Current News

/ArcaMax

Nonprofits take a hit in House earmark rules

WASHINGTON — House appropriators have made it more difficult for members to secure fiscal 2025 earmarks for some social services programs in their districts, according to new guidance Appropriations Chairman Tom Cole, R-Okla., announced Thursday.

Nonprofits are now blocked from the Department of Housing and Urban Development’s Economic ...Read more

Supreme Court's conservatives lean in favor of limited immunity for Trump as an ex-president

WASHINGTON — The Supreme Court’s conservative justices said Thursday they agree a former president should be shielded from prosecution for his truly official acts while in office, but not for private schemes that would give him personal gain.

They also suggested the case against former President Trump will have to be sent back to the lower...Read more

Biden administration aims to speed up the demise of coal-fired power plants

Burning coal to generate electricity is rapidly declining in the United States.

President Joe Biden’s administration moved Thursday to speed up the demise of the climate-changing, lung-damaging fossil fuel while attempting to ease the transition to cleaner sources of energy.

A suite of new regulations adopted by the U.S. Environmental ...Read more

Haiti Prime Minister Henry resigns ahead of ceremony to install new presidential council

Haiti Prime Minister Ariel Henry and his cabinet officially resigned on Thursday, indicating he will not stay around for the transition to a new era of governance. The decision leaves a political vacuum as the country continues to struggle with a worsening security and humanitarian crisis.

Henry announced the resignation in two letters to his ...Read more

Israel-Hamas war protesters clash with officers at Emory in Atlanta

ATLANTA — A group of people protesting the Israel-Hamas war and Atlanta’s planned public safety training center set up camp at Emory University’s quadrangle Thursday morning, prompting clashes with law enforcement and the detainment of several activists.

The encampment mirrored a growing number of college protests across the country.

In ...Read more

'Boy Kills World' review: A midnight movie not worth staying up for

Hi kids, do you like violence?

"Boy Kills World" is a bloody action thriller revenge comedy built for hyperactive, video game addled 12-year-old boys who think that blood and punching and Uzis spraying bullets while being held sideways are so, so awesome and the pinnacle of this thing we call life. Maybe some of them will see this movie and ...Read more

NYPD chief blasts AOC criticisms of response to Columbia University pro-Gaza encampment

NEW YORK — An NYPD chief blasted Rep. Alexandria Ocasio-Cortez Wednesday over her criticisms of police treatment of Columbia University pro-Palestine protesters who were temporarily cleared out of their encampment.

Ocasio-Cortez slammed Columbia’s decision to call on the NYPD to clear out the protesters.

“Not only did Columbia make the ...Read more

Key Bridge collapse: First large ship leaves Port of Baltimore using deeper temporary channel

BALTIMORE — The first of 11 ships trapped for a month behind the wreckage of the Francis Scott Key Bridge left the Port of Baltimore Thursday morning using an alternate shipping channel that opened less than two hours earlier.

Balsa 94, a cargo ship, sailed just before 10 a.m. with the help of two tugboats, passing chunks of the fallen steel ...Read more

New Jersey couple guilty of coercing undocumented immigrants into forced labor

NEW JERSEY — A New Jersey couple has been convicted of luring two women, both of them undocumented immigrants, to the United States and then forcing them to perform domestic labor and childcare, officials announced.

Bolaji Bolarinwa was found guilty of two counts of forced labor, one count of alien harboring for financial gain, and two counts...Read more

David Pecker set to return to witness stand as Trump's hush money trial resumes

NEW YORK — Former National Enquirer David Pecker is slated to return to the stand Thursday at Donald Trump’s Manhattan Supreme Court hush money trial — where the jurors are expected to hunker down for their first full day of testimony.

While lawyers for the former president argue before the U.S. Supreme Court in an attempt to get him out ...Read more

Migrant services groups call San Diego County for 'seat at the table' in deciding how to spend federal funds

SAN DIEGO — Local migrant services groups are urging San Diego County leaders to collaborate with those working directly with migrants on the ground before deciding how to spend its recent $19.6 million allocation from the federal government.

The grant is part of the Federal Emergency Management Agency's Shelter and Services Program, or SSP, ...Read more

Boston police arrest 108 at Emerson College pro-Palestinian tent encampment

BOSTON — Boston police arrested 108 pro-Palestinian protesters at the Emerson College encampment early today in a showdown over setting up tents on a public way.

BPD reports four officers were injured, three “minor” and one with more serious injuries. “No protesters in custody have reported injuries at this time,” police told the ...Read more

Israel prepares forces as conflict with Hezbollah intensifies

Israel is stepping up preparations for a potential all-out war with Hezbollah, as the risk of a devastating new phase in the country’s conflict with Iran and its proxy militias grows more acute.

Israeli forces have been exchanging cross-border fire with the Lebanon-based group almost daily since the start of the campaign against Hamas in ...Read more

Harvey Weinstein NYC rape conviction overturned by appeals court

NEW YORK — In a bombshell ruling Thursday morning, the New York state Court of Appeals has overturned fallen movie mogul Harvey Weinstein’s Manhattan rape and sex crime conviction.

The 4-3 ruling reverses a Manhattan Supreme Court jury’s 2020 verdict that Weinstein was guilty of rape for an attack on aspiring actress Jessica Mann at the ...Read more

Trump infers campus protests worse than Charlottesville rally where white supremacist killed protestor

Former President Donald Trump has downplayed the 2017 white nationalist rally in Charlottesville, Virginia where a counter-protester was killed by right-wing extremists.

Trump said the violent Unite the Right rally was “a peanut” compared to the pro-Palestinian protests sweeping college campuses since Israel invaded Gaza in retaliation for ...Read more

Harvey Weinstein rape conviction overturned by NY Court of Appeals

In a dramatic reversal of the nation's landmark #MeToo trial, a New York appeals court on Thursday overturned the sex assault conviction of movie mogul Harvey Weinstein, citing errors by the trial judge.

The state appeals court found, in a 4-3 decision, that the judge who presided over Weinstein's 2017 trial prejudiced the disgraced Hollywood ...Read more

Scientists confine, study Chinook at restored Snoqualmie River habitat

FALL CITY, Wash. — In newly restored river channels on the Snoqualmie, baby Chinook salmon are confined in 19 enclosures about the size of large suitcases as they munch on little crustaceans and invertebrate insects floating or swimming by.

What's in the salmon's stomachs, tracked by scientists, could hold clues about the species' survival.

...Read more

Spain's Sanchez threatens to quit. What are his options?

Pedro Sanchez’s decision to take several days to think about his future as Spain’s prime minister has left the euro-zone’s fourth-largest economy shrouded in political uncertainty.

The 52-year-old Socialist leader surprised even his closest allies on Wednesday when he said he was considering his position after a judge started an ...Read more

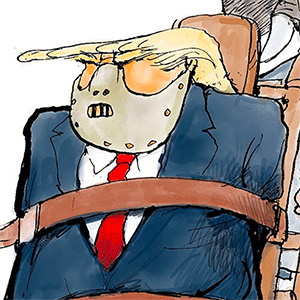

Will Supreme Court make Trump immune from Jan. 6 prosecution?

The Supreme Court on Thursday will hear former President Trump's claim that he is entirely immune from prosecution for all of his "official acts" during his time in the White House, including his effort to overturn his loss in the 2020 election.

Trump's claim of absolute immunity has been derided by legal experts and rejected by a federal trial...Read more

Key Bridge collapse: Deeper channel opens Thursday, allowing ships to leave Port of Baltimore

BALTIMORE — Ships trapped for a month behind the wreckage of the Francis Scott Key Bridge will be given a chance to leave the Port of Baltimore using an alternate shipping channel that opens Thursday morning.

The 35-foot channel will be the deepest yet of four temporary, alternate routes in and out of the port. But the new Fort McHenry ...Read more

Popular Stories

- Arizona’s 1864 abortion law was made in a women’s rights desert – here’s what life was like then

- After 25 years of selling tamales in Chicago, an undocumented immigrant mother returns to Mexico without her family

- SC has a teacher shortage. But teachers who leave can be blackballed from coming back

- He thinks his wife died in an understaffed hospital. Now he's trying to change the industry

- Holdout states consider expanding Medicaid -- with work requirements