, the U.S. Marine was in a ...Read more

Commentary: Health care is not a top issue in 2024. COVID-19 explains why

In a striking departure from recent voting and polling trends, health care has tumbled to the 16th most important problem facing Americans today, according to new Gallup data.

At first glance, this shift is bewildering, especially considering the central role health care played in the 2018, 2020 and 2022 election cycles.

Americans now list the...Read more

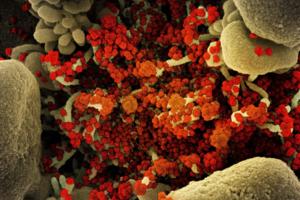

It's taken 100 scientists two years to rename airborne viruses after COVID-19 mistakes

Airborne viruses will be called “pathogens that transmit through the air” under new terminology the World Health Organization hopes will end a scientific rift that hampered the early response to COVID-19.

After two years of consultations involving over 100 scientists, a WHO-led working group agreed to the term to describe diseases caused ...Read more

Mayo Clinic Minute: What is pink eye?

Pink eye is extremely common in kids. According to the Centers for Disease Control and Prevention, public schoolchildren in the U.S. miss 3 million school days each year because of pink eye.

Dr. Tina Ardon, a Mayo Clinic family physician, explains what you should know about this contagious condition.

"Pink eye, or the medical term is ...Read more

States want to make it harder for health insurers to deny care, but firms might evade enforcement

For decades, Amina Tollin struggled with mysterious, debilitating pain that radiated throughout her body. A few years ago, when a doctor finally diagnosed her with polyneuropathy, a chronic nerve condition, she had begun to use a wheelchair.

The doctor prescribed a blood infusion therapy that allowed Tollin, 40, to live her life normally. That ...Read more

Mayo Clinic Minute: How often should you wash your hair?

To shampoo or not to shampoo? That might be your question each time you head into the shower. Dr. Dawn Davis, a Mayo Clinic dermatologist, says, when it comes to the scalp and the hair, there's a new trend online where shampooing less is preferred. Here's what she would like you to consider when it comes time to washing your hair.

In the shower...Read more

Paris Hilton backs California bill requiring sunshine on 'troubled teen industry'

Celebrity hotel heiress Paris Hilton is backing California lawmakers’ push to increase the transparency of residential teen therapeutic centers by requiring these programs to report the use of restraints or seclusion rooms in disciplining minors.

“We shouldn’t be placing youth in facilities without knowing what these children will be ...Read more

When rogue brokers switch people's ACA policies, tax surprises can follow

Tax season is never fun. But some tax filers this year face an added complication: Their returns are being rejected because they failed to provide information about Affordable Care Act coverage they didn’t even know they had.

While the concern about unscrupulous brokers enrolling unsuspecting people in ACA coverage has simmered for years, ...Read more

California health workers may face rude awakening with $25 minimum wage law

SACRAMENTO, Calif. — Nearly a half-million health workers who stand to benefit from California’s nation-leading $25 minimum wage law could be in for a rude awakening if hospitals and other health care providers follow through on potential cuts to hours and benefits.

A medical industry challenge to a new minimum wage ordinance in one ...Read more

Illinois House OKs measure to give mental health workers called to emergencies the same benefits as other first responders

SPRINGFIELD, Ill. — Lawmakers are moving ahead with a measure that would make mental health professionals who get sent on emergency calls alongside law enforcement eligible for the same benefits as other first responders if they’re also hurt in the line of duty.

Mental health advocates for years have pushed for a more holistic approach to ...Read more

Popular Stories

- Cannabis legalization has led to a boom in potent forms of the drug that present new hazards for adolescents

- 'Miracle' weight-loss drugs could have reduced health disparities. Instead they got worse

- Family caregivers face financial burdens, isolation and limited resources − a social worker explains how to improve quality of life for this growing population

- Mayo Clinic Minute: Creating an advance directive for your future well-being

- Ask the Pediatrician: How to manage screen time and temper tantrums