Business

/ArcaMax

Sony in talks to team with Apollo to bid for Paramount

Sony Pictures Entertainment is in talks to join Apollo Global Management in its $26 billion bid for Paramount Global — a partnership that would boost the private equity firm's efforts to wrangle the prize.

While the talks are preliminary, the two sides have been hashing out the contours of a deal that would have the Culver City, California-...Read more

Tesla co-founder JB Straubel has built an EV battery colossus

In the scrublands of western Nevada, Tesla co-founder JB Straubel stood on a bluff overlooking several acres of neatly stacked packs of used-up lithium-ion batteries, out of place against the puffs of sagebrush dotting the undulating hills. As if on cue, a giant tumbleweed rolled by. It was the last Friday of March, and Straubel had just struck ...Read more

Michael Hiltzik: California's salmon industry faces extinction -- not because of drought, but politics and government policies

Snapshots from an environmental and economic disaster:

Kenneth Brown, the owner of Bodega Tackle in Petaluma, California, reckons he has lost almost $450,000 in the last year.

"I haven't taken a paycheck in seven or eight months," he says. He has had to lay off all but one employee, leaving himself, his son and the one remaining worker to run ...Read more

Right-wing conservatives object to Vista's deal to sell Federal ammunition to Czech firm

More conservative lawmakers are putting pressure on Treasury Secretary Janet Yellen to quash a Czech company's bid for Minnesota-based Federal and other ammunition brands owned by Vista Outdoor.

Sen. John Kennedy of Louisiana became the latest Republican to send a letter to Yellen in her capacity of chair of the Committee of Foreign Investment ...Read more

How Ford's most profitable business is defying the EV slump

While malaise sets in across much of the electric vehicle market, there’s a corner that’s still going strong, where buyers like Chris Russo show little concern about high prices or range anxiety or spotty charging infrastructure.

The co-founder of Elite Home Care, a South Carolina-based company, bought his first EV more than two years ago �...Read more

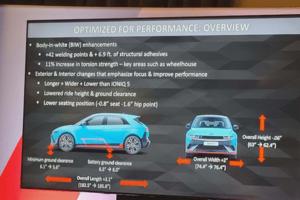

Auto review: Flat out in the Hyundai Ioniq 5 N electric track rat

LAGUNA SECA, California — Out of slow, 90-degree Turn 11 onto the Laguna Seca Raceway’s pit straight, my 2025 Hyundai Ioniq 5 N performance SUV instantly put down 545 pounds of torque and 601 horsepower to all four fat Pirelli P Zero performance tires. No downshift to second gear. No turbo lag. Just pure thrust. Zot! Seconds later, the EV ...Read more

Auto review: 2024 Lexus TX PHEV displays beauty and luxury

You heard it here first! As a Volvo fan myself, I don't see a lot of manufacturers that do it better, as the competition seems to always be chasing Volvo’s design, comfort and pricing. But with Lexus sharpening their pencil, we may have ourselves something here. I give you the 2024 Lexus TX550h+ Luxury.

This six-passenger hybrid SUV takes a ...Read more

Auto review: Two new Toyotas sure to satisfy your soul

Toyota has long been America’s favorite automaker, even if it hasn't always topped the sales charts. Certainly, it’s the world’s largest auto manufacturer, a spot once claimed by General Motors. So, when Toyota introduces two new models, it’s certainly big news. Better yet, along with the news came the chance to briefly experience both ...Read more

The O'Hare rebuild is mired in negotiations and potential changes. Here's how another airport finished construction

A few years before Chicago reached an agreement with the city’s airlines to overhaul O’Hare International Airport, New York officials jump-started a rebuild of LaGuardia Airport.

After years of discussion, planning and a design competition for the New York airport, in 2015 a development team got the go-ahead to begin the first piece of ...Read more

NYC storefront vacancies remain stuck at pandemic levels; lower Manhattan hit hard

Storefront vacancy rates in New York City have yet to recover from pandemic peaks, with Manhattan in particular struggling to bounce back, new city data show.

The issue made headlines during the pandemic, when retail storefronts on many major thoroughfares sat empty as businesses across the city shuttered. The issue was the focus of a City ...Read more

SFO strikes back against Oakland Airport with lawsuit over 'San Francisco Bay' name change

OAKLAND, California — San Francisco is suing Oakland over a controversial move to add “San Francisco Bay” to Oakland International Airport’s official name, marking the start of a possible legal war between the two cities.

The East Bay aviation complex — which, like its busier competitor to the west, abuts San Francisco Bay — is ...Read more

US existing-home sales decline as rates keep buyers sidelined

Sales of previously-owned homes in the U.S. fell in March from a one-year high, underscoring the lingering impact of high mortgage rates and elevated prices.

Contract closings decreased 4.3% from a month earlier to a 4.19 million annualized rate, according to National Association of Realtors data released Thursday. The pace was in line with ...Read more

Walgreens pharmacists' union to demonstrate outside 46 Chicago-area stores

A union representing Walgreens pharmacists plans to demonstrate outside of more than 46 local Walgreens stores over the next month to protest pay and working conditions.

The National Pharmacists Association-LIUNA, which says it represents 900 Chicago-area Walgreens pharmacists, plans to demonstrate outside two or three stores a day from now ...Read more

'This feels totally different': For 3rd time, VW workers mull joining UAW

CHATTANOOGA, Tennessee — Some are betting they will make history this week as Volkswagen AG workers vote on whether to join the United Auto Workers in this southern auto-producing state, where a right-to-work law is ingrained in its constitution.

Those pushing for unionization at the sprawling plant surrounded by the mountains of East ...Read more

Cargill to sell group of grain elevators to CHS Inc.

In a move that will enable the company to reinvest in its U.S. grain business, Minnesota-based Cargill is selling a group of elevators in five states to CHS Inc.

Cargill made the decision during a regular portfolio review, which the privately-held company routinely does "to ensure assets best fit our strategy to meet long term market demands," ...Read more

Sesame Street writers vote to strike if a new deal isn't reached Friday

Writers on the long-running kids’ show “Sesame Street” voted to strike if a new contract isn’t reached by Friday.

The Writers Guild of America East (WGAE) said 35 writers on the program “unanimously, with 100% participation” agreed to walk off the job should management fail to agree to a new collective bargaining agreement that’s ...Read more

Netflix adds 9.33 million customers, crushing Street forecasts

Netflix Inc. posted its best start to the year since 2020, attracting more new customers than anyone expected thanks to a strong slate of original programs and a crackdown on password sharing.

Netflix added 9.33 million customers in the first quarter of 2024, according to a statement Thursday, nearly doubling the 4.84 million average of ...Read more

Uber rolls out blue checkmark system for rider verification in 12 cities

Uber launched a pilot program Thursday in 12 cities around the U.S. to verify riders on the app for increased safety for drivers.

The new safety feature means riders using Uber will be verified on the app and have a blue checkmark badge added to their profile for drivers to see, according to a news release. Most accounts will be verified ...Read more

Disney, Universal report leg injuries, loss of consciousness on rides

Visitors at Walt Disney World and Universal Orlando experienced leg injuries, shortness of breath and loss of consciousness on rides at their theme parks in the first three months of 2024, a state report revealed Thursday.

The document listed eight guest injuries at Disney and two at Universal from January through March.

In January, a 63-year-...Read more

AG of Michigan to investigate $20M grant used by businesswoman to buy $4,500 coffee maker

LANSING, Mich. — Attorney General Dana Nessel's office has opened an investigation into a $20 million grant awarded to a Metro Detroit businesswoman that was used on expenses that included a $4,500 coffee maker, an $11,000 first-class plane ticket and $408,000 in salaries for two people over three months.

Nessel's office confirmed Wednesday ...Read more

Popular Stories

- False offers of cash subsidies used to 'capture' health insurance customers, lawsuit alleges

- The O'Hare rebuild is mired in negotiations and potential changes. Here's how another airport finished construction

- SFO strikes back against Oakland Airport with lawsuit over 'San Francisco Bay' name change

- California in a jam after borrowing billions to pay unemployment benefits

- Right-wing conservatives object to Vista's deal to sell Federal ammunition to Czech firm