Business

/ArcaMax

Atrium Health shared patient data with Facebook, class-action lawsuit alleges

A class-action lawsuit filed in North Carolina accuses Atrium Health of allowing Facebook and Google to access patient information online to use in targeted ads.

The plaintiffs, identified only as North Carolina-resident J.S. and Michigan-citizen J.R., allege they received spam mail and Facebook ads related to their medical conditions after ...Read more

Accounting firms are prioritizing work-life balance as they face a 'human capital issue' -- even during tax season

Molly Kowal decided to become an accountant in part because she knew it would be a stable career. After graduating from college in 2021, she saw friends in other fields struggling to find work but knew she would be able to find a job.

But that doesn’t mean she’s willing to work into the wee hours during busy season.

“My generation is ...Read more

Small-business owners brace for uncertainty as $20 hourly fast-food wage takes effect

Justin Foronda is the type of creative, motivated, second-generation entrepreneur who should be able to thrive in Los Angeles.

Born and raised in Historic Filipinotown, Foronda opened Hifi Kitchen in 2019 and kept the doors open during the pandemic's economic disruptions through pure hustle.

Last year the 37-year-old staged a Filipino holiday ...Read more

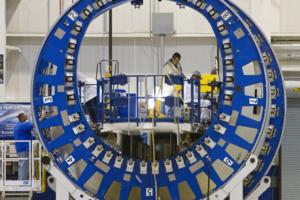

Boeing says no 787 safety risk after whistleblower raises troubling claims

NORTH CHARLESTON, South Carolina — At its 787 Dreamliner manufacturing complex in South Carolina on Monday, Boeing detailed an immense amount of analysis and testing it has done since the discovery in 2020 of small gaps at the fuselage joins on the jet.

Boeing has made meticulous, time-consuming changes to the way it manufactures the 787’s ...Read more

Justice Department preparing Ticketmaster antitrust lawsuit

The Justice Department may file an antitrust complaint as soon as next month aimed at forcing Live Nation Entertainment Inc. to spin off its Ticketmaster ticketing business, according to three people familiar with the matter.

The agency has been investigating the entertainment giant for years amid concerns Live Nation has illegally tied its ...Read more

MGM Resorts sues FTC, agency chair over cyberattack investigation

MGM Resorts International filed a lawsuit Monday against the Federal Trade Commission and its top officer, Chairwoman Lina M. Khan, claiming the agency violated the company’s Fifth Amendment right to due process while investigating a September cyberattack against the company.

In the four-count action, MGM also alleges the FTC failed to follow...Read more

US tax refunds declined 3.3% this year in run-up to deadline

Fewer U.S. taxpayers have received a refund this year in the run-up to tax day compared to 2023, signaling some consumer spending may be disrupted.

Data from the Internal Revenue Service showed that 66.8 million taxpayers were reimbursed through April 5 compared to 69.1 million through April 7 last year. That means that 3.3%, or roughly 2.3 ...Read more

California Supreme Court to hear appeal seeking to overturn new rooftop solar rules

A trio of environmental groups opposed to recent changes to the rules affecting the 1.8 million Californians who have installed rooftop solar on their homes and businesses will get their day before the state Supreme Court.

The high court has agreed to hear arguments by the Environmental Working Group, the Center for Biological Diversity and the...Read more

GM says it will move headquarters from RenCen to Hudson's site in 2025

DETROIT — General Motors Co. on Monday said it will move its global headquarters to the Hudson’s Detroit development next year as it works with billionaire mortgage mogul Dan Gilbert's real estate firm to redevelop the Renaissance Center, its current home a mile away.

GM CEO Mary Barra alongside Gilbert, Mayor Mike Duggan and Wayne County ...Read more

How the UAW is winning over new plants -- starting with Volkswagen

The United Auto Workers is on the cusp of a significant milestone in its audacious effort to grow by 150,000 people across 13 automakers, including Tesla Inc., BMW AG and Nissan Motor Co.

This week, a Volkswagen AG factory will vote on whether to become the only foreign commercial carmaker unionized in the US. It would also be the first vehicle...Read more

Atlanta's Hartsfield-Jackson remains world's busiest airport

Hartsfield-Jackson International has again been named the world’s busiest airport, handling more passengers than any other in 2023.

With 104.7 million passengers passing through last year, the Atlanta airport had more passengers than Dubai in the No. 2 spot with nearly 87 million passengers and Dallas/Fort Worth at No. 3 with 81.8 million ...Read more

How to save money at the pharmacy counter

Steve Wexler has experienced the trouble of finding affordable prescription drugs.

A few years ago, the 70-year-old Plymouth, Minnesota, resident opted to cut short his prescription for Eliquis, a popular blood thinner, rather than pay nearly $1,000 out-of-pocket for his final month on the medication.

Smart shopping can't always tame high ...Read more

Rainier Beer shortage has Seattle taps dry and fans frothing

It hasn't always been easy for Seattle fans of Rainier Beer.

There were the traumas of the 1970s, when the quintessential Seattle company was sold to the first in a string of out-of-state beer conglomerates.

Then Rainier's landmark brewery near Boeing Field was closed in 1999, and the actual brewing of the beer was outsourced — eventually to...Read more

Anheuser-Busch beer sales are down. Its non-alcoholic options are on the rise

ST. LOUIS — Anheuser-Busch InBev's beer sales dropped by $1.5 billion in North America last year, but its nonalcoholic beer sales are exceeding expectations, a shift experts credit to consumers becoming more health-conscious and beverage choices expanding.

The company's no-alcohol beer portfolio, which includes Budweiser Zero, Stella Artois 0...Read more

Labor costs, shortage, increasing reliability: Why we're seeing more robots inside plants

Long used mostly for the “dull, dirty and dangerous” tasks in manufacturing, robots are increasingly considered “desirable” amid rising labor costs and shortages, strike risks and the need for flexibility in navigating the bumpy electric vehicle transition.

A record contract between the United Auto Workers and the Detroit Three ...Read more

Cheap mortgages deter workers from relocating for $250,000 jobs

Manager recruits in the industrial Midwest are shunning offers to move to the American South — in part because they’re locked into super-low 30-year mortgages.

A tight labor market that’s allowing workers to stay closer to home, rising housing costs and a post-pandemic shift toward remote or hybrid-work arrangements are making it a ...Read more

Motormouth: Downshifting

Q: I own a car with an 8-speed automatic transmission and manual shifters. If I am approaching a red light 50-100 yards away, am I better off downshifting or gently applying the brakes? Does repeated downshifting do long term damage to the transmission?

P.J., South Windsor, Connecticut

A: Many transmissions remain in the drive mode or can be ...Read more

Hudson Yards Vessel to reopen three years after spate of deaths

The Vessel at Hudson Yards will reopen later this year, it was announced on Friday, three years after it was shuttered following a spate of suicides.

The honeycombed installation opened in March 2019 as the centerpiece of the new Hudson Yards neighborhood in Midtown Manhattan. But it quickly gained notoriety after several visitors took their ...Read more

Honda's Midwest manufacturing plants begin EV conversion

Move over Accord, here comes Honda’s EV line.

Honda Motor Co. is transferring production of its iconic, internal combustion engine-powered Accord sedan from its long-time home in Marysville, Ohio, to its Greensburg, Indiana, assembly plant to make room for electric vehicle production starting in 2025. The move is a major step in Honda’s "...Read more

New EV sales hit crossroads, while used EVs have open road for growth

No one said electrifying the auto industry was going to be a smooth ride.

Electric vehicle sales got off to a slow start in 2024, with some some automakers — namely EV pioneer Tesla — seeing their sales momentum reverse.

After the country eclipsed 1.2 million EV sales in 2023, new plug-in vehicle sales increased about 3% year-over-year ...Read more

Popular Stories

- Rainier Beer shortage has Seattle taps dry and fans frothing

- How to save money at the pharmacy counter

- Anheuser-Busch beer sales are down. Its non-alcoholic options are on the rise

- Cheap mortgages deter workers from relocating for $250,000 jobs

- Boeing says no 787 safety risk after whistleblower raises troubling claims