Current News

/ArcaMax

Illinois residents encouraged to destroy the eggs of invasive insects to slow spread

CHICAGO — While Chicagoans were alarmed to learn the spotted lanternfly had been found in Illinois last year, experts say spring is the time to take action against that insect — as well as another damaging invasive species that has made far more inroads and gotten less attention.

The spongy moth, formerly known as the gypsy moth, has been ...Read more

Steelhead trout, once thriving in Southern California, are declared endangered

Southern California’s rivers and creeks once teemed with large, silvery fish that arrived from the ocean and swam upstream to spawn. But today, these fish are seldom seen.

Southern California steelhead trout have been pushed to the brink of extinction as their river habitats have been altered by development and fragmented by barriers and dams...Read more

Commentary: Christian nationalism is a grave threat to America

My father, who served as a Navy officer in the South Pacific, shared fascinating World War II stories with me. With ensuing history classes, I became troubled by America’s slow response to Hitler’s atrocities in Europe and incredulous that Christians in Germany blindly followed their deranged dictator.

While pursuing a master of divinity ...Read more

Climate change supercharged a heat dome, intensifying 2021 fire season, study finds

As a massive heat dome lingered over the Pacific Northwest three years ago, swaths of North America simmered— and then burned. Wildfires charred more than 18.5 million acres across the continent, with the most land burned in Canada and California.

A new study has revealed the extent to which human-caused climate change intensified the ...Read more

Shelter dollars in Mass. 'close to running out' as funding bill sits on Beacon Hill, Gov. Healey says

BOSTON — A panel of lawmakers tasked with delivering a compromise on a spending bill that includes hundreds of millions for the state-funded shelter system appears no closer to a deal as the cash left to pay for services dwindles.

Two top Beacon Hill budget writers are privately hashing out the differences between legislation that taps ...Read more

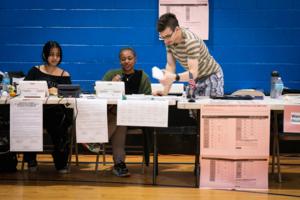

On a perfect day for voting, the Pennsylvania primary generates a 'super-low turnout'

PHILADELPHIA — A primary election day that was wall-to-wall splendid around here with unimpeded sun and a generous ration of April warmth was absolutely perfect for voting. And evidently for not voting.

With nominees already essentially chosen for president — and not everyone is happy with them — and U.S. Senate and a general absence of ...Read more

Aid finally set to flow as Senate clears $95.3 billion emergency bill

WASHINGTON — The Senate cleared a war funding package Tuesday night for President Joe Biden’s certain signature, capping a six-month struggle over Ukraine aid that divided GOP lawmakers, delayed Western weapons deliveries and gave Russia some breathing room in a military offensive against its neighbor.

The 79-18 vote to aid Ukraine, Israel ...Read more

Tensions grow at California universities as Gaza protests roil campuses from Berkeley to New York

LOS ANGELES — Officials shut down the campus of Cal Poly Humboldt on Monday night after masked pro-Palestinian protesters occupied an administrative building and barricaded the entrance as Gaza-related demonstrations roiled campuses across the nation.

Three students were arrested after law enforcement officers wearing helmets and riot shields...Read more

Plan to kill Catalina Island deer using sharpshooters in copters is opposed by LA County

LOS ANGELES — A plan to kill all the mule deer on Catalina Island using aerial sharpshooters from helicopters was strongly opposed by the Los Angeles County Board of Supervisors on Tuesday.

The controversial program as proposed by the Catalina Island Conservancy aims to eradicate up to 2,000 deer on the island that the conservancy says are ...Read more

Billboard company dumps racist, antisemitic images displayed in Michigan, apologizes

A billboard company has removed three billboards in Michigan and is apologizing after being accused of displaying images of Hitler and a racist message on roadside displays.

The move came after an unidentified user posted images of the billboards to an X account titled "White Lives Matter Michigan" at about 3 p.m. Saturday.

Two of the ...Read more

JFK Airport parking lot to become biggest solar array in New York

NEW YORK — The future is looking sunny for Kennedy Airport’s long-term parking lot No. 9.

Construction began Tuesday on a solar array meant to cover some 21 acres of the lot while maintaining the car park beneath.

“If that sounds big, it is,” said Rick Cotton, executive director of the Port Authority of New York and New Jersey.

“It ...Read more

Penn leaders plan 'listening session' as campus unrest escalates nationally over Gaza-Israel conflict

The interim president and provost of the University of Pennsylvania will host a “community listening session” on campus Thursday as encampments and protests over Israel’s treatment of Gaza have surfaced on college campuses elsewhere, resulting in arrests.

“Our campus is deeply impacted by external events, as the past months have ...Read more

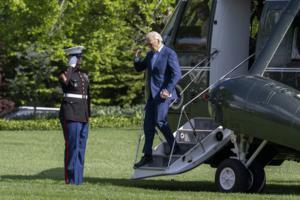

Biden's new chopper is demoted after scorching White House lawn

WASHINGTON — The new presidential helicopter has been demoted to backup duty because Lockheed Martin Corp. still can’t figure out how to keep it from scorching the White House’s South Lawn.

The VH-92 Patriot is landing only on paved runways for now, flying missions with White House officials or Secret Service staff instead of carrying ...Read more

Trump faces potential punishment for violating gag order in hush money trial

NEW YORK — During a devastating day for Donald Trump at his Manhattan hush money trial, a jury heard damning testimony from his decades-long ally David Pecker about a wide-ranging plan to hoist him out of obscurity and into the White House — and the presiding judge said his lead lawyer was “losing all credibility with the court.”

Before...Read more

The Bob Casey vs. Dave McCormick Senate matchup is officially set. Here's what each has to do to win

PHILADELPHIA — Democratic Sen. Bob Casey and Republican Dave McCormick won uncontested primaries in Pennsylvania Tuesday, launching what is expected to be one of the most expensive and politically consequential Senate contests in state history.

McCormick lost the 2022 Republican Senate primary to celebrity doctor Mehmet Oz by less than half a...Read more

Reintroduced gray wolf found dead in Larimer County, Colorado

DENVER — One of 10 gray wolves reintroduced to Colorado in December was found dead in Larimer County, the U.S. Fish and Wildlife Service confirmed.

Federal officials found out about the wolf on Thursday, agency spokesperson Joe Szuszwalak said in an email Tuesday night.

Initial evidence shows the wolf likely died of natural causes, ...Read more

News briefs

Flag fracas: Republicans ‘infuriated’ by show of support for Ukraine

WASHINGTON — Republicans were split roughly down the middle on Saturday’s vote to provide Ukraine with $60.8 billion in aid, but in the aftermath, Speaker Mike Johnson tried to project unity on at least one aspect of the ordeal.

“I just want to say simply what I ...Read more

Why Mayor Quinton Lucas says Kansas City doesn't need a sanctuary city resolution

KANSAS CITY, Mo. — Mayor Quinton Lucas clapped back Tuesday at local and state officials who distorted his remarks from last week welcoming migrants with legal work permits. His critics wrongly suggested, instead, that Lucas was promoting Kansas City as a place that would support an influx of people who entered the United States illegally.

�...Read more

Woman profanely accosts Mayor Adams on Miami flight

NEW YORK — In a video circulating on social media, a young woman accosted Mayor Eric Adams on a flight to Miami on Sunday, accusing him of “supporting the genocide in Palestine” and “partying all the time.”

Adams flew to Miami for the 2024 Concordia Americas Summit, a gathering of public officials and businesspeople from North America...Read more

9 more couples whose embryos were destroyed sue Newport Beach fertility clinic

ANAHEIM, California — Nine more couples have filed lawsuits against a Newport Beach fertility clinic, claiming their embryos were destroyed when an employee used hydrogen peroxide in an incubator instead of a sterile solution.

The couples join two others who filed lawsuits against Ovation Fertility last week, with one couple claiming they ...Read more

Popular Stories

- Relatives of kids killed at birthday party on Michigan woman charged: 'She took those babies from us'

- Tragedy narrowly averted on JFK runway by quick-thinking Swiss Air pilot

- Key Bridge collapse: Massive claw to clear remaining debris; deeper channel to open Thursday

- Over 20 family members of Key Bridge victims secure authorization to come to the US

- Lawmakers question FAA's resolve amid Boeing investigations