Business

/ArcaMax

Cruise demand leaves pandemic in rearview with record passengers, more construction on tap

MIAMI BEACH — The COVID-19 pandemic drove the cruise industry to a standstill, but numbers released Tuesday signal the years of comeback are officially over with more expansion on tap.

More than 31.7 million passengers took cruises worldwide in 2023, said Kelly Craighead, Cruise Line International Association president and CEO, speaking at ...Read more

Powell signals rate-cut delay after run of inflation surprises

Federal Reserve Chair Jerome Powell signaled policymakers will wait longer than previously anticipated to cut interest rates following a series of surprisingly high inflation readings.

Powell pointed to the lack of additional progress made on inflation after the rapid decline seen at the end of last year, noting it will likely take more time ...Read more

Some Target Up & Up acne products subject of federal class action suit

Target is facing a class action lawsuit after a Connecticut lab reportedly found high amounts of the cancer-causing chemical benzene were generated by some of Target's Up & Up acne treatments and other popular skin care items.

The lawsuit states that had Target said on its labels there was benzene in its benzoyl peroxide (BPO) acne products and...Read more

How Amazon became the largest private EV charging operator in the US

Amazon’s Maple Valley, Washington, warehouse is built for speed. At night, big rigs pull up to one end to unload boxes and padded mailers – some after a short drive from a bigger warehouse down the road, others following a flight in the hold of a cargo plane. Waiting employees scan, sort and load them into rolling racks.

Before 7 a.m. each...Read more

Cyberattack could cost UnitedHealth Group up to $1.6B this year

UnitedHealth Group spent about $872 million during the first quarter responding to the cyberattack at its Change Healthcare division and expects full-year costs could reach $1.6 billion.

The numbers, released Tuesday in the health care giant's first quarter financial results, provide the fullest accounting so far of financial impacts from the ...Read more

LA 2028 Olympic committee parts ways with Salesforce, one of its top sponsors

There are four years remaining until the 2028 Summer Olympics in Los Angeles — lots of time to prepare for the international sports event — but local organizers appeared to take a step backward this week.

The privately-run LA28 committee announced in a brief statement that it has "decided to amicably part ways" with one of its biggest ...Read more

World Business Chicago names new CEO

There’s a new leader heading up Chicago’s business recruitment efforts.

Philip Clement, whose resume includes stints as global chief marketing officer for Johnson Controls and Aon, was named Tuesday as president and CEO of World Business Chicago, the city’s public-private economic development arm.

In his new role, Clement will be in ...Read more

Atrium Health shared patient data with Facebook, class-action lawsuit alleges

A class-action lawsuit filed in North Carolina accuses Atrium Health of allowing Facebook and Google to access patient information online to use in targeted ads.

The plaintiffs, identified only as North Carolina-resident J.S. and Michigan-citizen J.R., allege they received spam mail and Facebook ads related to their medical conditions after ...Read more

Accounting firms are prioritizing work-life balance as they face a 'human capital issue' -- even during tax season

Molly Kowal decided to become an accountant in part because she knew it would be a stable career. After graduating from college in 2021, she saw friends in other fields struggling to find work but knew she would be able to find a job.

But that doesn’t mean she’s willing to work into the wee hours during busy season.

“My generation is ...Read more

Small-business owners brace for uncertainty as $20 hourly fast-food wage takes effect

Justin Foronda is the type of creative, motivated, second-generation entrepreneur who should be able to thrive in Los Angeles.

Born and raised in Historic Filipinotown, Foronda opened Hifi Kitchen in 2019 and kept the doors open during the pandemic's economic disruptions through pure hustle.

Last year the 37-year-old staged a Filipino holiday ...Read more

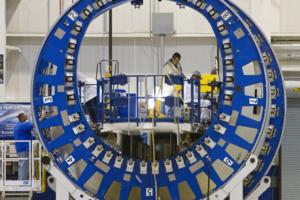

Boeing says no 787 safety risk after whistleblower raises troubling claims

NORTH CHARLESTON, South Carolina — At its 787 Dreamliner manufacturing complex in South Carolina on Monday, Boeing detailed an immense amount of analysis and testing it has done since the discovery in 2020 of small gaps at the fuselage joins on the jet.

Boeing has made meticulous, time-consuming changes to the way it manufactures the 787’s ...Read more

Justice Department preparing Ticketmaster antitrust lawsuit

The Justice Department may file an antitrust complaint as soon as next month aimed at forcing Live Nation Entertainment Inc. to spin off its Ticketmaster ticketing business, according to three people familiar with the matter.

The agency has been investigating the entertainment giant for years amid concerns Live Nation has illegally tied its ...Read more

MGM Resorts sues FTC, agency chair over cyberattack investigation

MGM Resorts International filed a lawsuit Monday against the Federal Trade Commission and its top officer, Chairwoman Lina M. Khan, claiming the agency violated the company’s Fifth Amendment right to due process while investigating a September cyberattack against the company.

In the four-count action, MGM also alleges the FTC failed to follow...Read more

US tax refunds declined 3.3% this year in run-up to deadline

Fewer U.S. taxpayers have received a refund this year in the run-up to tax day compared to 2023, signaling some consumer spending may be disrupted.

Data from the Internal Revenue Service showed that 66.8 million taxpayers were reimbursed through April 5 compared to 69.1 million through April 7 last year. That means that 3.3%, or roughly 2.3 ...Read more

California Supreme Court to hear appeal seeking to overturn new rooftop solar rules

A trio of environmental groups opposed to recent changes to the rules affecting the 1.8 million Californians who have installed rooftop solar on their homes and businesses will get their day before the state Supreme Court.

The high court has agreed to hear arguments by the Environmental Working Group, the Center for Biological Diversity and the...Read more

GM says it will move headquarters from RenCen to Hudson's site in 2025

DETROIT — General Motors Co. on Monday said it will move its global headquarters to the Hudson’s Detroit development next year as it works with billionaire mortgage mogul Dan Gilbert's real estate firm to redevelop the Renaissance Center, its current home a mile away.

GM CEO Mary Barra alongside Gilbert, Mayor Mike Duggan and Wayne County ...Read more

How the UAW is winning over new plants -- starting with Volkswagen

The United Auto Workers is on the cusp of a significant milestone in its audacious effort to grow by 150,000 people across 13 automakers, including Tesla Inc., BMW AG and Nissan Motor Co.

This week, a Volkswagen AG factory will vote on whether to become the only foreign commercial carmaker unionized in the US. It would also be the first vehicle...Read more

Atlanta's Hartsfield-Jackson remains world's busiest airport

Hartsfield-Jackson International has again been named the world’s busiest airport, handling more passengers than any other in 2023.

With 104.7 million passengers passing through last year, the Atlanta airport had more passengers than Dubai in the No. 2 spot with nearly 87 million passengers and Dallas/Fort Worth at No. 3 with 81.8 million ...Read more

How to save money at the pharmacy counter

Steve Wexler has experienced the trouble of finding affordable prescription drugs.

A few years ago, the 70-year-old Plymouth, Minnesota, resident opted to cut short his prescription for Eliquis, a popular blood thinner, rather than pay nearly $1,000 out-of-pocket for his final month on the medication.

Smart shopping can't always tame high ...Read more

Rainier Beer shortage has Seattle taps dry and fans frothing

It hasn't always been easy for Seattle fans of Rainier Beer.

There were the traumas of the 1970s, when the quintessential Seattle company was sold to the first in a string of out-of-state beer conglomerates.

Then Rainier's landmark brewery near Boeing Field was closed in 1999, and the actual brewing of the beer was outsourced — eventually to...Read more

Popular Stories

- Small-business owners brace for uncertainty as $20 hourly fast-food wage takes effect

- Accounting firms are prioritizing work-life balance as they face a 'human capital issue' -- even during tax season

- Boeing says no 787 safety risk after whistleblower raises troubling claims

- California Supreme Court to hear appeal seeking to overturn new rooftop solar rules

- MGM Resorts sues FTC, agency chair over cyberattack investigation