Business

/ArcaMax

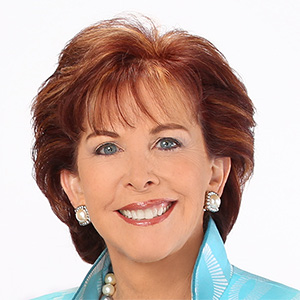

Terry Savage: Warning on credit repair and chasing rewards

In my recent column about credit card warnings, I explained the dangers of zero-interest cards, particularly those offered by retail stores. If you fail to pay the FULL balance off within the specified zero-rate time period, you can be charged a 30%+ rate for the entire amount, retroactively from the original date of purchase!

Even the zero-...Read more

Terry Savage: Credit Card 'Bewares'

Some of my best column ideas come from you, my readers. The example below was posted on my AskTerry blog at TerrySavage.com. It inspired me to do some digging, not only into this situation, but other credit card tricks that can be truly shocking if you’re unaware.

"Terry, I purchased furniture at The RoomPlace three years ago on a 36-month ...Read more

The pros and cons of reverse mortgages

For seniors who own their own home — fully paid off or with a small remaining mortgage — but need more income, a reverse mortgage can be the perfect solution. Or it can be a costly mistake. And you won’t know until you consider all the costs as well as your likely future housing needs.

Here are some key details on how reverse mortgages ...Read more

Terry Savage: Commissioner steps up to address Social Security horror stories

New Social Security Commissioner Martin O’Malley has just taken a major step to offer immediate relief to those facing clawbacks from his agency.

Economist Larry Kotlikoff and I detailed these horror stories on "60 Minutes" last November — and in our book "Social Security Horror Stories." Millions of Americans have been or are due to be ...Read more

Terry Savage: The dangers of debt

Let’s stop ignoring $1.3 trillion in credit card debt owed by millions of Americans. Perhaps including by you. Even if you stop buying, balances grow like a cancer, because the average annual interest rate on credit cards is 20.75%, according to Bankrate (many cards now charge 29% or higher). In most states, credit card rates are not subject ...Read more

Terry Savage: Tax filing ironies

Have you filed your 2023 income tax return yet? Millions already have. The rest of us are now officially procrastinators. But we’ll get it done. Except for the 125,000 high-income earners who did not even file tax returns going back to 2017 — and who owe roughly $100 billion in back taxes.

It boggles the mind. How did the IRS even find ...Read more

Terry Savage: A widow’s guide to financial recovery

On average, women live longer than men. It’s an actuarial fact known by every insurance company and financial planner. At age 65, the life expectancy of a woman is 20 years, while men at the same age have a life expectancy of 17 years.

So, it stands to reason that the 2020 Census Bureau reports that there were 11,271,000 widows in the United ...Read more

Terry Savage: Time-Sensitive Column Updates

Today's column focuses on two time-critical updates on recent columns. The first is for younger families who are seeking financial aid for college through the FAFSA form. The second is for seniors who want to rethink their Medicare Advantage programs. Time is running out for both!

Millions of students and their parents are still caught up in ...Read more

You can't plan a retirement without understanding longevity

Here’s a personal question: How long do you think you’ll live? Most people will roll their eyes, believing that only a higher power has the answer to that question. It’s an imponderable. Why bother asking, since it makes us so uncomfortable?

We know the longevity statistics, which tell us that a girl born today is predicted to live to age...Read more

Terry Savage: Insurers' losses to squeeze Advantage plans

Medicare Advantage is causing huge losses for insurers like Humana, which recently reported a surprising loss, attributed to higher than anticipated spending in Advantage plans. The company’s stock immediately fell 22% on Jan. 25 on the news, as the company disclosed their earnings would likely be less than half what had been widely expected. ...Read more

Terry Savage: Will rate cuts keep stocks soaring?

The good news is in the headlines. On the same day that the S&P 500 stock index hit all-time highs, consumer confidence (the University of Michigan’s consumer sentiment index) climbed dramatically to 78.8 from 69.7 in December. This is the second month in a row that the index has seen a strong gain, and the index is now at the highest level ...Read more