Current News

/ArcaMax

Austin talks with China counterpart as nations' ties improve

WASHINGTON — Secretary of Defense Lloyd Austin spoke with his Chinese counterpart as the two countries continue a push to stabilize ties.

Austin and Chinese Defense Minister Dong Jun discussed freedom of navigation in the South China Sea, “provocations” by North Korea and Russia’s war in Ukraine, according to a statement from the ...Read more

7 jurors chosen on 2nd day of Donald Trump's hush money trial

NEW YORK — Seven diverse New Yorkers were sworn in as jurors at Donald Trump’s hush money trial on Tuesday, securing their places in history as those who will weigh the first criminal charges ever brought against a former U.S. president.

Among the three women and four men chosen to serve were an oncology nurse who lives on the Upper East ...Read more

NYC Mayor Adams looks to tap ex-Giuliani aide Randy Mastro as administration's top lawyer, sources say

NEW YORK — New York City Mayor Eric Adams is looking to bring in Randy Mastro, a legal bulldog and veteran of the Giuliani administration, as his top lawyer, two sources told the New York Daily News on Tuesday.

Mastro would replace Sylvia Hinds-Radix as the city government’s corporation counsel. She is expected to step down from her post.

...Read more

A Connecticut river is named one of 'most endangered' in US. Here's why and what it means for residents

HARTFORD, Conn. — The Farmington River, “the top priority watershed in the state,” according to the state’s environmental agency, has been named one of America’s Most Endangered Rivers by the organization American Rivers.

The 47-mile river, which flows into the Connecticut River, “has the potential to be the biggest positive ...Read more

Massachusetts antisemitic incidents spike, New England hits record high: 'Simply stunning'

Antisemitic incidents across the region reportedly spiked last year, especially after the Hamas terror attacks as antisemitic acts soared to a record high.

The Anti-Defamation League recorded a total of 440 antisemitic incidents in Massachusetts last year, nearly triple the 152 reported incidents in 2022.

ADL’s annual Audit of Antisemitic ...Read more

Reports: Biden administration set to deny 200-mile Ambler mining road through Alaska wilderness

ANCHORAGE, Alaska — The U.S. Department of the Interior as early as this week is expected to issue an environmental report that recommends denying a permit needed to build a 200-mile access road to the Ambler mining district, according to national news reports on Tuesday.

The Alaska Industrial Development and Export Authority applied for the ...Read more

Bob Graham, former Florida governor and US senator, dies at 87

MIAMI — Bob Graham, the former Florida governor and U.S. senator who ushered in the state’s era of school-competency testing, crafted the foundation for its modern environmental policies and grappled with the mass influx of Cuban rafters in the early 1980s, died Tuesday night, according to his family. He was 87.

Graham left his fingerprints...Read more

Denver shutting down homeless encampment without shelter to offer for the first time in months

DENVER — City crews on Tuesday morning began shutting down a homeless encampment in Denver’s western Lincoln Park neighborhood due to public safety concerns including three overdose deaths and more than two dozen felony arrests there over the last few months, according to city officials.

Cleanup work at the encampment centered on the ...Read more

Next up is launch, as Boeing's Starliner takes trek to Cape Canaveral

The spacecraft has left the building.

Boeing’s CST-100 Starliner, set to take its first humans on board during the Crew Flight Test mission next month, was transported from Boeing’s Commercial Crew and Cargo Processing Facility at Kennedy Space Center in Florida on a 10-mile trip to Cape Canaveral Space Force Station.

It arrived at United ...Read more

Flights to Haiti won't be starting any time soon; visas to come to the US are on hold

Travelers who have been been waiting to fly in and out of Haiti’s volatile capital ever since international flights were canceled on March 4 shouldn’t make any travel plans before May. U.S.-based commercial carriers are still staying out of Port-au-Prince.

American Airlines, which had announced it would restart its daily service on ...Read more

US will sanction Iranian drone program after attack on Israel

WASHINGTON — The U.S. will impose new sanctions on Iran targeting the country’s missile and drone program following its weekend attack on Israel that threatened to push the Middle East into a wider conflict.

White House national security adviser Jake Sullivan said Tuesday that sanctions would be unveiled “in the coming days” and added ...Read more

US considers plea deal for Wikileaks founder Julian Assange

The U.S. government has submitted assurances that would pave the way for Wikileaks founder Julian Assange’s extradition while it considers a possible plea deal.

U.S. officials are considering a request from the Australian government to strike a deal with Assange under which he would enter a felony guilty plea, according to a person familiar ...Read more

Jailed students in Massachusetts sue Department of Elementary and Secondary Education over special ed access

A group of jailed men have sued the state Department of Elementary and Secondary Education over special education access for incarcerated students.

The three men between 18 and 22 on Tuesday filed the class-action lawsuit against DESE for reportedly not providing special ed instruction and services in houses of correction — which they’re ...Read more

Women at California prison dubbed the 'rape club' now worry where they'll be transferred

The sun was barely up at the Federal Correctional Institute in Dublin, California, but the prisoners knew there was something afoot.

The inmate workers still hadn’t left for their jobs that morning, and there were extra guards at the troubled federal facility in Northern California.

“We could tell these were not new officers,” Rhonda ...Read more

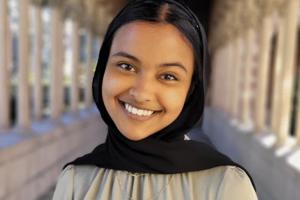

USC valedictorian barred from graduation speech: 'The university has betrayed me'

LOS ANGELES — When Asna Tabassum learned that the University of Southern California had barred her from speaking at next month’s graduation, she hadn’t yet planned what she would say in her remarks, beyond that she would convey a message of hope.

University leaders who announced the decision Monday, after pro-Israel groups criticized a ...Read more

Georgia prosecutors revive lawsuit challenging GOP-backed oversight panel

ATLANTA — A bipartisan group of Georgia district attorneys has revived its challenge to a Republican-backed commission created to discipline and oust state prosecutors after Gov. Brian Kemp signed a new version of the law.

The lawsuit filed Tuesday takes aim at the Prosecuting Attorneys Qualifications Commission, which was renewed by ...Read more

News briefs

Congress’ tech plate is full, with little time at the table

WASHINGTON — Congress has a full slate of technology policy challenges to resolve, ranging from artificial intelligence systems to data privacy and children’s online safety — with not much time on the congressional calendar before the November election intrudes.

In the absence...Read more

Washington state declares statewide drought emergency following poor snowpack

SEATTLE — People across the state held on to hope throughout the winter, keeping an eye to the forecasts and crossing their fingers for more snow.

Relief never really came.

Now, just two weeks since Washington's snowpack typically peaks, the state Department of Ecology officials declared a statewide drought emergency, bracing for a dry ...Read more

Army Corps denies permit appeal by Pebble mine developer

ANCHORAGE, Alaska — The U.S. Army Corps this week rejected a permitting appeal by Pebble Limited Partnership, another setback for the copper and gold prospect in Southwest Alaska.

The Corps in 2020 had denied a permit for the project. That led to an appeal by Pebble and an additional review by the Corps.

The Corps said in a statement Monday ...Read more

Maui fire officials defend response to deadly Lahaina blaze

Maui Fire Department officials defended their initial response to what became the deadliest fire in Hawaii history, saying they stayed at the scene of the Aug. 8 blaze until it was fully extinguished.

The officials commented at a press conference held Tuesday to discuss a report on their department’s involvement in the disaster. They said the...Read more

Popular Stories

- Chicago aldermen fighting gun violence deem ShotSpotter an 'invaluable tool' as council to consider bucking Mayor Johnson on the technology

- 'Every singe day': Judge tells woman to remember destroying family of pregnant teen she killed, then hands down 50-year sentence

- Motion to oust House Speaker Mike Johnson gets co-sponsor over Ukraine aid

- Passover is a Jewish holiday remembering sorrowful events and celebrating hope for a better future

- 'Every single day': Judge tells woman to remember destroying family of pregnant teen she killed, then hands down 50-year sentence