Business

/ArcaMax

NYC storefront vacancies remain stuck at pandemic levels; lower Manhattan hit hard

Storefront vacancy rates in New York City have yet to recover from pandemic peaks, with Manhattan in particular struggling to bounce back, new city data show.

The issue made headlines during the pandemic, when retail storefronts on many major thoroughfares sat empty as businesses across the city shuttered. The issue was the focus of a City ...Read more

SFO strikes back against Oakland Airport with lawsuit over 'San Francisco Bay' name change

OAKLAND, California — San Francisco is suing Oakland over a controversial move to add “San Francisco Bay” to Oakland International Airport’s official name, marking the start of a possible legal war between the two cities.

The East Bay aviation complex — which, like its busier competitor to the west, abuts San Francisco Bay — is ...Read more

US existing-home sales decline as rates keep buyers sidelined

Sales of previously-owned homes in the U.S. fell in March from a one-year high, underscoring the lingering impact of high mortgage rates and elevated prices.

Contract closings decreased 4.3% from a month earlier to a 4.19 million annualized rate, according to National Association of Realtors data released Thursday. The pace was in line with ...Read more

Walgreens pharmacists' union to demonstrate outside 46 Chicago-area stores

A union representing Walgreens pharmacists plans to demonstrate outside of more than 46 local Walgreens stores over the next month to protest pay and working conditions.

The National Pharmacists Association-LIUNA, which says it represents 900 Chicago-area Walgreens pharmacists, plans to demonstrate outside two or three stores a day from now ...Read more

'This feels totally different': For 3rd time, VW workers mull joining UAW

CHATTANOOGA, Tennessee — Some are betting they will make history this week as Volkswagen AG workers vote on whether to join the United Auto Workers in this southern auto-producing state, where a right-to-work law is ingrained in its constitution.

Those pushing for unionization at the sprawling plant surrounded by the mountains of East ...Read more

Cargill to sell group of grain elevators to CHS Inc.

In a move that will enable the company to reinvest in its U.S. grain business, Minnesota-based Cargill is selling a group of elevators in five states to CHS Inc.

Cargill made the decision during a regular portfolio review, which the privately-held company routinely does "to ensure assets best fit our strategy to meet long term market demands," ...Read more

Sesame Street writers vote to strike if a new deal isn't reached Friday

Writers on the long-running kids’ show “Sesame Street” voted to strike if a new contract isn’t reached by Friday.

The Writers Guild of America East (WGAE) said 35 writers on the program “unanimously, with 100% participation” agreed to walk off the job should management fail to agree to a new collective bargaining agreement that’s ...Read more

Netflix adds 9.33 million customers, crushing Street forecasts

Netflix Inc. posted its best start to the year since 2020, attracting more new customers than anyone expected thanks to a strong slate of original programs and a crackdown on password sharing.

Netflix added 9.33 million customers in the first quarter of 2024, according to a statement Thursday, nearly doubling the 4.84 million average of ...Read more

Uber rolls out blue checkmark system for rider verification in 12 cities

Uber launched a pilot program Thursday in 12 cities around the U.S. to verify riders on the app for increased safety for drivers.

The new safety feature means riders using Uber will be verified on the app and have a blue checkmark badge added to their profile for drivers to see, according to a news release. Most accounts will be verified ...Read more

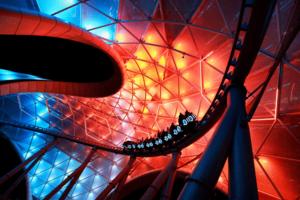

Disney, Universal report leg injuries, loss of consciousness on rides

Visitors at Walt Disney World and Universal Orlando experienced leg injuries, shortness of breath and loss of consciousness on rides at their theme parks in the first three months of 2024, a state report revealed Thursday.

The document listed eight guest injuries at Disney and two at Universal from January through March.

In January, a 63-year-...Read more

AG of Michigan to investigate $20M grant used by businesswoman to buy $4,500 coffee maker

LANSING, Mich. — Attorney General Dana Nessel's office has opened an investigation into a $20 million grant awarded to a Metro Detroit businesswoman that was used on expenses that included a $4,500 coffee maker, an $11,000 first-class plane ticket and $408,000 in salaries for two people over three months.

Nessel's office confirmed Wednesday ...Read more

Google fires 28 employees who protested Israel cloud contract

Google has terminated 28 employees after dozens of workers participated in sit-ins inside company offices earlier this week to protest the tech giant's work in Israel amid the war against Hamas in Gaza.

The protests, organized by the No Tech for Apartheid campaign, raised concerns about Google and Amazon's $1.2-billion cloud computing ...Read more

California in a jam after borrowing billions to pay unemployment benefits

California's massive budget deficit, coupled with the state's relatively high level of joblessness, has become a major barrier to reducing the billions of dollars of debt it has incurred to pay unemployment benefits.

The surge in unemployment brought on by the COVID-19 pandemic pushed the state's unemployment insurance trust into insolvency. ...Read more

Mercedes-Benz workers to vote on whether to join the UAW in May

Employees at Mercedes-Benz Group's assembly and battery plants outside Tuscaloosa, Alabama, will vote whether to join the United Auto Workers from May 13-17, the National Labor Relations Board said Thursday.

The election will be the Detroit-based union's second at a foreign-owned assembly plant following the launch of its $40 million organizing...Read more

Red state coal towns still power the West Coast. We can't just let them die

COLSTRIP, Montana — In the early morning light, it’s easy to mistake the towering gray mounds for an odd-looking mountain range — pale and dull and devoid of life, some pine trees and shrublands in the foreground with lazy blue skies extending up beyond the peaks.

But the mounds aren’t mountains.

They’re enormous piles of dirt, torn...Read more

Downtown LA is hurting. Frank Gehry thinks arts can lead a revival

With two major expansions of downtown Los Angeles cultural institutions in the works, Bunker Hill is primed to elevate its status as the region's leading arts center even as the area around it struggles with persistent homelessness and post-pandemic losses of office tenants.

Bunker Hill will soon have the largest concentration of buildings ...Read more

Real estate Q&A: How can I get my HOA to allow car covers?

Q: I recently moved and am now, for the first time, dealing with a homeowners association. I have a classic Cadillac that I used to keep covered at my previous residence. The rules in place at my new residence forbid car covers. Other nearby communities seem to allow covered cars, but not mine, so this rule was established by my association only...Read more

Media groups urge feds to investigate after Google limits California news in search results

Two journalism trade organizations representing thousands of publishers this week called on California Attorney General Rob Bonta, the U.S. Department of Justice and the Federal Trade Commission to investigate Google, after the tech giant announced Friday that it was pulling California news articles from its search platforms for some users.

...Read more

Michael Hiltzik: With his Truth Social stock, Trump may be laughing all the way to the bank -- but his investors have reason to weep

With their life savings, childrens' college funds and their own retirement prospects at stake, most people probably view investing in stocks as a serious business. Now and then, however, the markets produce comedy gold.

Hello, Trump Media & Technology Group.

The owner of Truth Social, a social media platform exclusively hitched to Donald Trump...Read more

Construction paused at VinFast's NC site as carmaker seeks a smaller footprint

Nearly nine months after VinFast broke ground on its planned $4 billion electric vehicle factory in North Carolina, construction at the Chatham County site has stalled while local officials await updated building plans from the Vietnamese carmaker.

Chatham County confirmed Tuesday what News & Observer drone footage makes clear: No significant ...Read more

Popular Stories

- California in a jam after borrowing billions to pay unemployment benefits

- False offers of cash subsidies used to 'capture' health insurance customers, lawsuit alleges

- Red state coal towns still power the West Coast. We can't just let them die

- Michael Hiltzik: With his Truth Social stock, Trump may be laughing all the way to the bank -- but his investors have reason to weep

- Construction paused at VinFast's NC site as carmaker seeks a smaller footprint