Current News

/ArcaMax

Crew suspected of taking $250,000 in Scratchers from 44 stores arrested by sheriff's department

LOS ANGELES — Los Angeles County Sheriff's detectives investigating a series of strong-arm robberies during which thousands of California Lottery Scratchers games were stolen from convenience stores caught a break last week.

On April 11, detectives spotted a vehicle linked to 44 robberies over a nine-week stretch parked outside a 7-Eleven ...Read more

Biden administration updates campus protections for LGBTQ students, assault victims

WASHINGTON — The Biden administration on Friday finalized new rules designed to bolster legal protections at colleges and universities for LGBTQ+ and pregnant students and victims of sexual misconduct.

The new rules do not address the politically contentious issue of transgender athletes competing on women’s sports teams, however. Last year...Read more

Get ready for one of the busiest Atlantic hurricane seasons on record, forecasters say

PHILADELPHIA — The 2024 Atlantic hurricane season is likely to be destructive and costly and has the potential to be one of the busiest on record.

That's the consensus of several major forecasting services, all of which point to conditions in the tropical Pacific and in the Atlantic hurricane-formation zone that are ripe for a tropical-storm ...Read more

Kemp on Medicaid expansion in 2025: 'I'm in the no camp.'

ATHENS – Gov. Brian Kemp said he opposes an effort to expand Medicaid next year, even as a growing number of Republicans say they’re open to a debate on allowing Georgia to join the 40 other states that have boosted their programs for low-income residents.

The governor told Politically Georgia during a live event Thursday that he’s ...Read more

Chicago Public Schools launches a new, 'more equitable' funding model

CHICAGO — While legislators in Springfield consider a bill that would prevent Chicago Public Schools from closing schools or making changes to its admissions policies through 2027, district officials have begun finalizing a budget they claim will benefit all of the district’s schools – neighborhood and selective enrollment – in the ...Read more

Pregnancy complications linked to risk of early death, even decades later

From gestational diabetes to preeclampsia, pregnancy complications may be associated with a woman’s risk of early death — even decades later.

“Adverse pregnancy outcomes may lead to small physiologic changes that are initially hard to detect, such as inflammation or other abnormalities in small blood vessels,” Dr. Casey Crump, a ...Read more

Rule for emergency aid bill adopted with Democratic support

WASHINGTON — The House adopted a rule Friday to take up a $95.3 billion aid package for Ukraine, Israel and Taiwan, in a bipartisan show of support that likely paves the way for passage Saturday.

With scores of Republicans opposed to Ukraine aid and furious that a border security measure was left on the sidelines, Democrats took the unusual ...Read more

Trump back in NYC court for hush money trial, slams 'unfair' gag order

Trump back at court, complains gag order is ‘unfair’

NEW YORK — Jury selection at Donald Trump’s historic hush money trial is expected to enter the home stretch Friday, with only five alternates to be seated before prosecutors make their case against the former president to a panel of his peers.

Trump returned to the lower Manhattan ...Read more

Newsom offers a compromise to protect indoor workers from heat

SACRAMENTO, Calif. — Gov. Gavin Newsom’s administration has compromised on long-sought rules that would protect indoor workers from extreme heat, saying tens of thousands of prison and jail employees — and prisoners — would have to wait for relief.

The deal comes a month after the administration unexpectedly rejected sweeping heat ...Read more

25 years later, a Columbine teacher reflects on why she stayed: “We take care of each other”

DENVER — Twenty-five years ago, Michelle DiManna sat in the math office at Columbine High School grading papers and talking to a colleague when she heard students screaming in terror.

Two heavily armed shooters had entered the Jefferson County school late in the morning on April 20, 1999, and proceeded to kill 12 of their classmates and a ...Read more

Rule for debate on war supplemental heads to House floor

WASHINGTON — The House Rules Committee approved a rule late Thursday for consideration of a $95.3 billion foreign aid package in a rare bipartisan vote that signaled solid support for the measure despite considerable GOP opposition.

The committee voted 9-3 for the rule setting terms for floor consideration of the long-stalled aid package, ...Read more

Colorado “assault” weapons ban faces likely key vote in Senate from father of mass shooting victim

The proposed ban on the sale, transfer and manufacturing of many high-powered, semi-automatic guns in Colorado will face an uphill fight in the state Senate after clearing the state House for the first time.

The measure, House Bill 1292, would ban guns referred to as “assault” weapons by its Democratic sponsors. It now heads to a Senate ...Read more

'Help me, help me': Metro bus driver stabbed, reviving fears about safety

LOS ANGELES — A video circulating on social media captured the moments a bus driver was stabbed Saturday night by a passenger in Willowbrook as other passengers watched.

The driver survived and is recovering at home, but the incident heightens concern about the safety of Metro's bus drivers and passengers. The attack came less 24 hours after ...Read more

Wild turkey numbers are falling in some parts of the US – the main reason may be habitat loss

Birdsong is a welcome sign of spring, but robins and cardinals aren’t the only birds showing off for breeding season. In many parts of North America, you’re likely to encounter male wild turkeys, puffed up like beach balls and with their tails fanned out, aggressively strutting through woods and parks or stopping traffic on your street....Read more

Getting a good night’s rest is vital for neurodiverse children – pediatric sleep experts explain why

Most of us are all too familiar with the consequences of a poor night’s sleep – be it interrupted sleep or simply too little of it. If you’re a parent with kids at home, it often leaves you and your children on edge.

Children with neurodiverse conditions, such as autism and attention-deficit/hyperactivity disorder, or ADHD, are ...Read more

Caring for older Americans’ teeth and gums is essential, but Medicare generally doesn’t cover that cost

C. Everett Koop, the avuncular doctor with a fluffy white beard who served as the U.S. surgeon general during the Reagan administration, was famous for his work as an innovative pediatric surgeon and the attention he paid to the HIV-AIDS crisis.

As dentistry scholars, we believe Koop also deserves credit for something else. To help ...Read more

South Korean President Yoon faces foreign policy challenges after the National Assembly election

South Korea’s parliamentary election of April 10, 2024, was widely seen as a referendum on President Yoon Suk Yeol’s first two years in office.

That being the case, the nation collectively expressed its strong disapproval.

With a relatively high turnout of 67%, voters handed Yoon’s conservative People’s Power Party ...Read more

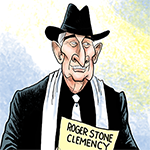

How Trump is using courtroom machinations to his political advantage

The second week is wrapping up in former President Donald Trump’s first criminal trial on charges from the state of New York related to paying hush money to an adult film star. So far, the jury has been selected, but no other proceedings have begun.

The Conversation U.S. interviewed Tim Bakken, a former New York prosecutor and now a...Read more

Are tomorrow’s engineers ready to face AI’s ethical challenges?

A chatbot turns hostile. A test version of a Roomba vacuum collects images of users in private situations. A Black woman is falsely identified as a suspect on the basis of facial recognition software, which tends to be less accurate at identifying women and people of color.

These incidents are not just glitches, but examples of more ...Read more

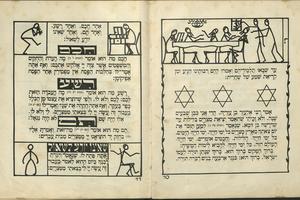

From sumptuous engravings to stick-figure sketches, Passover Haggadahs − and their art − have been evolving for centuries

The Jewish festival of Passover recalls the biblical story of the Israelites enslaved by Egypt and their miraculous escape. During a ritual feast known as a Seder, families celebrate this ancient story of deliverance, with each new generation reminded to never take freedom for granted.

Every year, a written guide known as a “...Read more

Popular Stories

- How Trump is using courtroom machinations to his political advantage

- Wild turkey numbers are falling in some parts of the US – the main reason may be habitat loss

- Caring for older Americans’ teeth and gums is essential, but Medicare generally doesn’t cover that cost

- Getting a good night’s rest is vital for neurodiverse children – pediatric sleep experts explain why

- 'I live in constant fear': Fraternity suspended after UC Davis student alleges hazing