Current News

/ArcaMax

NYC squatters got engaged, spent big after stuffing slay victim in duffel bag, prosecutors say

NEW YORK — The young squatter couple accused of beating a Manhattan woman to death and stuffing her body in a duffel bag went on a wild shopping spree, got engaged while on the lam and even bought a diamond ring with the victim’s credit card to seal the deal, authorities said Thursday.

After fleeing to Pennsylvania and crashing the victim�...Read more

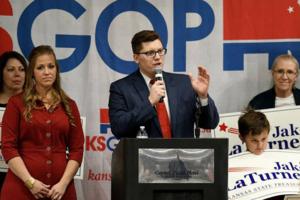

Leavenworth prosecutor, state lawmaker weighing runs for Congress as Kansas rep LaTurner exits

U.S. Rep. Jake LaTurner’s sudden announcement Thursday that he won’t seek reelection upended the race for Kansas’ 2nd Congressional District, with Leavenworth County Attorney Todd Thompson and Kansas House Majority Leader Chris Croft both weighing a candidacy.

“I appreciate what Jake’s done. I really am going to have to look into it. ...Read more

Karen Read trial: 3rd day of jury selection sees a pool of 57 potential jurors

BOSTON — Attorneys on Thursday have begun interviewing a third batch of potential jurors in the white-hot Karen Read murder case at Norfolk Superior Court.

The pool for today was significantly smaller than the prior two days of the jury selection, which began on Tuesday. While the other days had 90 or more potential jurors each, Thursday saw ...Read more

Dunleavy lays out efforts to preserve ability to spend public funds at private and religious schools

ANCHORAGE, Alaska — In the wake of a court decision that struck down key statutes governing Alaska's public homeschooling programs, Gov. Mike Dunleavy said Wednesday that he would not immediately seek to advance new statutes or regulations ensuring the programs can continue.

Anchorage Superior Court Judge Adolf Zeman ruled last week that the ...Read more

DeSantis signs school chaplains bill opposed by pastors, Satanists, ACLU

KISSIMMEE, Fla. — Gov. Ron DeSantis signed a bill into law Thursday allowing volunteer chaplains to counsel students in public and charter schools, despite warnings from a pastors group, the ACLU and the Satanic Temple that it would violate the First Amendment.

“There are some students (who) need some soul prep,” said DeSantis, who signed...Read more

Legislation would ban most uses of toxic forever chemicals within a decade

Despite widespread understanding of the health and environmental damages caused by forever chemicals, manufacturers continue to win federal approval to synthesize new versions of the toxic compounds with little, if any, government oversight.

U.S. Sen. Dick Durbin wants to begin shutting off the tap by outlawing per- and polyfluoroalkyl ...Read more

Kansas Congressman Jake LaTurner won't seek reelection, creating race for open seat

U.S. Rep. Jake LaTurner, a Republican who represents Kansas’ 2nd District, announced Thursday he won’t seek reelection, creating another open race in a furious partisan fight for control of the House.

LaTurner, 36, was first elected to the House in 2020. In a statement, LaTurner said it was time to “pursue other opportunities and have the...Read more

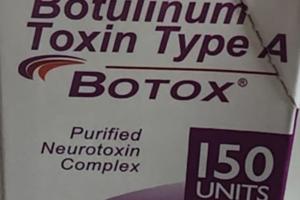

An FDA warning about droopy eyelids, blurred vision and fake Botox in nine states

“Harmful reactions” from women in nine states led to alerts from the FDA and CDC this week about fake Botox, unlicensed medical facilities and unlicensed people giving the shots.

Here’s what’s known:

Where did the ‘harmful reactions’ happen? Who got harmed?

The agencies say the “adverse event” reports came from 19 women in ...Read more

Atlantic City mayor says child abuse charges don't change commitment to city

Atlantic City, New Jersey, Mayor Marty Small on Thursday said he remains committed to his family and city residents, three days after prosecutors charged him and his wife with physically abusing their teenage daughter.

The 50-year-old Democrat, who has served as mayor since 2019, said the explosive allegations made public over the past few days...Read more

Full jury selected for Trump hush money trial

NEW YORK — A full jury was sworn in Thursday for Donald Trump’s historic hush money criminal trial in Manhattan.

The seven jurors selected late in the day join the five panelists chosen earlier this week, and comes after two were dismissed Thursday morning.

The newest selections include someone who follows Trump on Truth Social and former ...Read more

California lawmakers reject bill to let parents sue schools that don't ban 'harmful' books

SACRAMENTO, Calif. — California lawmakers recently voted down a bill requiring school boards to ban books with “harmful material” from libraries and classrooms, legislation that would have given parents the ability to sue those that did not comply.

The Senate Education Committee on Tuesday did not advance Senate Bill 1435 from Sen. ...Read more

Missouri lawmakers pass massive education bill targeting 4-day weeks, boosting private schools

JEFFERSON CITY, Mo. — Missouri lawmakers on Thursday approved a sweeping education bill that requires voters to decide whether large school districts can shift to four-day school weeks, raises teacher pay and expands a scholarship program for students to attend private or charter schools.

The bill, which passed the Missouri House on a vote of...Read more

NYPD arrests students, clears Columbia University campus of pro-Palestinian protest encampment

NEW YORK — NYPD officers with batons and wearing helmets took dozens of Columbia University students into custody Thursday after groups protesting the war in Gaza refused to take down a two-day encampment zone.

Hundreds of cops entered campus in the early afternoon, with several “school buses” on standby to transport those arrested. ...Read more

Ex-Minneapolis officer Thomas Lane finishes federal prison time in George Floyd killing

MINNEAPOLIS — Thomas Lane, one of the former Minneapolis police officers convicted for killing George Floyd nearly fours ago, has completed the federal portion of his prison time and now is nearing an end to being locked up.

Lane, 41, will remain housed at the low-security federal lockup in Littleton, Colorado, until his state sentence for ...Read more

Woman wheels dead uncle into Brazilian bank to 'sign' for loan

A woman was arrested, and her uncle was sent to the morgue after she wheeled his corpse into a bank in Brazil and tried to obtain a loan with his signature.

He couldn’t give it, of course, being dead.

Security video showed Erika de Souza Vieira Nunes, 42, wheeling the late Paulo Roberto Braga, 68, into a Rio de Janeiro bank on Tuesday and ...Read more

Wife calls 911 for help, then cops shoot Texas man dead amid mental health crisis, suit says

A newly filed lawsuit accuses Texas deputies of using excessive force when they fatally shot a man while he was having a mental health emergency in October 2022.

The lawsuit, filed April 11 in an Austin federal court by Kaplan Law Firm on behalf of the man’s wife, names the Llano County Sheriff’s Office, the sheriff and two deputies as ...Read more

Ukraine's allies see bleak times ahead without more air defenses

As Ukraine’s ammunition stocks dwindle some of the country’s biggest allies are expressing growing concern that it may not be able to defend itself for much longer against Russia’s invasion. Group of Seven foreign ministers gathering on the Italian island of Capri will call for stronger support.

German Foreign Minister Annalena Baerbock,...Read more

Kansas Rep. Jake LaTurner won't run for third term

WASHINGTON — Rep. Jake LaTurner, a Kansas Republican whose swift rise through the political ranks began when he was elected to the state Senate at the age of 24, is the latest member of the House to announce that he won’t seek reelection.

LaTurner, who at 36 is the third-youngest Republican in the House, said in a statement Thursday that ...Read more

Georgians claimed more than $109 million in deductions for 'unborn dependents'

ATLANTA — More than 36,000 Georgians used a new “unborn dependents” deduction in 2022, lowering their taxable income by about $109 million, state officials say.

The new deduction is the result of Georgia’s 2019 abortion law, which allows expectant parents to claim an embryo or fetus as a dependent on their taxes. Georgia is the only ...Read more

Two jurors, one too frightened to serve, excused from Trump hush money trial

NEW YORK — Two jurors in the Donald Trump hush money trial were excused Thursday, one after telling the court she was too scared and intimidated to serve, as prosecutors renewed their request to hold Trump in criminal contempt over alleged gag order violations.

The first juror, one of seven initially chosen to serve on the case, told Judge ...Read more

Popular Stories

- 5 years after the the Mueller Report into Russian meddling in the 2016 US election on behalf of Trump: 4 essential reads

- States want to make it harder for health insurers to deny care, but firms might evade enforcement

- Health workers may face rude awakening with $25 minimum wage law

- Juror too frightened to serve excused from Trump hush money trial

- 'Shame on them': How police fumbled the case of gymnastics coach accused of sex abuse