Current News

/ArcaMax

Donald Payne Jr., who filled father's seat in the House, dies at 65

WASHINGTON — Rep. Donald M. Payne Jr., a former Newark, New Jersey, city council president who followed his trailblazing father to Congress, has died at age 65, New Jersey Gov. Phil Murphy announced Wednesday.

“With his signature bowtie, big heart and tenacious spirit, Donald embodied the very best of public service,” Murphy said in a ...Read more

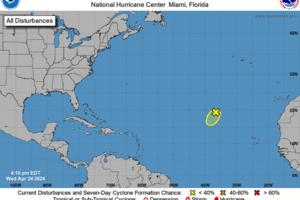

Hurricane center watching blip in Atlantic. No threat but hints at busy season ahead

MIAMI — The National Hurricane Center is already watching something in the Atlantic, and it’s only April.

The low-pressure area in question is a thousand miles away from inhabited land and expected to dissolve in the next few days, but it’s also a reminder that the upcoming hurricane season is poised to be an active one.

The season ...Read more

Gov. Gavin Newsom sent CHP officers to fight crime in Oakland. Now he's sending them to Bakersfield

Gov. Gavin Newsom announced Wednesday that he's sending California Highway Patrol officers to Bakersfield, an expansion of a law enforcement campaign launched earlier this year with an effort to tamp down crime in hard-hit California cities.

Kern County, home to Bakersfield, has higher rates of violent and property crime and more arrests ...Read more

Universal Studios tram riders were seriously injured in crash, lawyer says

LOS ANGELES — A passenger on a Universal Studios tram car that crashed into a guardrail on Saturday estimates the ride reached speeds up to 20 to 25 mph after the driver apparently lost control of the tram, which is much faster than the usual slow pace of the attraction, according to the man's attorney.

Fifteen passengers aboard the tram ...Read more

After complaints, National Institutes of Health launches review of Havana Syndrome study

A review board at the National Institutes of Health is conducting an internal investigation of a study about Havana Syndrome that did not find brain damage in patients, following complaints from participants and questions from Congress about newly reported information suggesting Russia might be behind directed energy attacks against U.S. ...Read more

Students shut down Cal Poly Humboldt campus to support Gaza ceasefire, divestment from Israel

After a violent clash with campus and local police Monday night, students at California State Polytechnic University, Humboldt have taken over a campus administration building and barricaded themselves inside, demanding that the university sever ties with Israel and any companies that support “the Zionist entity.”

Cal Poly Humboldt joins ...Read more

Vice Lord gang members convicted of racketeering in latest crackdown by feds in Detroit

DETROIT — Three members of the Almighty Vice Lord Nation were convicted of federal racketeering charges Wednesday, the latest in a years-long prosecution of a violent street gangs blamed for murder, drugs and other crimes in Detroit.

The jury verdicts followed a seven-week trial in federal court in Detroit almost three years after federal ...Read more

Mayor Adams' budget plan restores NYPD funding but keeps $58 million cut to city libraries

NEW YORK — Mayor Eric Adams’ latest city budget proposal would pump more than $62 million into hiring new NYPD officers — but keep in place a similarly sized spending cut to New York’s public library systems that their leaders say could deal an existential blow to their branches’ ability to operate.

The executive budget for the 2025 ...Read more

South Carolina police chief, 9 others arrested in county prostitution sting

Police in Horry County, South Carolina, have arrested 10 individuals, including the police chief of the town of Atlantic Beach, in an undercover prostitution operation, authorities said Wednesday.

The arrests followed a multi-agency sting at a hotel in the Myrtle Beach section of Horry County late on Tuesday.

Myrtle Beach, a resort city on ...Read more

Supreme Court sounds wary of Idaho's ban on emergency abortions for women whose health is in danger

WASHINGTON — The Supreme Court justices voiced doubt Wednesday about a strict Idaho law that would make it a crime for doctors to perform an abortion even for a woman who arrives at a hospital suffering from a serious, but not life-threatening, medical emergency.

Solicitor Gen. Elizabeth B. Prelogar, representing the Biden administration, ...Read more

Michigan prosecutor issues first charges under new safe storage law after boy, 8, shoots himself in head

WARREN, Mich. — Warren police and the Macomb County prosecutor on Wednesday implored gun owners to secure their firearms after announcing charges against the father of an 8-year-old who shot himself in the head in Warren last week, the first time a parent in the county has been charged under Michigan's new safe storage law.

Prosecutor Peter ...Read more

Prime Minister Pedro Sanchez threatens to quit, putting Spain on course for elections

MADRID, Spain — Prime Minister Pedro Sanchez announced that he may resign over right-wing attacks against him and his wife, a move that would push Spain into unchartered political territory and raise the possibility of a new general election.

Sanchez, 52, canceled his public appearances through the weekend and said he’d reflect on the ...Read more

LA Metro declares emergency over attacks on bus operators

LOS ANGELES — The stabbing of a bus driver in Willowbrook this month amid a spate of increasingly violent assaults on public transit operators prompted transit officials this week to declare an emergency to speed up the building of enclosed protective barriers for drivers.

"These incidents have occurred with no prompting or warning and have ...Read more

Gilgo Beach serial slayings investigators probe woods 50 miles away, report says

NEW YORK — Detectives investigating Long Island’s Gilgo Beach serial slayings have launched a painstaking search in a thatch of woods nearly 50 miles from where the victims’ bodies were discovered, according to reports.

The search, which is being conducted off the Long Island Expressway near Exit 70 in Manorville, is part of the Gilgo ...Read more

House Speaker Johnson calls for Columbia University president Shafik resignation ahead of campus visit

NEW YORK — U.S. House Speaker Mike Johnson on Wednesday called on Columbia University President Minouche Shafik to resign over her handling of the Gaza protests ahead of an afternoon campus visit with Jewish students, who say they feel unsafe amid campus unrest.

“President Shafik has shown to be a very weak and inept leader,” Johnson said...Read more

David Pecker's bombshell testimony at hush money trial detailed media manipulation that helped Trump win

NEW YORK — Publishing honcho David Pecker’s testimony this week at Donald Trump’s Manhattan trial opened a rare window on an unholy alliance that helped propel Trump into the Oval Office and spawned a vortex of unflattering stories smearing his political opponents and manipulating news cycles to divert the attention of the American ...Read more

The law is 'clear,' Idaho AG Labrador says. Supreme Court hears case on abortion ban

WASHINGTON — Outside the front steps of the U.S. Supreme Court on Wednesday morning, anti-abortion groups and abortion rights advocates battled to make their stances known, each wielding signs, stickers and blaring PA systems.

Inside the court’s cool marble walls, the tension over abortion access — specifically whether Idaho can enforce ...Read more

Loose military horses stampede through central London

Five military horses, including one that appeared to be covered in blood, stomped through central London Wednesday, where they ran into a double-decker bus, a taxi and other vehicles, according to the BBC.

The spooked animals reportedly got loose when building materials were dropped next to them during a rehearsal for The King’s Birthday ...Read more

Want to lower your dementia risk? Becoming a teacher is a good start

From your 30s to well into your 60s, a new study proposes working a mentally challenging job can pay off in more ways than one. It can even help maintain your cognitive health while preventing dementia later in life.

“Our results show the value of having an occupation that requires more complex thinking as a way to maintain memory and ...Read more

Hamas releases video of American-Israeli hostage Hersh Goldberg-Polin

Hamas released Wednesday a propaganda/proof of life video of American-Israeli hostage Hersh Goldberg-Polin.

The 24-year-old was one of the hundreds of people taken hostage in Hamas’ Oct. 7 attack on Israel. He’s one of 133 hostages remaining in Gaza, though dozens of them are believed to be dead.

In the heavily edited video, which is also ...Read more

Popular Stories

- Senate approves nearly $61B of Ukraine foreign aid − here’s why it helps the US to keep funding Ukraine

- Climate change supercharged a heat dome, intensifying 2021 fire season, study finds

- Gender-nonconforming ancient Romans found refuge in community dedicated to goddess Cybele

- Illinois residents encouraged to destroy the eggs of invasive insects to slow spread

- JFK Airport parking lot to become biggest solar array in New York