Entertainment

/ArcaMax

Fire breaks out at Oregon hotel featured in 'The Shining'

An inferno erupted at the historic Oregon hotel featured in Stanley Kubrick’s famous horror flick “The Shining,” officials confirmed early Friday.

The three-alarm fire broke out late Thursday night in the attic of the Timberline Lodge, called the Overlook Hotel in the 1980 classic starring Jack Nicholson.

Firefighters across multiple ...Read more

What prison life is like for Todd and Julie Chrisley, the former reality TV stars

ATLANTA — Former Atlanta multimillionaires and reality television stars Todd and Julie Chrisley are “doing as best they can” while behind bars at federal prison facilities plagued with mold and other unhealthy conditions, their daughter says.

Savannah Chrisley told The Atlanta Journal-Constitution she’s “fearful” about the ...Read more

A field guide to the references on Taylor Swift's 'The Tortured Poets Department'

Taylor Swift release day always arrives with a thicket of real-life allusions to ancient myths, literary heroes and local bars alike. The 31-track (!) "Tortured Poets Department" is packed with new poets to read, bands to discover and weird vacation towns to visit, and here's a brief field guide to the best of them.

As you're crushing "Florida!...Read more

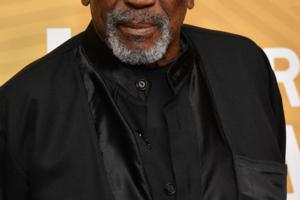

Louis Gossett Jr.'s cause of death revealed as lung disease

NEW YORK — Brooklyn-born Oscar winner Louis Gossett Jr. died from a lung condition, according to his death certificate obtained Friday.

Per documents reviewed by TMZ, the Coney Island native suffered from chronic obstructive pulmonary disease for years. The condition is listed as his primary cause of death, while heart failure and atrial ...Read more

Here's what to know about Taylor Swift's new album

Taylor Swift’s “The Tortured Poets Department” is finally here.

In February, the pop superstar announced the album while accepting the Grammy Award for best pop vocal album (for 2022′s “Midnights”).

“An anthology of new works that reflect events, opinions and sentiments from a fleeting and fatalistic moment in time - one that was...Read more

Taylor Swift's 'The Tortured Poets Department' is here -- let's dive into the lyrics

The first meeting of “The Tortured Poets Department,” chaired by Taylor Swift, has come to order.

“The author,” as she dubbed herself on Instagram, shared a message to fans as the album dropped, calling it “An anthology of new works that reflect events, opinions and sentiments from a fleeting and fatalistic moment in time — one that...Read more

Surprise: Taylor Swift's 'Tortured Poets Department' is a double album, 'The Anthology'

Seems Taylor Swift has been one busy girl. And overnight she dropped the entirety of that effort, turning “The Tortured Poets Department” into a double album release and tacking “The Anthology” onto the title.

“It’s a 2am surprise,” she wrote on Instagram at 11 p.m. “The Tortured Poets Department is a secret DOUBLE album. I’d ...Read more

'Chrisley Knows Best' case in Atlanta court today

ATLANTA — A panel of federal appeals court judges in Atlanta will hear arguments Friday in the attempt by Todd and Julie Chrisley to overturn many of their convictions for bank fraud and tax evasion.

The former Atlanta multimillionaires and reality television stars are serving prison sentences of 12 and seven years, respectively, having been ...Read more

Mandisa, 'American Idol' star and Grammy winning Christian music singer, dies at 47

Mandisa, the Christian music singer who competed on "American Idol" and then pursued a Grammy Award-winning career, has died. She was 47.

A representative confirmed to The Times on Friday that the California-born artist "was found in her home [in Tennessee] deceased."

"At this time, we do not know the cause of death or any further details," ...Read more

Katy Perry picks Jelly Roll to replace her on 'American Idol'

Katy Perry has named her top pick to be the new judge on “American Idol” next season: country music star Jelly Roll.

The “Firework” singer, who recently announced her exit from the long-running talent competition, extolled the virtues of who she sees as her ideal successor.

“I gotta say Jelly Roll was crazy when he came on the show,�...Read more

Taylor Swift drops surprise second 'Tortured Poets' album: 'The Anthology'

NEW YORK — Swifties got a double dose of sweet torture at 2 a.m. when Taylor Swift dropped another 15 tracks and announced that “The Tortured Poets Department” is a double album.

She announced the second half on social media with new album art and a message about her folie à deux:

“It’s a 2am surprise: The Tortured Poets Department ...Read more

These lyrics in 2 new Taylor Swift songs are about Travis Kelce, her fans say

KANSAS CITY, Mo. — All that screaming and crying late Thursday night in Kansas City and points beyond came from fans of Taylor Swift and Travis Kelce as they listened to her new album, “The Tortured Poets Department.”

The album and song lyrics leaked on Wednesday, so many people knew there might be a song about her current boyfriend.

...Read more

Where is Taylor Swift's new song “Florida!!!” really taking us?

TAMPA, Fla. — From the first line in her new song “Florida!!!,” you can already tell that Taylor Swift has heard our state’s unofficial motto: A sunny place for shady people.

“You can beat the heat if you beat the charges too,” she sings. “They said I was a cheat, I guess it must be true.”

In “Florida!!!,” Swift paints a ...Read more

Review: Taylor Swift turns heel, owning her chaos and messiness on 'The Tortured Poets Department'

Taylor Swift has spent years warning us not to believe everything we hear about her. As the biggest star of pop music's parasocial age, she argues that the facts of her existence are constantly warped by gossip and misinformation, which is one reason the Easter eggs and coded messages she's long built into her work have helped create such a ...Read more

Taylor Swift's new album is rife with breakup songs. Psychologists explain why we love them

Perhaps never before have so many been so eager for something so steeped in heartbreak.

Taylor Swift's legions of devotees have eagerly anticipated her new album, "The Tortured Poets Department," in hopes of gaining insight into her notoriously private six-year relationship with actor Joe Alwyn — particularly her perspective on its demise.

...Read more

Review: Our critic and a 13-year-old Swiftie discuss Taylor Swift's new album (first iteration)

Taylor Swift tantalizes and tortures us once again. This time it's with her new album "The Tortured Poets Department," which dropped at midnight ET Friday. Which guy(s) in her life is she singing about? Why is she so unlucky in love? Which of these songs is about new beau Travis Kelce?

After one listen to the 16 songs on her 11th studio album, ...Read more

Review: 'The Wiz' on Broadway is freshened up and ready for an adoring audience

NEW YORK — “Everybody look around,” they’re singing, festively, at the Marquis Theatre. “There’s reason to rejoice, you see.”

For a lot of Broadway fans, especially Black audiences of a certain age, the return of the Super Soul Musical (it was the 1970s) “The Wiz” to the Great White Way after some 50 years is a cause for ...Read more

'We Grown Now' review: Coming of age in Chicago's Cabrini-Green projects, in a movie of true distinction

Can we really trust tears as a sign of a film’s quality? A century of so many shameless, relentless cinematic mediocrities suggest the answer is no. If a movie will stop at nothing in its mission to make you cry, yes, statistically speaking, you’ll probably comply. Or not, because you feel jerked around as a viewer. But just as there are ...Read more

Documentary gives insight on Crumbley prosecutors' thoughts before, during parents' trial

DETROIT — The ABC News Studios documentary about the prosecution of James and Jennifer Crumbley, the parents of the Oxford High School shooter, is now available on Hulu, and while it delves into prosecutors' mindsets while charging and prosecuting the case, little previously unheard information was revealed.

The documentary began with a bird'...Read more

Lewis Black rants about Trump/Biden replay, retiring from touring

Lewis Black, like some of his comparably seasoned brethren on the music side such as Elton John and Kenny Loggins, has decided to retire from hardcore touring as he approaches his 76th birthday.

“I used to do 200 shows a year, then cut back to 125 and I’m now at about 100,” Black told The Atlanta Journal-Constitution recently. “Now I’...Read more

Inside Entertainment News

Popular Stories

- Harry Styles' stalker gets prison sentence, decade-long concert ban

- Taylor Swift announces first 'Tortured Poets Department' single as fans fight album leaks

- Television Q&A: What is 'The Talk' on why CBS show is ending?

- Documentary gives insight on Crumbley prosecutors' thoughts before, during parents' trial

- These lyrics in 2 new Taylor Swift songs are about Travis Kelce, her fans say