Health Advice

/Health

It's taken 100 scientists two years to rename airborne viruses after COVID-19 mistakes

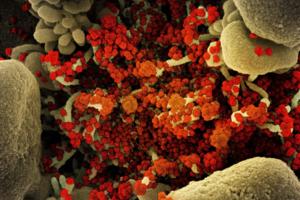

Airborne viruses will be called “pathogens that transmit through the air” under new terminology the World Health Organization hopes will end a scientific rift that hampered the early response to COVID-19.

After two years of consultations involving over 100 scientists, a WHO-led working group agreed to the term to describe diseases caused ...Read more

Mayo Clinic Minute: What is pink eye?

Pink eye is extremely common in kids. According to the Centers for Disease Control and Prevention, public schoolchildren in the U.S. miss 3 million school days each year because of pink eye.

Dr. Tina Ardon, a Mayo Clinic family physician, explains what you should know about this contagious condition.

"Pink eye, or the medical term is ...Read more

States want to make it harder for health insurers to deny care, but firms might evade enforcement

For decades, Amina Tollin struggled with mysterious, debilitating pain that radiated throughout her body. A few years ago, when a doctor finally diagnosed her with polyneuropathy, a chronic nerve condition, she had begun to use a wheelchair.

The doctor prescribed a blood infusion therapy that allowed Tollin, 40, to live her life normally. That ...Read more

Mayo Clinic Minute: How often should you wash your hair?

To shampoo or not to shampoo? That might be your question each time you head into the shower. Dr. Dawn Davis, a Mayo Clinic dermatologist, says, when it comes to the scalp and the hair, there's a new trend online where shampooing less is preferred. Here's what she would like you to consider when it comes time to washing your hair.

In the shower...Read more

Paris Hilton backs California bill requiring sunshine on 'troubled teen industry'

Celebrity hotel heiress Paris Hilton is backing California lawmakers’ push to increase the transparency of residential teen therapeutic centers by requiring these programs to report the use of restraints or seclusion rooms in disciplining minors.

“We shouldn’t be placing youth in facilities without knowing what these children will be ...Read more

When rogue brokers switch people's ACA policies, tax surprises can follow

Tax season is never fun. But some tax filers this year face an added complication: Their returns are being rejected because they failed to provide information about Affordable Care Act coverage they didn’t even know they had.

While the concern about unscrupulous brokers enrolling unsuspecting people in ACA coverage has simmered for years, ...Read more

California health workers may face rude awakening with $25 minimum wage law

SACRAMENTO, Calif. — Nearly a half-million health workers who stand to benefit from California’s nation-leading $25 minimum wage law could be in for a rude awakening if hospitals and other health care providers follow through on potential cuts to hours and benefits.

A medical industry challenge to a new minimum wage ordinance in one ...Read more

Illinois House OKs measure to give mental health workers called to emergencies the same benefits as other first responders

SPRINGFIELD, Ill. — Lawmakers are moving ahead with a measure that would make mental health professionals who get sent on emergency calls alongside law enforcement eligible for the same benefits as other first responders if they’re also hurt in the line of duty.

Mental health advocates for years have pushed for a more holistic approach to ...Read more

Sugar cravings could be caused by loneliness, study finds

If you’ve spent a lonely night at home eating chocolates and/or ice cream, you shouldn’t feel guilty. That’s because loneliness can cause an intense desire for sugary foods, a new study found.

Published in JAMA Network Open, researchers linked brain chemistry from those who socially isolate to poor mental health, weight gain, cognitive ...Read more

FDA announces recall of heart pumps linked to deaths and injuries

A pair of heart devices linked to hundreds of injuries and at least 14 deaths has received the FDA’s most serious recall, the agency announced Monday.

The recall comes years after surgeons say they first noticed problems with the HeartMate II and HeartMate 3, manufactured by Thoratec Corp., a subsidiary of Abbott Laboratories. The devices are...Read more

Worried about housing shortages and soaring prices? Your community’s zoning laws could be part of the problem

Local governments often try to combat housing costs and create affordable housing by passing legislation that changes current zoning and land-use regulations. But the changes are not without controversy. SciLine interviewed Jessica Trounstine, the centennial chair and professor of political science at Vanderbilt University, who discussed why ...Read more

5 foods you’re probably cleaning wrong

An essential part of the cooking process is prepping your ingredients. Most of us probably don’t think too much about how we wash fruits, veggies and other foods, but as with most things, there’s a right way and there’s a wrong way. Sometimes, incorrect cleaning means a little grit in your salad, but in other instances it can be the ...Read more

A tough question: When should an older driver stop driving?

When my grandmother repeatedly clipped the mailbox backing out of her driveway, she always had a ready explanation: “the sun was in my eyes” or “your grandfather distracted me.” Our family knew we needed to take action. But no one wanted to be the one to ask her to stop driving. She was fiercely independent, didn’t agree that her ...Read more

Mayo Clinic Q&A: Women and thyroid disease

DEAR MAYO CLINIC: I recently read that thyroid issues affect women more often than men. Can you explain what the thyroid is and how it affects my body? Can I do anything to prevent having issues with my thyroid as I age?

ANSWER: The thyroid is a small butterfly-shaped gland at the neck’s base. The thyroid has a significant effect on the body ...Read more

As bans spread, fluoride in drinking water divides communities across the US

MONROE, N.C. — Regina Barrett, a 69-year-old retiree who lives in this small North Carolina city southeast of Charlotte, has not been happy with her tap water for a while.

“Our water has been cloudy and bubbly and looks milky,” said Barrett, who blames fluoride, a mineral that communities across the nation have for decades added to the ...Read more

Organ donation: Don't let these myths confuse you

Over 100,000 people in the U.S. are waiting for an organ transplant. Unfortunately, many may never get the call saying that a suitable donor organ — and a second chance at life — has been found. It's estimated that more than 15 people die every day in the U.S. because of the lack of donor organs.

It can be hard to think about what's going ...Read more

Lawsuit alleges Obamacare plan-switching scheme targeted low-income consumers

A wide-ranging lawsuit filed Friday outlines a moneymaking scheme by which large insurance sales agency call centers enrolled people into Affordable Care Act plans or switched their coverage, all without their permission.

According to the lawsuit, filed in U.S. District Court for the Southern District of Florida, two such call centers paid tens...Read more

Arkansas led the nation in measuring obesity in kids. Did it help?

LITTLE ROCK, Ark. — Sixth-grade boys were lining up to be measured in the Mann Arts and Science Magnet Middle School library. As they took off their shoes and emptied their pockets, they joked about being the tallest.

“It’s an advantage,” said one. “You can play basketball,” said another. “A taller dude can get more girls!” a ...Read more

Commentary: The decline in American life expectancy harms more than our health

American life expectancy started dropping even before the pandemic. It’s a critical barometer of our nation’s health and a sign that all is not well in the U.S.

Much of the increase in preventable, premature death is attributable to drug overdose, which increased five-fold over the last couple decades. But this malaise is far broader, ...Read more

Tech neck is a pain in more than just the neck

The typical average adult head weighs approximately 10-12 pounds. But did you know that bending it forward at a 45-degree angle to look at a cellphone or tablet can dramatically increase your chances to have "tech neck?"

"That's like having an 8-pound bowling ball as your head. Then you have 72 pounds at your elbow and 96 pounds on your ...Read more

Popular Stories

- Mayo Clinic Minute: How often should you wash your hair?

- California health workers may face rude awakening with $25 minimum wage law

- Mayo Clinic Minute: What is pink eye?

- Paris Hilton backs California bill requiring sunshine on 'troubled teen industry'

- Sugar cravings could be caused by loneliness, study finds